Demand for loans to buy houses, cars and investments... has decreased sharply, causing the consumer lending sector to slow down for the first time in many years.

The end of the year is usually the peak season for consumer loans such as real estate, cars, electronics... but bank leaders say "everything has slowed down, consumer credit has not yet passed the difficult period".

There are no figures for the end of 2023, but consumer loans, which account for 20% of total outstanding loans flowing into the economy, only increased by 1.5% by the end of the first three quarters of last year. The disbursement rate for consumer loans is the lowest in 5 years, according to data from the Vietnam Banking Association (VNBA).

In the economic locomotive of Ho Chi Minh City, lending to this segment by the end of October 2023 only increased by 1.4% while in the same period last year it grew by nearly 19%.

Transaction at a commercial bank. Photo: Giang Huy

People reduce loans to buy houses and cars

Mr. Nguyen Tung (HCMC) said that in 2022, when the market was still bustling and prices were increasing every week, he borrowed more than one billion VND from the bank to buy a plot of land in the province. His plan was to take advantage of the very low preferential interest rate in the first year to have capital to speculate on this plot of land. However, the plan failed. After more than a year, he still could not find a buyer despite selling the plot of land at a break-even price. He was "stuck" with a debt of billions of VND and was under pressure to pay interest to the bank every month.

"My income in the last six months has not been as good as before. Now I just hope to sell the real estate to pay off the loan and reduce my debt. At this stage, no one dares to borrow money to invest in real estate anymore," said Mr. Tung.

Every year, loans for real estate purchase and home repair are the mainstay, contributing significantly to outstanding consumer loans. For example, in Ho Chi Minh City, 65% of outstanding consumer loans by the end of October 2023 were disbursed for loans for home purchase, home repair and real estate transfer, according to data from the State Bank of Ho Chi Minh City.

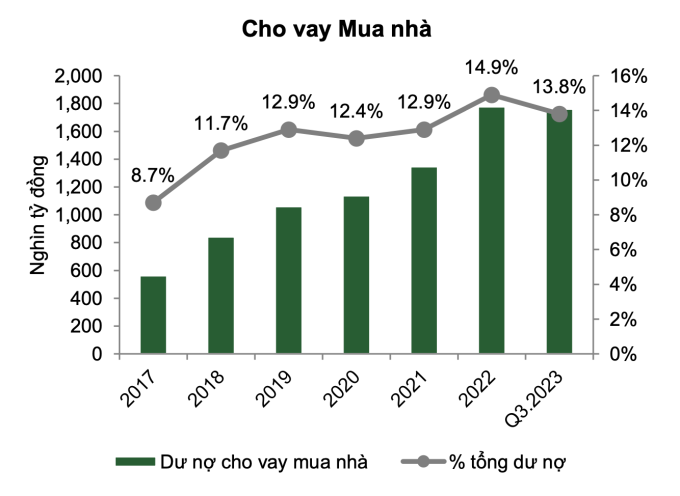

According to Vietcombank Securities Company (VCBS), home loans have been the main growth driver of the retail segment for many years but will slow down in 2023 due to high interest rates and a "frozen" real estate market. Outstanding home loans across the system by the end of the third quarter of 2023 even decreased by 1% compared to the beginning of the year.

Outstanding home loans, which are the growth driver of consumer lending, decreased by 1% compared to the beginning of the year by the end of the third quarter of 2023. Source: VCBS

The leader of the 100% foreign-owned bank said that borrowing from banks to speculate on real estate has become very risky in the current context, causing the motivation of real estate traders to decline. "Therefore, the number of customers borrowing for real estate investment purposes has decreased sharply and only those with real needs are putting down money at this time," he said.

Not only real estate loans, other consumer loan needs such as buying cars, electronics... also weakened when people's income decreased and their wallets tightened.

Mr. Manh (59 years old, Ho Chi Minh City) said that he had intended to borrow money to buy a car to run a technology car service and combine it with family needs. However, seeing his friends running the service often have low sales for many months and have not recovered the money to buy a car, he had to reconsider. Not to mention, the preferential policy of reducing registration fees has also stopped this year, forcing Mr. Tung to temporarily put his intention of buying a car on hold.

By the end of October 2023, car sales had decreased by nearly 30% compared to the same period last year. In the electronics market, weak and prolonged purchasing power has forced electronics companies to engage in fierce price wars during the peak season, but the situation remains bleak.

Banks are reluctant to lend due to rapidly increasing risks.

Retail lending used to be a favorite of banks, but now they are cautious with this segment. Bad debt of the consumer lending group is increasing rapidly, from 2% in the period of 2018 - 2022, to 3.7% in the second half of 2023, according to data from the Banking Association.

Many banks have therefore postponed their retail market expansion activities to adapt to the market context. Data from Vietcombank Securities Company (VCBS) shows that the proportion of retail credit to total outstanding loans decreased from 47% at the end of 2022 to 46% at the end of the third quarter of 2023.

At the conference with investors in 2023, Mr. Ho Van Long, Deputy General Director of VIB said that the method of credit allocation must be adjusted compared to before.

"In previous years, VIB prioritized credit limits for the retail sector to develop the real estate, auto and credit card lending markets. However, due to the slow recovery of core demand for retail lending products, the bank will give way to other segments such as corporate lending and bonds," said Mr. Long.

Mr. Jens Lottner, General Director of Techcombank, also said that the bank itself wants to promote the retail sector and does not want to expand its loan portfolio to corporate customers, but the current market context is "not suitable".

In the current environment, according to the CEO of Techcombank, large companies and corporations are more resilient. The source of money from this group is diverse, coming from different components of the economy, helping their ability to balance better. "We are not stopping the expansion of the retail segment, but if we have to find a place to invest money at this time, it should be large enterprises," said the CEO of Techcombank.

With 16 finance companies serving "sub-prime" banking customers, the picture is even worse. Accounting for 5% of outstanding consumer loans are from finance companies, lending by this group has declined sharply. Outstanding loans of 16 finance companies lending to serve living needs as of August 2023 even decreased by more than 30% compared to the beginning of the year.

According to VNBA General Secretary Nguyen Quoc Hung, the bad debt ratio of financial companies is even at risk of increasing by over 15%. Many companies are in a difficult situation, even suffering losses due to high provisions for bad debt risks. Many companies have had to stop making new loans at times.

Mr. Le Quoc Ninh, Chairman of the Consumer Finance Club (Banking Association) said at a meeting: "Consumer credit is in the most difficult period in the past 15 years."

In the unsecured loan segment at financial companies, the main target customers are low-income earners who have gone through a difficult year. Many workers have lost their jobs, their income has decreased... causing consumer demand to decline.

Mr. Marcin Figlus, Director of Risk Management of FE Credit, said that licensed consumer finance companies are facing a common problem in debt collection, which is the outbreak of organized debt collection activities in society. A segment of customers are deliberately equating the legitimate debt collection activities of licensed companies with illegal activities in order to boycott and delay debt repayment.

Although there is still a loan promotion program, Ms. Olena Khlo, Deputy General Director of Saigon - Hanoi Bank Finance Company, said that she will not promote disbursement drastically but will lend selectively. "In 17 years working in the banking and finance sector, this is one of the most difficult years," she said.

Bad debts are increasing rapidly while debt collection is facing difficulties, which is a common factor that makes financial companies shrink. According to financial company leaders, the picture in the near future will not improve soon. Therefore, consumer lending will find it difficult to return to its golden age.

However, analysts expect that home loans will lead the growth of the consumer loan segment in the near future thanks to the high demand for real estate and partly the increase in demand for property investment.

Quynh Trang

Source link

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)