How will homebuyer psychology change in the next 2 years?

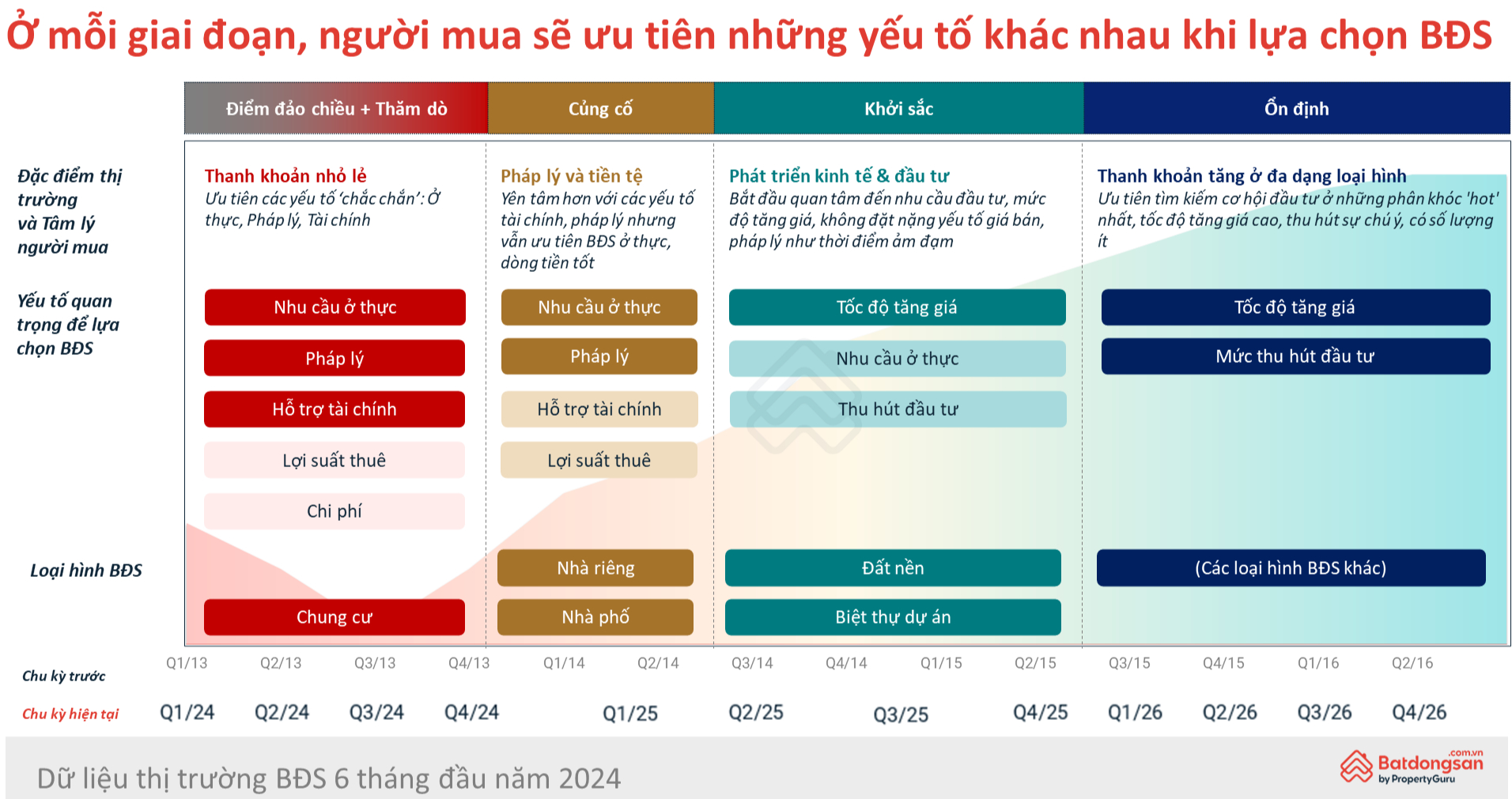

Based on big data and market research through development cycles, Mr. Nguyen Quoc Anh - Deputy General Director of Batdongsan.com.vn predicts that in the next 2 years, the Vietnamese real estate market may go through the following stages: reversal, exploration, consolidation, prosperity and stability. At each stage, buyers will prioritize different factors when choosing real estate.

Specifically, from now until the end of 2024, the market is still exploring, buyers prioritize certain factors such as serving real housing needs, clear legal status, good financial support policies, along with stable rental yields and optimizing costs. At this stage, apartments attract a lot of attention and record the best liquidity among all types.

Entering the consolidation period expected to start in the first quarter of 2025, buyers and investors will be more confident with financial and legal factors but still prioritize products that serve real needs and bring good cash flow. At this time, if monetary factors are more favorable, high-cost types such as private houses and townhouses will gradually improve in transaction volume.

Buyer psychology at each stage of the real estate market (Photo: Batdongsan.com.vn)

From the second quarter of 2025 to the fourth quarter of 2025, it is forecasted to be a period of prosperity, people will pay more attention to investment needs, price growth rate and will not put too much emphasis on selling price and legal factors as in the period of the gloomy market. This will be the time when land and villas gradually regain their advantage and have better liquidity. It is expected that from the beginning of 2026, the Vietnamese real estate market will enter a stable cycle, buyers will prioritize looking for investment opportunities in types with high price growth rates, small quantities but attracting a lot of attention.

In addition to forecasting buyer and investor trends in the next 2 years, Batdongsan.com.vn also analyzed their short-term tastes through the Real Estate Consumer Psychology Survey in the second half of 2024. Accordingly, the market sentiment index is flat. Buyers are waiting for positive signals from the market, lower interest rates compared to 2023 and new legal policies coming into effect to create better psychology for people.

According to experts from Batdongsan.com.vn, the Government's proposal to allow the Land Law, Housing Law, and Real Estate Business Law to take effect from August 1, 2024 is a positive signal, helping to clarify the legal framework and accelerate the market's recovery process. The effective laws will promote more consistent and realistic land valuation, tighten requirements for investors in project development to ensure the rights of buyers, create favorable conditions for real estate ownership for overseas Vietnamese, attract more foreign investment, and enhance professionalism and transparency in the brokerage community.

Important factors that drive home buyers' "down payment" actions

In addition, the demand for real estate is always present, the main target buyers in the coming time are young families, especially newlyweds. This unit's survey shows that 73% of married people without children plan to buy a house in the next year. While single people prioritize working space when choosing real estate, married people are most interested in school amenities and shopping centers and stores. The trend of buying secondary products is increasing due to the low primary supply while the opening price of primary projects is high.

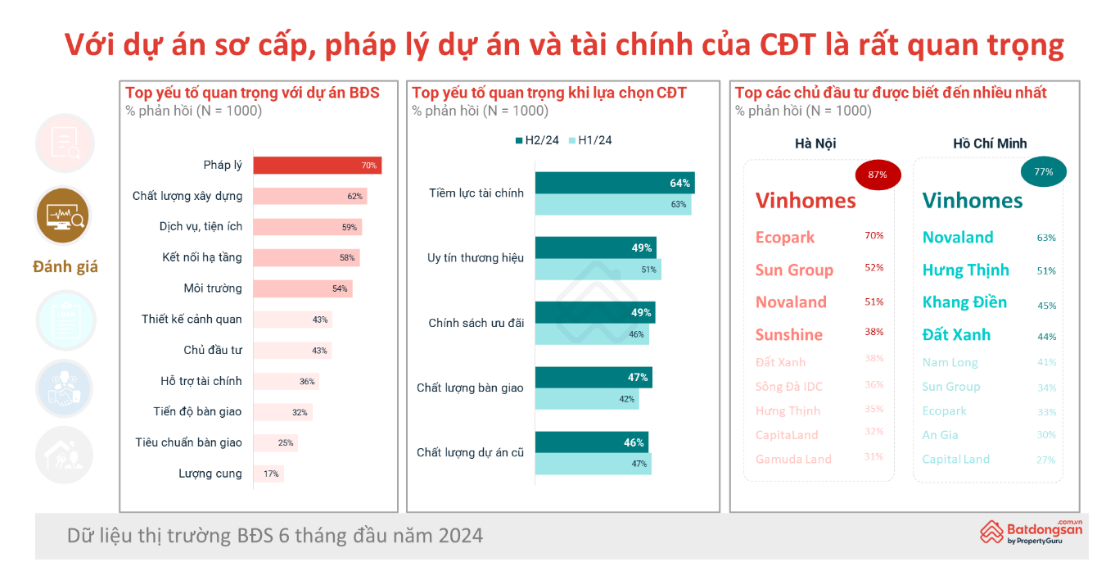

A survey on consumer psychology in the second half of 2024 also showed that buyers prioritize searching for information on major news sites and the official website of the investor. When considering an investor, they pay most attention to financial potential, and when choosing a project, legality is the top factor. When looking for a real estate broker to support the transaction, buyers value expertise, experience and attitude the most, followed by brokerage fees.

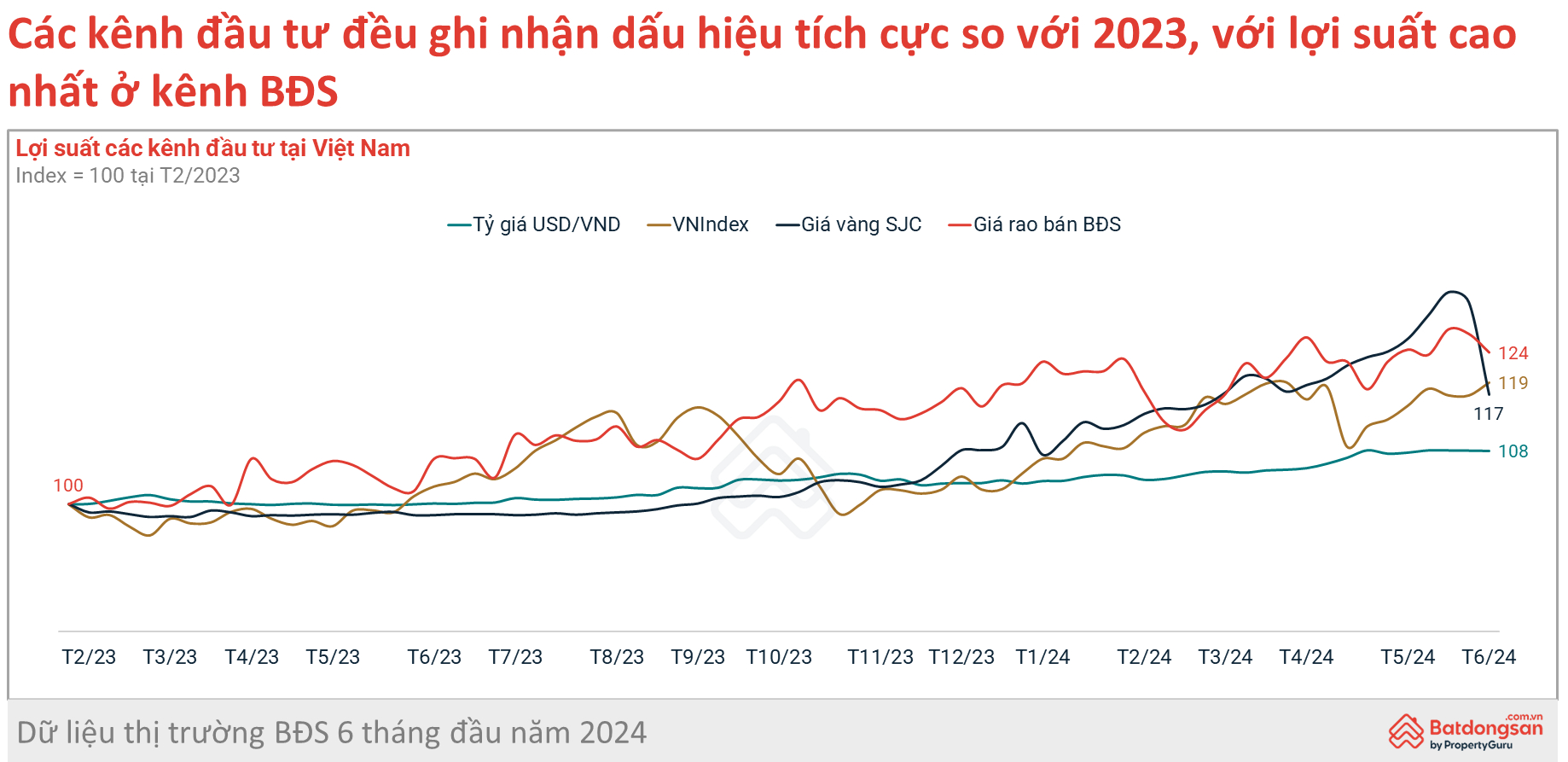

Real estate still leads in yield among investment channels

Real estate market data for the first 6 months of 2024 from Batdongsan.com.vn shows that most investment channels have recorded positive signs compared to 2023. Of which, real estate is still the channel with the highest investment yield. As of June 2024, the average selling price of real estate increased by 24% compared to the beginning of 2023. Meanwhile, VNIndex, which reflects stock price fluctuations, increased by 19%, SJC gold price increased by 17%, and USD exchange rate increased by 8%.

As one of the localities leading in price increase, Hanoi recorded a 32% increase in private house prices compared to the beginning of 2023, an increase of 31% in apartments, and an increase of 10-19% in land, villas, and townhouses. Meanwhile, real estate prices in Ho Chi Minh City have remained almost unchanged over the past year and a half, except for apartments, which increased slightly by 6%, while the remaining types have maintained their price levels.

Regarding the types of properties on the market, land and private houses have a certain recovery in terms of interest and transactions in the first half of 2024. Specifically, the interest in private houses has recovered by 87%, and land has recovered by 60% compared to the first quarter of 2021. However, this is only a local improvement in some areas, especially the northern provinces.

Real estate is still the most effective investment channel.

In some northern provinces alone, such as Hung Yen, the interest in land increased by 194%, and private houses increased by 70%. Hanoi also witnessed an increase in interest in land by 75%, and private houses by 48%. In particular, the interest and prices increased sharply in the suburban areas of Hanoi thanks to planning factors and auction activities. Specifically, in the first half of 2024, land in Dong Anh, Gia Lam, Hoai Duc, Thach That, and Quoc Oai recorded an increase in demand from 48% - 104%, leading to an increase in land prices in these suburban districts from 4% - 24% compared to the second half of 2023.

In addition, apartments are the most vibrant type of real estate market, especially in the Hanoi market. Research by this unit shows that the demand for buying apartments in Hanoi peaked in March 2024, up nearly 60% compared to the end of 2023. Currently, although interest in apartments has "cooled down", prices have not decreased. The selling price of apartments in Hanoi in May 2024 was equal to that of Ho Chi Minh City, reaching 50 million VND/m2. At the same time, apartments are still the type with the best liquidity in the market, 48% of brokers participating in the survey of Batdongsan.com.vn said that apartments are in a period of strong growth.

Mr. Dinh Minh Tuan - Southern Regional Director of Batdongsan.com.vn commented that currently there is no sign of a "bubble" in apartments because the factors creating this situation are over-inflated demand, more investment demand than real demand; prices are pushed up compared to the economy and other types; and loose monetary policy creates conditions for capital control in the market.

Apartments are the most vibrant type of market, especially in Hanoi.

Data from Batdongsan.com.vn shows that compared to other cities in the world, the difference in apartment prices with Vietnam's GDP is still not too high. It is estimated that to buy a 50m2 apartment in Bangkok (Thailand), people need to spend more than 47 years of income, in Manila (Philippines) it is more than 56 years, in Kuala Lumpur (Malaysia) it is nearly 17 years. Meanwhile, in Hanoi and Ho Chi Minh City, people need to spend about 14-15 years of income to buy an apartment of similar size.

“The population growth rate in the two major cities shows that the real demand for apartments is still very high. The forecast for the total housing demand in the period of 2021-2030 in Hanoi is 89 million square meters of floor space, in Ho Chi Minh City is 107.5 million square meters of floor space. Despite such high demand, current apartment prices in Hanoi and Ho Chi Minh City are not too high compared to other cities in the world. Meanwhile, home purchase interest rates are not expected to be low as deposit interest rates have just been adjusted to increase. Therefore, there is no “bubble” phenomenon in apartments. In fact, limited supply and high opening prices have caused the recent strong growth,” Mr. Dinh Minh Tuan explained.

Tran Thi My Nhat

Source: https://www.congluan.vn/bds-tiep-tuc-dung-dau-ve-loi-suat-dau-tu-nguoi-mua-dang-tham-do-thi-truong-post301219.html

![[Photo] Air Force actively practices for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16fdec3e42734691954b853c00a7ce01)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

![[Photo] Ho Chi Minh City after 50 years of national reunification through buildings and symbols](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a224d0b8e489457f889bdb1eee7fa7b4)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

Comment (0)