Chinese authorities launched a crackdown on domestic Big Tech in late 2020, concerned that major internet platforms were losing control. Beijing’s efforts to rein in the industry have wiped out trillions of dollars in market capitalization, hobbled one of the world’s second-largest economies, and accelerated the polarization between the US and China. As a result, China’s top tech companies, once on par with their American counterparts, have shrunk significantly.

Here are the key milestones in China's 32-month crackdown on domestic technology:

November 2020

Ant Group’s IPO – potentially the world’s largest – was called off at the last minute in Shanghai and Hong Kong, shocking the global investment community. The IPO was shelved after Alibaba founder Jack Ma made controversial remarks. Ant Group is Alibaba’s fintech arm.

Authorities quickly brought Ant Group's operations under the purview of traditional financial regulation, forcing the giant to restructure internally.

In late November, 27 major Internet companies, including Tencent, Meituan, ByteDance, and Alibaba, were summoned to hear requests to rectify alleged monopolistic practices, unfair competition, and counterfeit goods. The State Administration for Market Regulation (SAMR) released guidelines for anti-monopoly on the Internet.

December 2020

At the annual Central Economic Work Conference, China’s top leaders stressed the need to curb “disorderly expansion of capital,” aiming to curb the influence and scale of Big Tech. The message to investors and entrepreneurs is that the Internet industry’s boom is over.

On Christmas Eve, SAMR announced the formal opening of an antitrust investigation into Alibaba.

April 2021

China’s market regulator fined Alibaba a record 18.2 billion yuan ($2.8 billion), or 4% of its 2019 revenue, for abusing its “dominant position in China’s online retail platform services market since 2015.” The antitrust regulator then summoned 34 tech companies, including Alibaba, Tencent, and Meituan, to a meeting and asked them to pay attention to Alibaba’s case.

July 2021

Regulators began reviewing mergers in the early 2000s and fined Big Tech for failing to report certain transactions for antitrust review. At least 22 fines of 500,000 yuan each were issued against Alibaba, Tencent, and Didi Global.

As a result, Big Tech M&A has slowed down, with companies starting to divest from previous investments to slim down their balance sheets.

China’s Cyberspace Administration (CAC) has launched an unprecedented investigation into Didi over national security and data breaches, just two days after its IPO on the New York Stock Exchange. The decision opens a new front in the crackdown on Big Tech, and has put other Chinese IPOs in the US on hold.

Didi was banned from allowing users to sign up on its main app. Two months later, China's data security law took effect.

October 2021

China fined Meituan 3.4 billion yuan for abusing its market position by forcing sellers to sign exclusive agreements. The fine is equivalent to 3% of Meituan’s 2020 domestic revenue.

January 2022

The storm is showing signs of abating as authorities released guidelines to promote the sustainable and healthy development of the platform economy. It reaffirms Beijing’s commitment to cracking down on monopolies, unfair competition and data abuse, but sends a positive message by acknowledging the role of Big Tech in the economy and encouraging its development.

May 2022

Vice Premier Liu He told several tech CEOs that the government would support the sector's development and initial public offerings (IPOs), raising hopes the worst is over.

July 2022

CAC fines Didi Global 8 billion yuan for data breach, ending year-long investigation.

December 2022

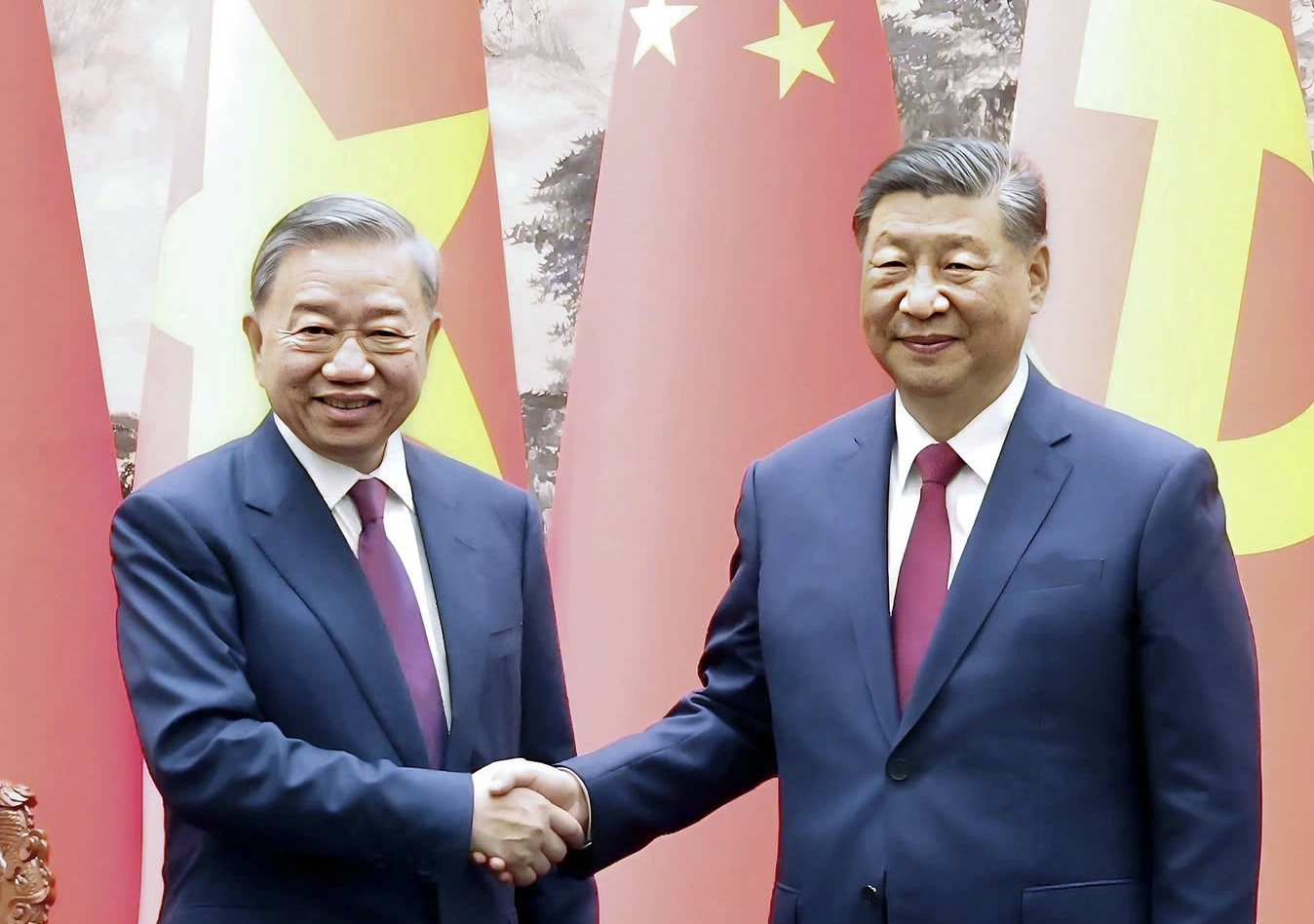

Chinese President Xi Jinping attends the Central Work Conference in Beijing, which concluded that internet platforms will be supported to “fully demonstrate their capabilities” in stimulating the economy, creating jobs and competing internationally.

January 2023

Didi Global resumed new registrations on the app after receiving approval from the CAC. Also this month, Ant Group and 13 other platforms said they had basically completed business remediation under the guidance and supervision of financial regulators.

July 2023

Two and a half years have passed since the government killed Ant Group’s IPO. Ant Group was finally fined a total of 7.1 billion yuan for violating regulations related to “corporate governance and personal financial protection,” a move that industry insiders said marked the end of China’s tech crackdown.

Premier Li Qiang later offered support for major tech companies at a symposium, while the National Development and Reform Commission praised Alibaba, Tencent and Meituan for their contributions to the country's economic growth and progress.

(According to SCMP)

Source

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

Comment (0)