The stock market is still in a sideways trend, the cash flow lacks a breakthrough. While waiting for the market to recover, what should investors do to optimize profits?

The stock market is still in a sideways trend, the cash flow lacks a breakthrough. While waiting for the market to recover, what should investors do to optimize profits?

|

The sideways state continues.

At the end of January 2025, the VN-Index closed at 1,265.05 points. The market at the beginning of the new year was somewhat less optimistic in the first half of January and recovered somewhat in the second half of the first month, but still ended the month with a score almost unchanged compared to the end of 2024.

Low liquidity is still a problem for the market. The average matched liquidity on the HoSE in January 2025 was low, at VND9,500 billion/session, 37% lower than the same period and 42% lower than the average in 2024. Investors tend to narrow transactions in both buying and selling directions due to unpredictable risk factors.

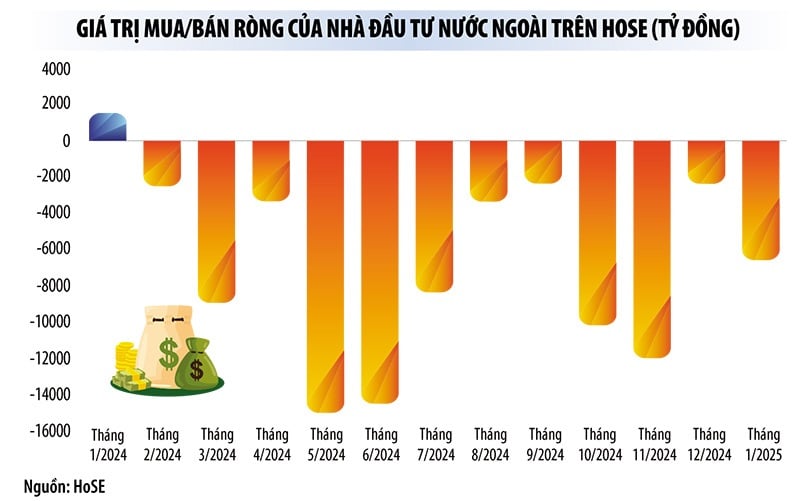

Foreign investors extended their net selling streak to the fourth consecutive month, with a value of nearly VND6,500 billion on HoSE, including VND4,300 billion through order matching and VND2,200 billion through negotiated net selling, with the stocks that were heavily net sold being VIC, FPT, and STB. However, the prices of the above stocks only fluctuated narrowly during the month thanks to the buying power of domestic investors. On the other hand, the two stocks with the highest net buying value were two banking stocks, HDB (VND404 billion) and LPB (VND362 billion).

From a technical perspective, some securities companies believe that the trend of the VN-Index in the coming period will still be mainly sideways. SSI forecasts that the medium-term trend of the VN-Index is still in the accumulation phase within the price channel of 1,180 - 1,300 points. However, the cash flow continues to weaken during the price channel testing phases, so the expectation of the VN-Index breaking the upper limit is not high.

In SSI's scenarios for the market in February 2025, the scenario of a sideways accumulation market accounts for a probability of up to 60%, with the main fluctuation range from 1,260 - 1,275 points. KBSV believes that although the VN-Index is still in the main sideways trend, cash flow is still actively looking for potential stocks; many leading stocks/groups of stocks still have quite positive developments and have successfully surpassed mid-term peaks.

KBSV is inclined to the scenario that VN-Index will continue to maintain its upward momentum, approaching the mid-term resistance zone around 1,315 points (+/-10) before strong pressure may appear. In the remaining scenario (30% probability), the Index may face the risk of weakening and reversing right at the resistance zone near 1,290 points (+/-5), falling back to the support zone of 125x before re-establishing a state of balance.

Defense from capital, portfolio to trading method

Ms. Vu Hong Nhung, Director of Brokerage at Dai Viet Securities Company (DVSC), assessed that the stock market is currently quite quiet, with low liquidity and no excitement in cash flow. This development is equivalent to a manifestation of an accumulation phase, re-evaluating new news about international and domestic developments, especially the strong net selling movement that has not stopped by foreign investors.

“Therefore, the strategy that investors should aim for now is defense. Defense from capital sources, to portfolios and trading methods,” said Ms. Nhung.

With capital defense, investors need to re-evaluate capital for securities, prioritize long-term capital and limit the use of leverage to avoid risks in case of market correction. Using short-term capital can cause great pressure if the market does not bring about the expected efficiency.

For portfolio defense, this is the time to review, select and re-evaluate the stocks in the portfolio, focusing on businesses with solid foundations, long-term growth potential and competitive advantages in the industry. In addition, investors can consider allocating a portion of capital to other financial products such as fund certificates from reputable organizations to diversify the portfolio and optimize investment efficiency.

Regarding trading methods during this period, experts from DVSC suggest that investors should focus on prioritizing buying favorite stocks at low prices during correction sessions, controlling FOMO emotions and maintaining disciplined trading. This can help avoid discouragement in the context of a prolonged market slump and miss many attractive market opportunities ahead.

“A sluggish market can make many investors discouraged, but it is also an opportunity to accumulate positions before the market enters a new growth cycle,” said Ms. Vu Hong Nhung.

Prepare a strategy to preserve profits during the accumulation phase, but there are still positive factors that will affect the market this February.

KBSV forecasts that, in the context of the profit level of listed enterprises showing a positive upward trend over the past year, the EPS of the whole market has been boosted, bringing the P/E valuation of VN-Index to a relatively attractive level. Positive results from the Q4/2024 business results reporting season are gradually reflected in market developments. Positive profit reports, especially from the technology and banking sectors, have further strengthened investor sentiment and created expectations to help attract more capital flows into the market.

A stable or slightly decreasing exchange rate helps reduce risks for businesses that import and have large foreign currency debts, while creating favorable conditions to attract foreign investment. Exchange rate stability also helps control inflation, creating a safer investment environment, and has positive implications for the stock market.

In particular, the focus of the market in the coming period will come from the process of upgrading the Vietnamese stock market according to FTSE. The market continues to wait for new information, Vietnam may be included in the list of upgrade considerations in September 2025 and officially upgraded in March 2026. KBSV affirms that this development is expected to maintain optimism and open up many positive investment opportunities in the market.

Source: https://baodautu.vn/chung-khoan-di-ngang-nha-dau-tu-chon-chien-luoc-nao-d246149.html

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

![[Photo] Binh Thuan organizes many special festivals on the occasion of April 30 and May 1](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/5180af1d979642468ef6a3a9755d8d51)

![[Photo] "Lovely" moments on the 30/4 holiday](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/1/26d5d698f36b498287397db9e2f9d16c)

Comment (0)