|

UK inflation shows signs of cooling. (Source: Getty Images) |

The figure was lower than the 8.2% forecast by economists polled by Reuters .

However, June 2023 inflation data was in line with the Bank of England's (BoE) forecast of 7.9%.

Core inflation (excluding food, energy, alcohol and tobacco prices) also eased to 6.9%, from a 31-year high of 7.1% last month.

Analysts say that core inflation will remain unchanged in the near term. Inflation in the services sector fell to 7.2% from a 31-year high of 7.4% in May.

"Core inflation and service sector inflation will ease as the impact of previous rate hikes takes effect," said Paul Dales, chief economist at Capital Economics.

Previously, the BoE said that the country's economy has so far demonstrated good "resilience" in the face of sharp increases in interest rates over the past year, but it will take time to see the full impact of this trend.

BoE Governor Andrew Bailey stressed: "The UK economy and financial system so far remain resilient to the risks from interest rates."

Capital Economics said that the “persistent pressures” that have not yet ended will cause the BoE to raise interest rates slightly, with a high probability of peaking in the range of 5% to 6%.

Source

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

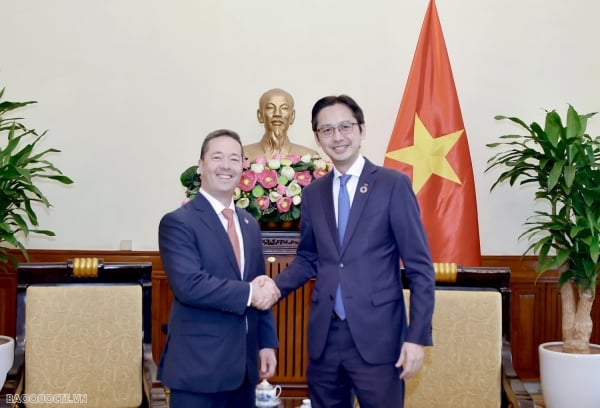

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)