Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank – HoSE: VCB) has just announced information on the results of early bond buyback.

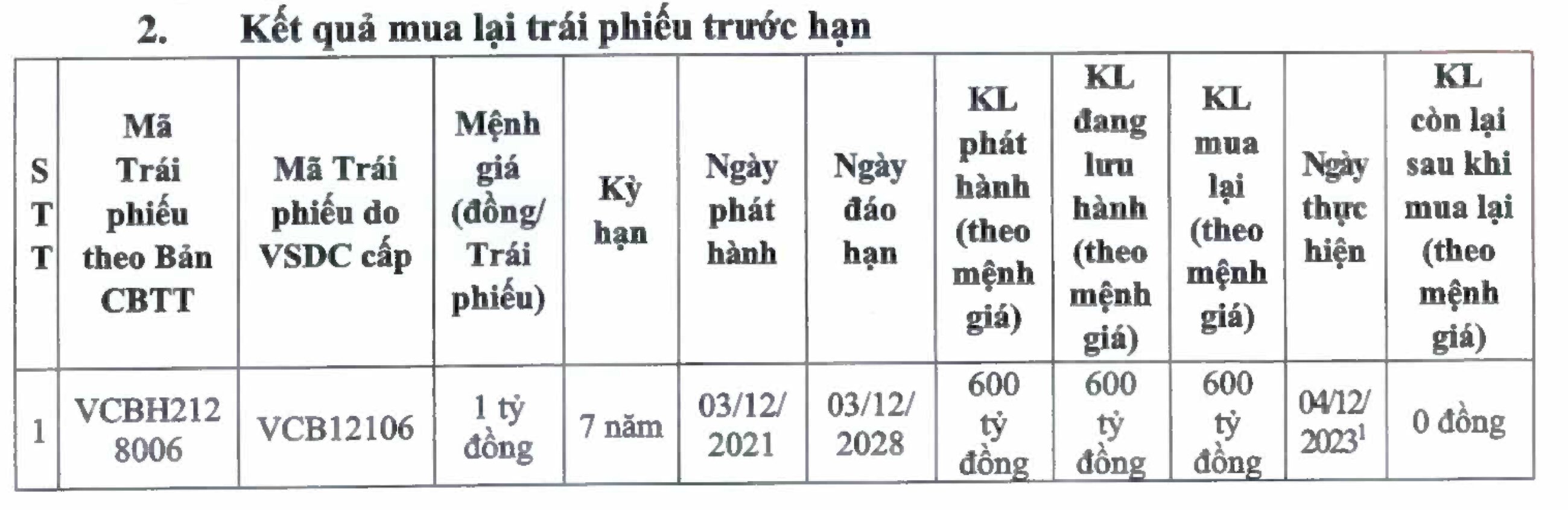

Accordingly, Viecombank has purchased back the VCBH2128006 bond lot with a face value of VND 1 billion/bond, total value of VND 600 billion on December 4, 2023.

The bonds have a term of 7 years, the issuance date is December 3, 2021 and will not mature until December 3, 2028. This is a non-convertible corporate bond, without warrants and is not secured by assets.

Bonds are issued individually in the form of book entries through an underwriting organization as prescribed.

The purpose of issuing the bond lot is to increase Tier 2 capital to supplement operating capital and meet Vietcombank's medium and long-term lending needs for socio-economic development. At the same time, the bond issuance aims to improve the bank's financial capacity, ensuring safety according to the regulations of the State Bank.

Information on the bond lot bought back by Vietcombank before maturity.

This is the third bond lot that Vietcombank has bought back this year. Previously, in November, the bank bought back VND200 billion of VCBH2128002 bonds and VND500 billion of VCBH2128004 bonds ahead of schedule. Thus, in 2023, Vietcombank spent VND1,300 billion to buy back bonds ahead of schedule.

The above two bonds were both issued in November 2021 with a term of 7 years and will not mature until November 2028. The issuance interest rate is 6.13%/year. Similar to the VCBH2128006 bond lot, the two bond codes were both issued with the purpose of increasing Tier 2 capital, supplementing operating capital for the bank.

According to information from the Hanoi Stock Exchange, in 2023, apart from buying back bonds before maturity, Vietcombank has absolutely no new bond mobilization movements. Accordingly, the last batch of bonds issued by Vietcombank was from August 2022 with a total value of 90 billion VND .

Thu Huong

Source

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

Comment (0)