In response to Toyota and Ford's proposal to loosen conditions and add some components and spare parts to the 0% tax bracket, the Ministry of Finance disagreed because they can be produced domestically.

According to the 2023 tax incentive program, businesses wishing to enjoy MFN preferential import tax (Vietnam's import tax applied to goods from WTO member countries) must meet the conditions for automobile production and assembly certificates and vehicle output. In case the output requirements are not met within 6 or 12 months, the business will not enjoy tax incentives. Sending a request to the Ministry of Finance, the Vietnam Automobile Manufacturers Association (VAMA), the Hai Duong Provincial People's Committee wants this agency to consider the proposal of Ford Vietnam Co., Ltd. to loosen this condition.

However, in a recent submission to the Government on amending the Decree on preferential import-export tariffs, the Ministry of Finance said that the vehicle output condition to enjoy tax incentives is "important and prerequisite" to encourage businesses to invest and expand production scale.

During the complicated Covid-19 pandemic period (2021-2022), the output of some vehicle groups was adjusted down by the authorities to support businesses. The Ministry said that it did not raise the issue of increasing the output conditions over the years, but maintained stability for 5 years (2022-2027).

In addition, the Government has recently had many policies to support the domestic automobile manufacturing and assembly industry. Therefore, the proposal to reduce production to enjoy a preferential import tax of 0% is not suitable for the current situation, according to the Ministry of Finance.

Territory model rolling in Hanoi. Photo: FVN

Similarly, the Ministry of Finance also disagreed with the proposal to add some spare parts and components of Toyota Vietnam Automobile Company to the list of products enjoying 0% MFN tax. This agency believes that the list of products enjoying 0% tax is for products that cannot be produced domestically, but the components Toyota offers are all basic types that have been produced domestically.

On the other hand, it is also difficult to determine the quantity of these items used in the production and assembly of automobiles to serve as a basis for applying preferential tax. Therefore, the Ministry of Finance said it would not recommend the Government to add spare parts and components as proposed by Toyota to the list of 0% MFN tax.

According to data from VAMA, in the first 10 months of the year, the total number of cars sold on the market reached 235,296 units, down 29% compared to the same period in 2022. Of these, more than 59% were domestically produced and assembled vehicles, the rest were imported. Sales of all brands decreased compared to the same period in 2022, by 27% for domestic brands and 33% for imported brands.

Source link

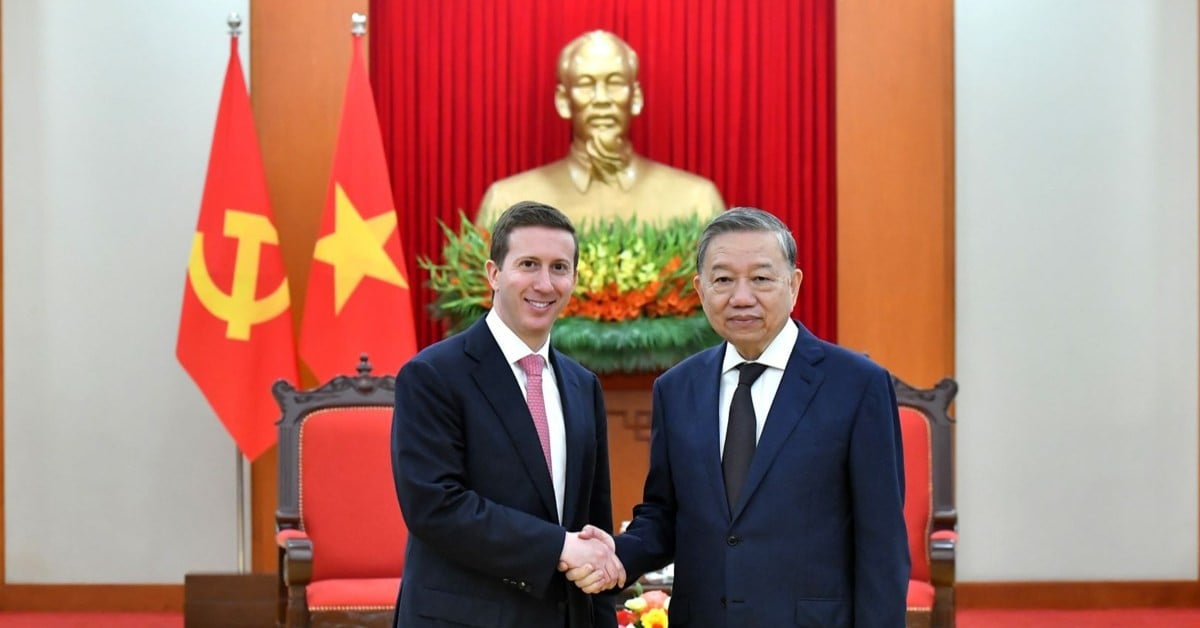

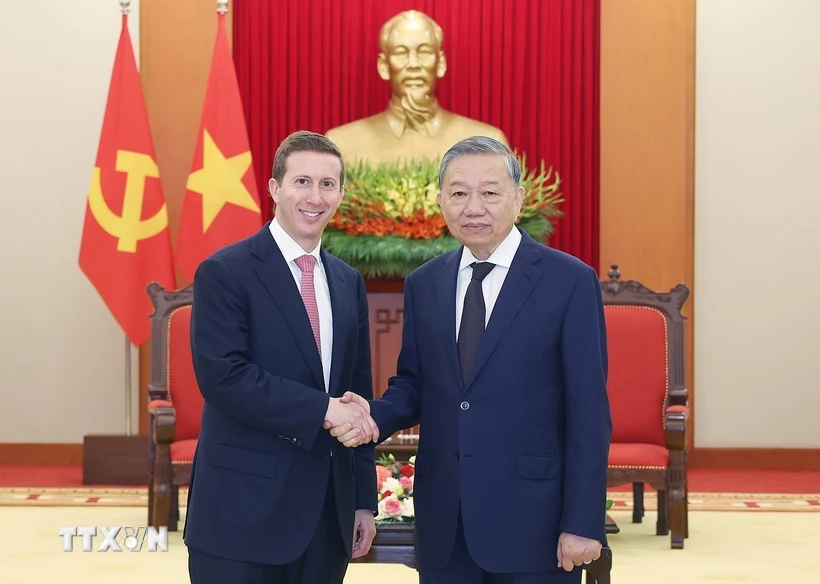

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)