The Vietnam Commodity Exchange (MXV) said the world raw material market reacted strongly after US President Donald Trump announced the reciprocal tax policy. The price list was filled with red.

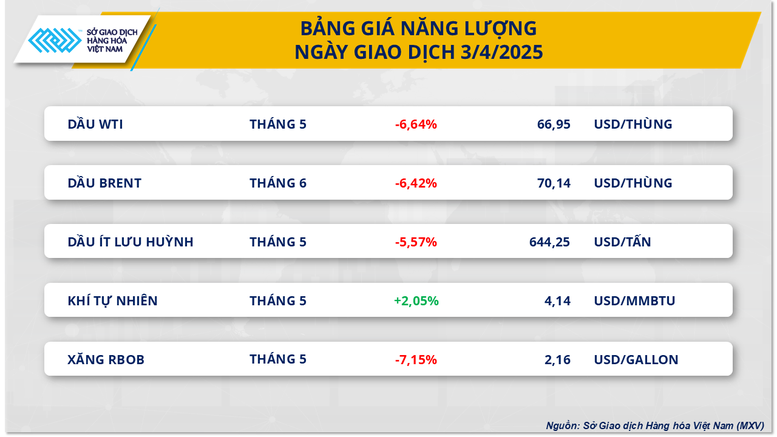

In the energy market , according to MXV, pressure was heavy on the energy market yesterday when 4/5 commodities fell sharply. In particular, oil prices plummeted after Mr. Trump announced reciprocal tariffs on more than 180 countries and territories. In addition, OPEC+'s May oil production plan continued to "add fuel to the fire", causing the crude oil market to slide in yesterday's trading session.

At the end of the session, Brent and WTI oil prices lost 6.42% and 6.64% to $70.14/barrel and $66.95/barrel, respectively. This is the deepest decline for Brent oil prices since August 1, 2022, and for WTI oil prices since July 11, 2022.

In the metal market, all commodities were in the red in yesterday's trading session, with concerns about global economic growth and weakening metal consumption prospects.

In the precious metals market, silver prices plunged 7.73% to $31.97/ounce. Meanwhile, platinum also fell sharply by 3.62% to $942.5/ounce.

The decision to impose global reciprocal tariffs has sent precious metals markets reeling as investors worry that escalating trade tensions could lead to supply chain disruptions and higher production costs, reducing demand.

Meanwhile, the majority of demand for silver and platinum comes from the industrial manufacturing sector. Specifically, about 60% of silver demand is used in industries such as electrical and electronic equipment and solder alloys; while nearly 70% of platinum demand comes from the automotive and high-tech industries. If the global economy weakens, the consumption outlook for these two metals will be negatively affected, putting further pressure on prices.

The base metals group was also not out of the deep downward trend. COMEX copper prices fell sharply by 4.21% to $10,645/ton, while iron ore extended its decline by another 0.94% to close at $101.84/ton.

Higher-than-expected reciprocal tariffs have eroded global growth expectations, putting significant pressure on copper consumption prospects. According to Citigroup, copper prices could fall another 8-10% in the coming weeks. Notably, although copper is not currently subject to reciprocal tariffs, Washington is investigating the possibility of imposing its own tariffs on the commodity.

Source: https://baodaknong.vn/thi-truong-hang-hoa-4-4-bang-gia-tran-ngap-sac-do-luc-ban-ap-dao-248264.html

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)