After 4 consecutive sessions of cautious and volatile trading, the market has shifted to a state of excitement and explosion. The short-term trend of the market has become more positive when VN-Index conquered the 1,250 point zone with an impressive trading session at the end of the week on August 16.

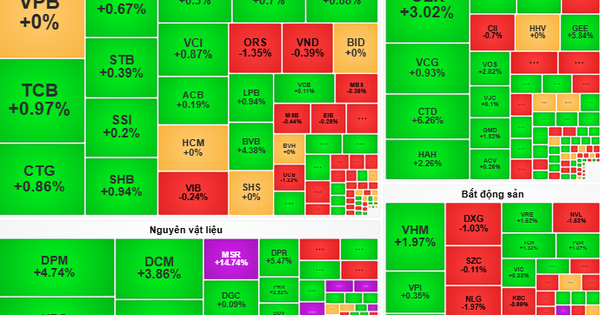

Statistics on transactions on the HOSE floor last week showed that the VN-Index had 3 sessions of increase and 2 sessions of decrease. At the end of the trading week, the VN-Index increased by 28.58 points (+2.34%) to 1,252.22 points. Liquidity on the HOSE floor this week decreased by 12.5% compared to the previous week, with a total transaction value of nearly 75 trillion VND.

Besides the market developments showing more optimistic signals, foreign investors were also impressed when confirming the strongest net buying week since the beginning of the year with a value of nearly 1,100 billion VND.

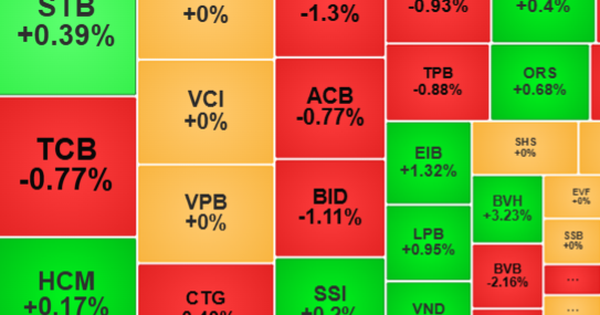

The sell-off at the beginning of last week, with the VN-Index losing more than 50 points, caused many investors to panic. The two subsequent recovery sessions of the main index were not enough to reassure investors. However, from the perspective of experts, sharp declines are always an opportunity for investors to buy potential stocks at more reasonable prices.

The strong increase in the last session of the week was strongly marked by the fact that real estate stocks became the focus of this session, and that alone was enough to help these stocks record positive increases throughout the week.

For the banking sector, economic activities are expected to recover more positively in the second half of 2024 (especially the non-financial sector), helping credit growth to improve and reducing stress on bad debt.

In addition, the NIM ratio of the banking group is expected to improve thanks to the cost of mobilization decreasing faster than the lending interest rate. In 2025, securities companies forecast that the banking industry's profit can reach a growth rate of 20%, creating attractive opportunities for investors.

Forecasting the scenario of VN-Index in August 2024, according to experts from TPS Securities Company, in the medium term, VN-Index will maintain an upward trend starting from November 2023 until now.

In the positive scenario, VN-Index surpasses 1,280 points, retests and starts a new uptrend. In this scenario, the market continues to recover, retesting the 1,220 point threshold (+/- 20 points) is entirely possible. Investors can take advantage of this test to participate in new purchases, after which the price may increase with liquidity gradually improving to the average threshold of the last 20 sessions.

If VN-Index surpasses the 1,280 point threshold with large liquidity, this will be a clear confirmation session that the market's upward scenario will return in the following months.

In the neutral scenario, VN-Index is heading towards the 1,180 point area. In this scenario, the market will face difficulties before the resistance level of 1,240 points, causing the trend to change to a downtrend and VN-Index may reach the price area of 1,180 points. After reaching 1,180 points, the market will confirm model 2. At that price area, TPS expects the market to find the momentum to end the downtrend and switch to an accumulation trend.

Source: https://laodong.vn/kinh-doanh/chung-khoan-se-tiep-tuc-duy-tri-nhip-phuc-hoi-1381254.ldo

Comment (0)