Ms. Nguyen Thi Xuan, Head of the Law & Professional Department (Vietnam Banking Association) said that since the beginning of 2023, credit institutions have reduced lending interest rates for existing and new loans to support the economy.

After the State Bank loosened credit room and provided liquidity support solutions for banks, many banks announced their commitment to reduce lending interest rates by 0.5% - 1.5% per year.

Up to now, the mobilization interest rate level has gradually remained stable and decreased by 1-2% compared to the end of 2022, creating a basis for credit institutions (CIs) to reduce lending interest rates and support businesses under the direction of the Government and the State Bank.

However, due to the general impact of the world economy, domestic enterprises face many difficulties, credit demand decreases and capital absorption by enterprises is weak. The difficult economy causes credit growth of banks to be low compared to the same period in 2022.

According to Mr. Tran Van Tan, member of the Board of Directors of VietinBank, this bank is still seriously and actively implementing the instructions of the Government and the State Bank in implementing the 2% interest rate support package, with outstanding debt reaching over VND 10,000 billion; actively implementing debt restructuring according to Circular 02/2023/TT-NHNN and credit for social housing.

Mr. Le Quang Vinh, Deputy General Director of Vietcombank, said that there are currently two main tasks: supporting businesses and people to overcome difficulties and increasing credit growth to support the economy.

Vietcombank has proactively reduced interest rates for customers. Specifically, in the first phase, from the beginning of the year to April 31, Vietcombank reduced interest rates by 0.5% for about 130,000 customers. In the second phase, from the beginning of May 2023, Vietcombank also reduced interest rates by 0.5% for about 110,000 customers.

According to Mr. Le Xuan Trung, Member of the Board of Directors of Agribank, the bank has actively implemented the debt restructuring policy according to Circular 02. By the end of June, it had restructured debts for more than 2,000 customers.

Agribank has supported interest rates according to Decree 31, with loan turnover of 10,813 billion VND, outstanding debt of 4,973 billion VND, interest rate support amount of 57.4 billion VND... .

In the first 6 months of the year, Agribank was the bank that reduced lending interest rates the most in the system, with 14 reductions in deposit interest rates and 7 adjustments in lending interest rates.

Source

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

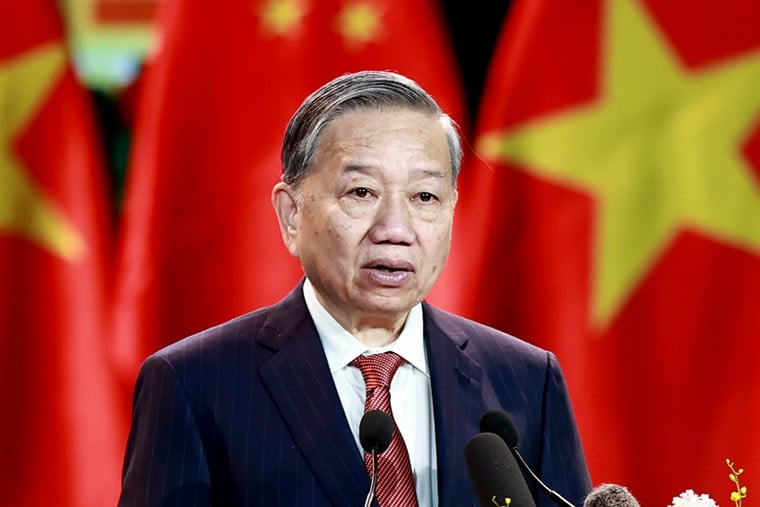

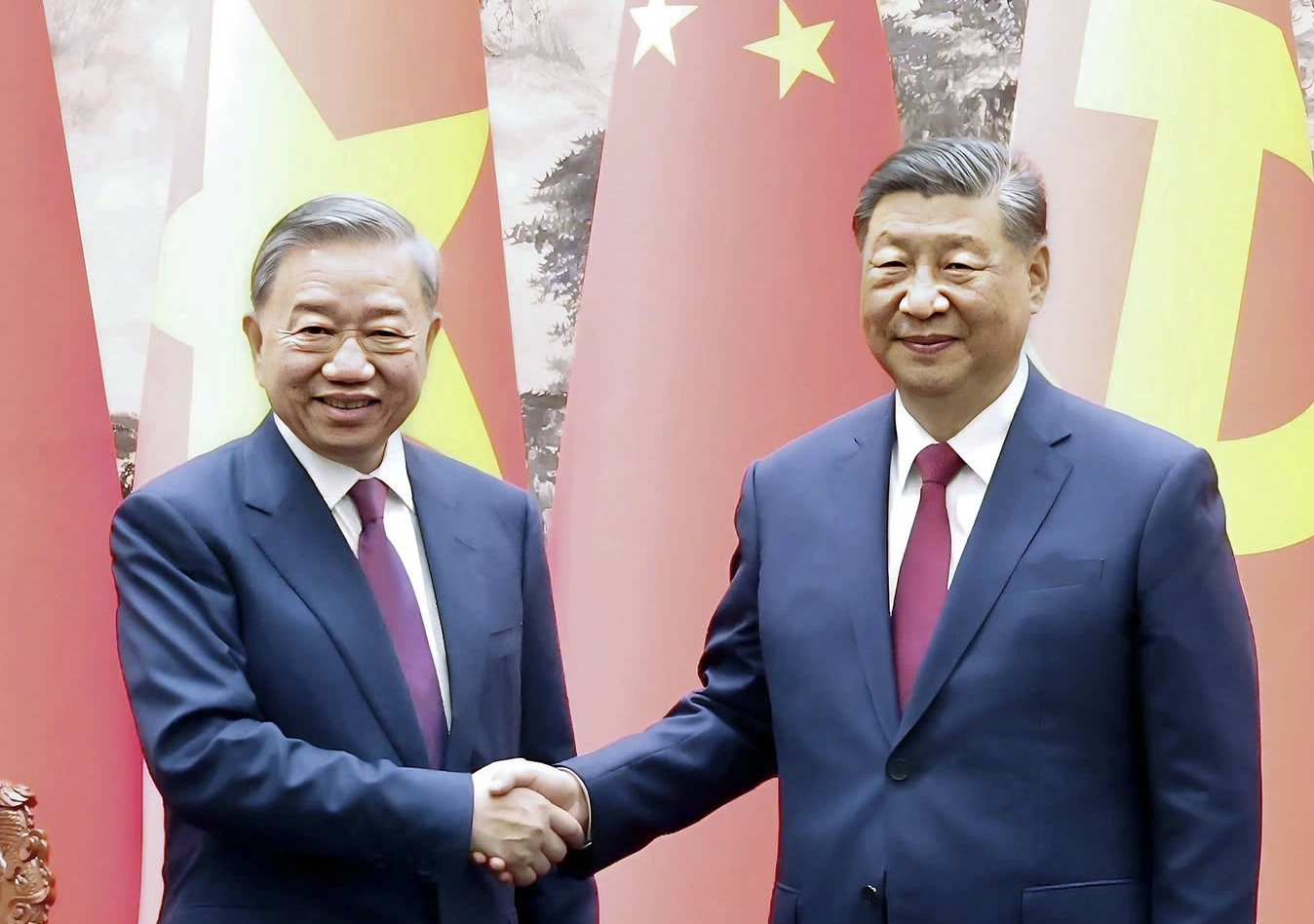

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

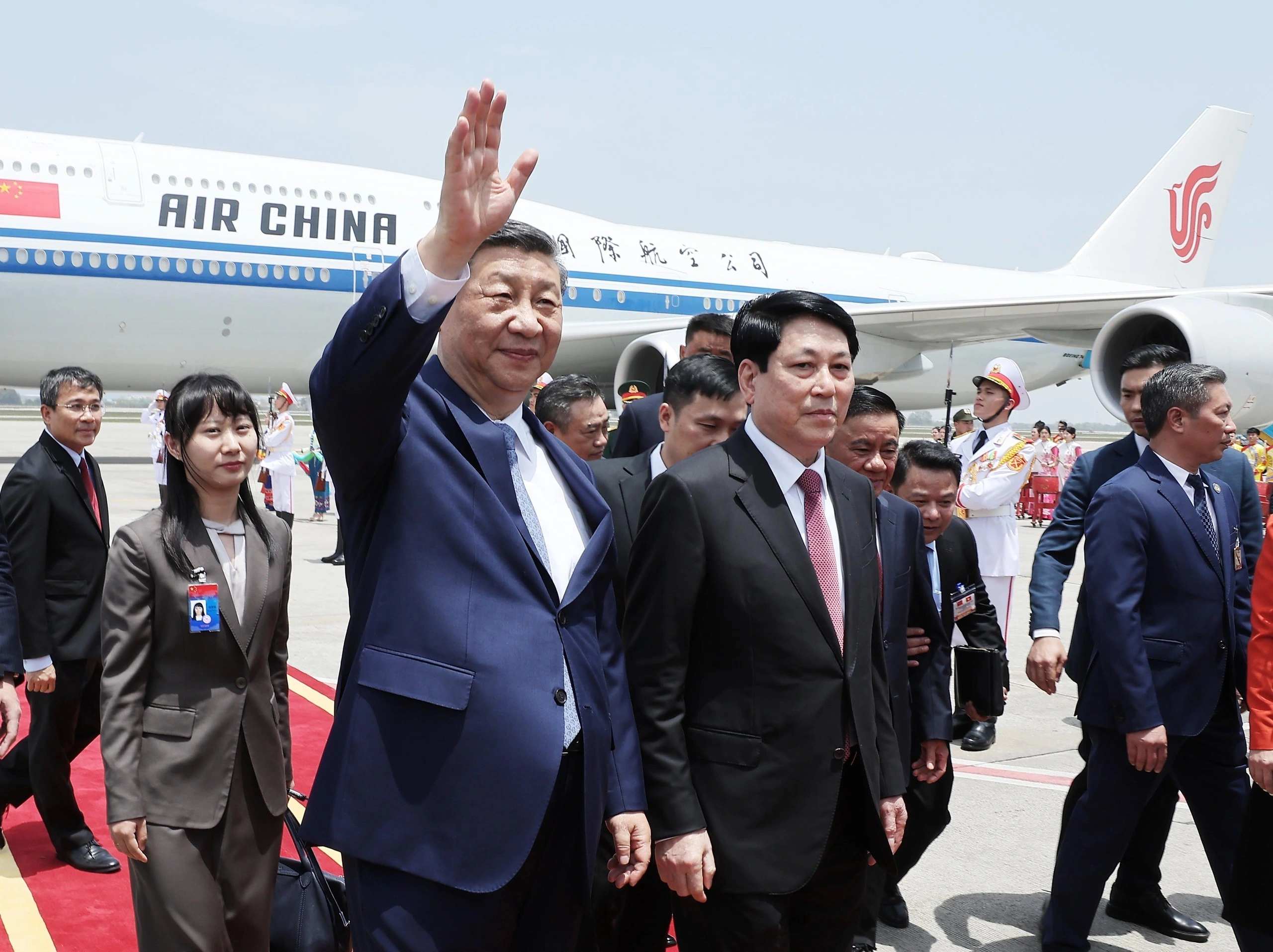

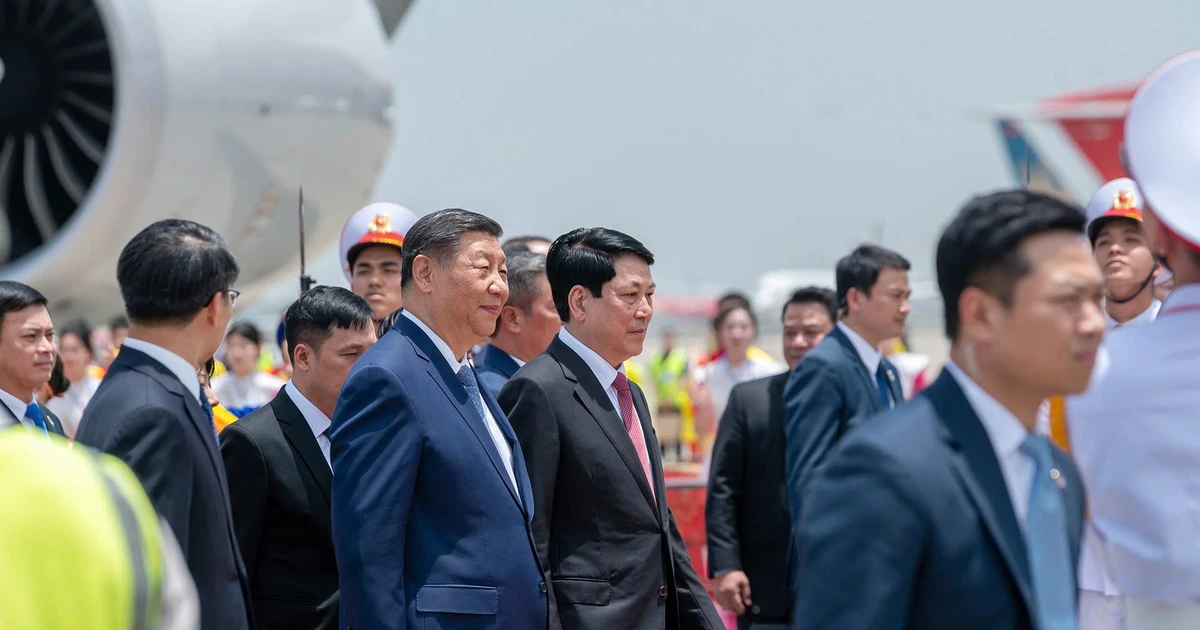

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)