VN-Index green floor, liquidity still high

Stocks on June 21 were more optimistic as green appeared early. Cash flow is increasing but still much lower than the billion dollar figure of transaction value. However, liquidity remains high, supporting the market.

At the close of the stock market session on June 21, VN-Index increased by 6.74 points, equivalent to 0.61% to 1,118.46 points; VN30-Index increased by 7.8 points, equivalent to 0.71% to 1,112.07 points. It can be seen that blue-chips still have a stronger growth rate than the whole market.

The whole floor recorded 323 stocks increasing in price (14 stocks hitting the ceiling), 55 stocks remaining unchanged and 108 stocks decreasing in price.

Liquidity of the stock market session on June 21 continued to be high when 876 million shares, equivalent to 17,520 billion VND, were successfully traded. Investors still chose penny and midcap stocks, so the trading volume of the VN30 group only reached 219 million shares, equivalent to 5,816 billion VND.

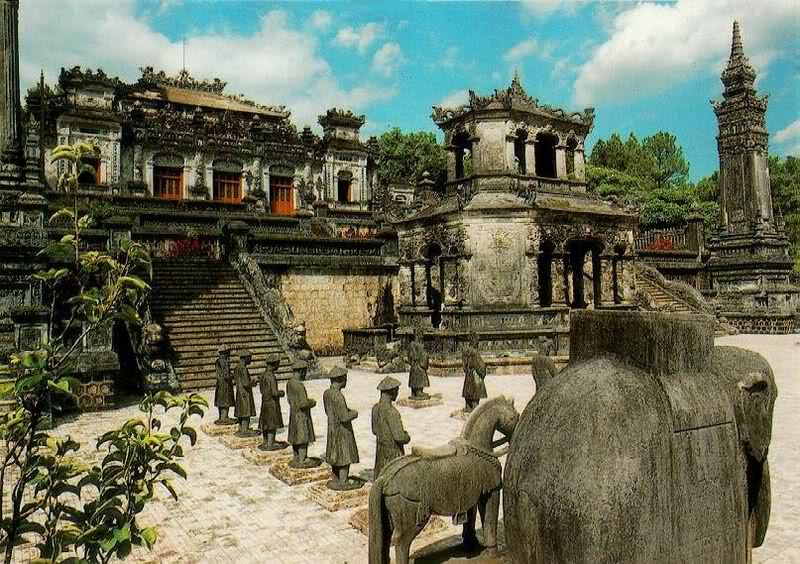

Stocks on June 21 recorded a "sea of fire" across Asia, but the VN-Index remained green with liquidity standing at a high level. Illustrative photo

Hoa Phat Group's HPG shares continued to heat up and contributed significantly to helping the stock market maintain its green color on June 21. At the end of the session, HPG increased by VND950/share, equivalent to 4% to VND24,600/share.

In addition, some other blue-chips also shouldered the responsibility of keeping the green color for the stock market session on June 21, such as GVR (up 700 VND/share, equivalent to 3.7% to 19,500 VND/share), MSN (up 900 VND/share, equivalent to 1.2% to 76,100 VND/share), SSI (up 300 VND/share to 26,000 VND/share),...

The most impressive group of stocks on the June 21 session were securities stocks. Today, this industry group had 2 representatives hitting the ceiling, AGR and CTS. At the end of the session, AGR increased by 900 VND/share to 14,000 VND/share, CTS increased by 1,350 VND/share to 21,150 VND/share,...

On the Hanoi Stock Exchange, the indices increased even more strongly. At the close of the stock market session on June 21, the HNX-Index increased by 3 points, equivalent to 1.31% to 231.77 points; the HNX30-Index increased by 8.33 points, equivalent to 1.92% to 442.62 points.

Asia engulfed in “sea of fire”

Asia-Pacific markets largely fell on Wednesday following sharp swings on Wall Street as China's two main indexes lost ground amid declines in technology and other sectors.

Mainland Chinese markets were weaker, with the Shenzhen Component down 2.18% to end the day at 11,058.63, dragged down by education and technology stocks and leading the region's losses. The Shanghai Composite also fell 1.31% to close at 3,197.9 and posted its third straight day of losses.

Hong Kong's Hang Seng index fell about 2%, led by technology and health care stocks.

In Japan, the Nikkei 225 was the only major index in the green as it reversed earlier losses and rose 0.56%, along with the Topix, which rose 0.49%. The Nikkei closed at 33,575.14, while the Topix ended at 2,295.01.

In Australia, the S&P/ASX 200 fell 0.26%, snapping a seven-day winning streak, to end the day at 7,314.9. South Korea's Kospi fell 0.7% to close at 2,582.63, its third straight day of decline, and the Kosdaq closed down 1.21% at 875.7.

Overnight in the United States, all three major indexes fell, with the Dow Jones Industrial Average down 0.72% and the S&P 500 down 0.72%. The Nasdaq composite had the smallest loss, down just 0.16%.

Against this backdrop, the Asian market emerged as India. The Indian stock market hit an all-time high as investor sentiment remained bullish.

India's BSE Sensex hit a record high on Wednesday, up 0.15% since the start of the trading day to 63,442.83.

Similarly, Nifty 50 has also gained momentum and has surpassed the previous high of 18,812.50 reached on December 1, 2022, and is currently at 18,829.15.

There is growing interest in investing in India as many investors look to diversify away from China.

Source

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)