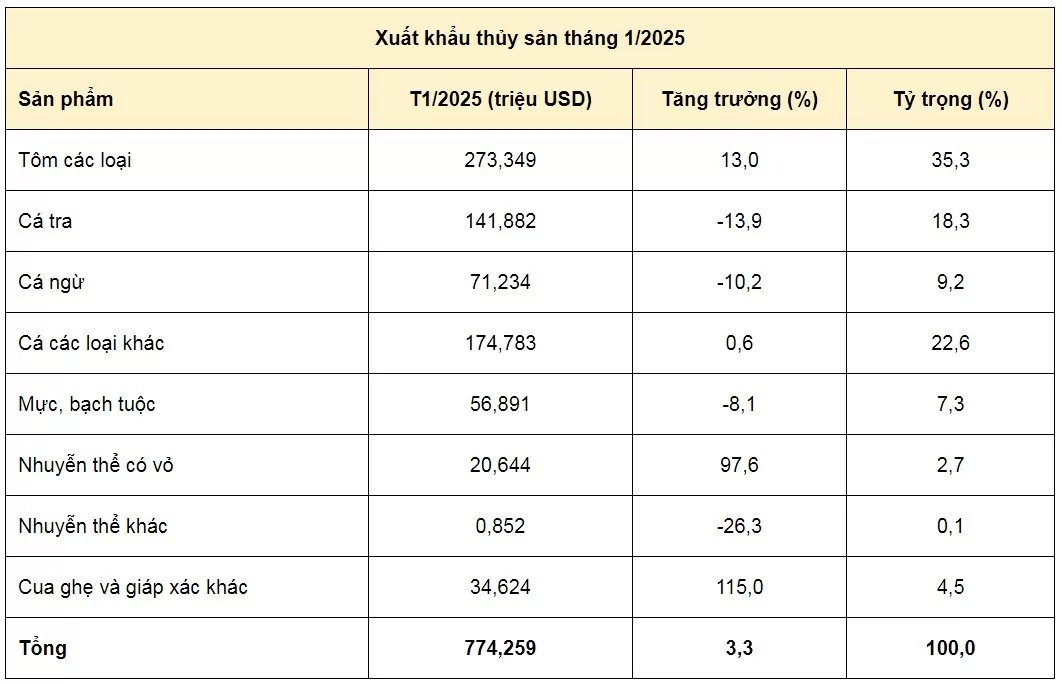

In January 2025, Vietnam's total seafood export turnover reached 774.3 million USD, up 3.3% over the same period in 2024, which is a positive result.

Seafood exports are positive at the beginning of the year

According to information from the Vietnam Association of Seafood Exporters and Producers (VASEP), shrimp continued to be the item with the strongest growth in January 2025, with an export value of 273.349 million USD, accounting for 35.3% of total seafood export turnover.

Reports from Rabobank show that the global shrimp industry is in a rebalancing phase as producing countries slow production growth to close the gap between supply and demand. This is expected to help shrimp prices gradually recover in the first half of 2025, especially as demand from markets such as the US and EU improves.

However, the Chinese market, one of the major partners of Vietnamese shrimp, is facing a decline in consumption demand. Changes in the spending habits of the middle class, coupled with rising income pressure, have led to a decline in white shrimp consumption, especially in large cities. Competition from cheaper seafood products and the preference for other food items may affect shrimp exports to China in the coming months.

|

| Vietnam's seafood exports are positive in the first month of the year. |

As for Vietnamese pangasius, it continued to face difficulties in the first months of 2025, despite strong growth in pangasius prices due to limited supply. Although demand from markets such as China and the EU remains stable, the shortage of fingerlings and fluctuations in international tariffs, especially anti-dumping policies, could negatively affect the growth potential of pangasius exports this year.

Limited pangasius supply, combined with volatility in export markets, could lead to an increase in export value in the short term. However, raw material shortages and changes in tariff policies could create a difficult environment for the pangasius industry in the near term.

Vietnam's tuna industry faced a decline in exports in January 2025, with a decrease of 10.2%. However, with the steady growth of demand for tuna products in markets such as the US and EU, the tuna industry is expected to have a chance to recover in 2025. The biggest opportunity comes from changes in tariff policies of major markets, especially the US, where tariff measures can help Vietnam's tuna products become more competitive compared to other imported products.

According to VASEP's assessment, the tuna industry still has many problems that need to be resolved to create motivation for further development. For fishermen, it is necessary to ensure that, in addition to complying with legal regulations including IUU, they have the motivation to increase marine exploitation and reinvest to go offshore. For businesses, it is necessary to continue reviewing and improving the process/procedures for issuing S/C and C/C certificates to resolve the problems that have arisen in the past...

In addition, the tuna industry needs to focus on developing sustainable production models, expanding markets through improving product quality and cooperating with other countries to exploit the sea effectively.

Global seafood market is expected to have many fluctuations.

According to the Vietnam Association of Seafood Exporters and Producers (VASEP), Vietnam's export markets recorded a large difference in consumption trends. While the Chinese and Hong Kong (China) markets grew strongly with a growth rate of 64.9%, the US and EU markets faced difficulties with a decline of 16.0% and 17.6% respectively.

|

| In January 2025, Vietnam's total seafood export turnover reached 774.3 million USD. |

The decline in US consumption, due to President Donald Trump’s tariffs on imported seafood products, is likely to affect demand for Vietnamese seafood products, especially shrimp and salmon. However, increased demand for easy-to-cook seafood products, such as frozen shrimp, could help to partially offset the decline in consumption of premium products.

On the other hand, the ASEAN market recorded stable growth with an increase of 10.5%, showing that the potential from Southeast Asian countries is still a bright spot in Vietnam's seafood exports. The Middle East and other markets all saw a decline in consumption, which requires Vietnamese seafood enterprises to adjust their export strategies accordingly.

In 2025, the global seafood market is expected to experience many fluctuations, with factors such as changing consumer habits, tariff policies and fluctuations in supply and demand affecting Vietnam's seafood exports. In particular, the decline in demand in major markets such as China and the US will pose a major challenge to products such as shrimp, pangasius and tuna.

However, with increasing demand from ASEAN markets and supportive tariff policies from major countries, Vietnam's seafood industry can still maintain its growth momentum in 2025. Developing value-added products, improving product quality and expanding new export markets will be decisive factors for Vietnam's seafood industry to continue to develop sustainably in the future.

| In 2024, Vietnam's seafood industry reached an impressive finish line, with an export turnover of 10 billion USD, an increase of 12% compared to 2023. Key products all had positive growth such as: Shrimp increased by 14%; tuna increased by 17%; pangasius increased by 10%... |

Source: https://congthuong.vn/xuat-khau-thuy-san-kha-quan-trong-thang-dau-nam-372659.html

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Commercial Aircraft Corporation of China (COMAC)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/93ca0d1f537f48d3a8b2c9fe3c1e63ea)

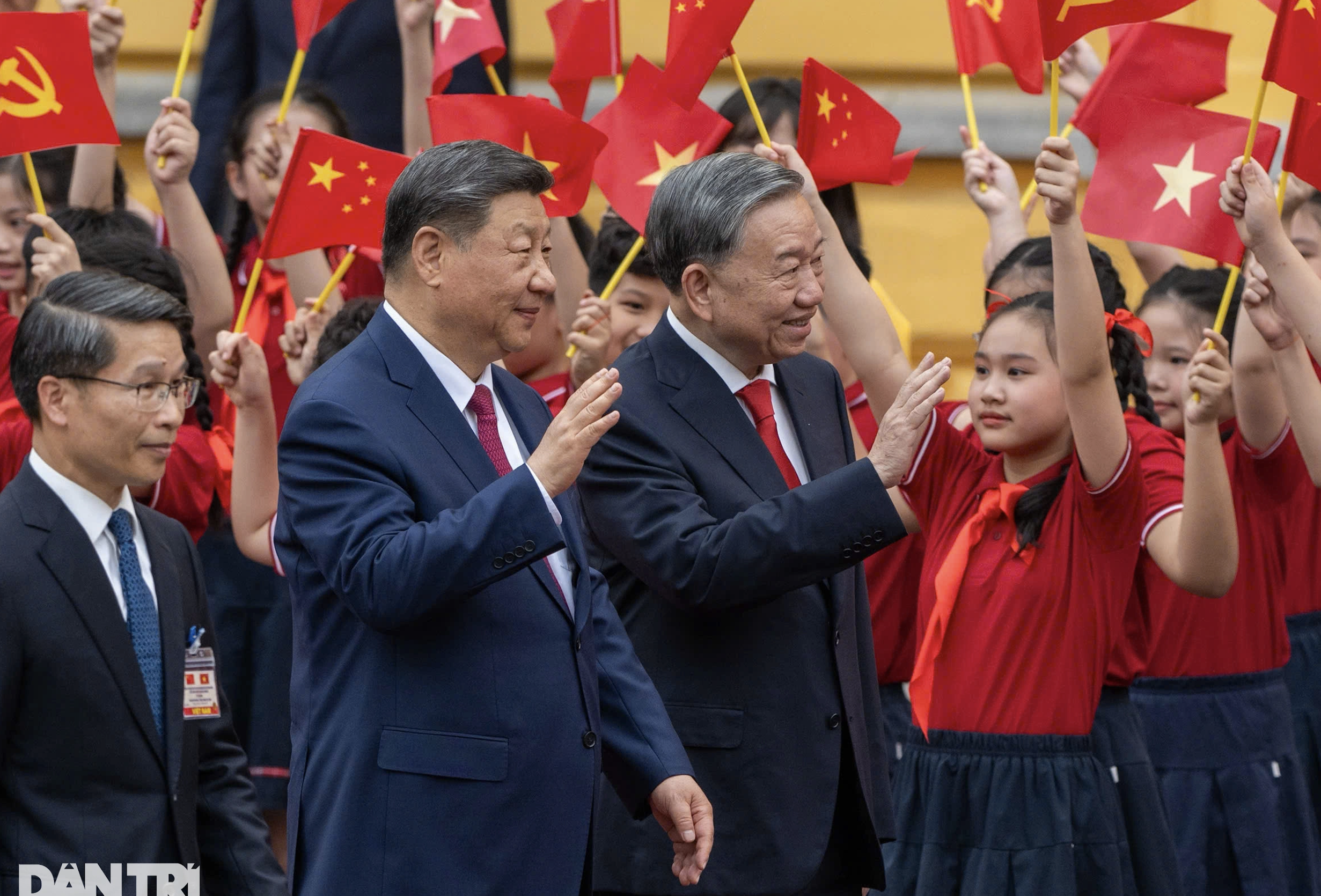

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

Comment (0)