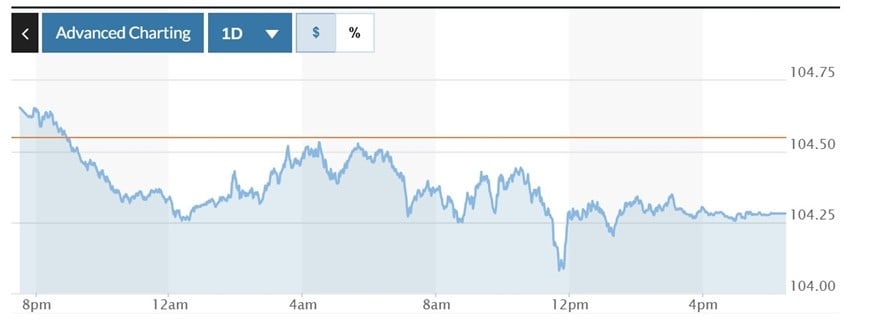

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.27% to 104.28.

USD exchange rate today in the world

The US dollar was mixed in the last trading session, as traders weighed the tough tariffs that US President Donald Trump is expected to announce next week, while the Canadian dollar and Mexican peso weakened after Mr Trump announced trade tariffs on cars.

Rising optimism that President Donald Trump will be flexible in his tariff policy boosted the greenback earlier this week, but traders remained nervous ahead of his planned “reciprocal” tariff announcement on April 2.

On March 26, Mr. Trump announced a 25% tariff on imported cars and light trucks, which will take effect next week.

The Mexican peso fell 1.03% against the dollar to 20.329. The Canadian dollar fell 0.33% against the dollar to 1.43.

The United States imported $474 billion worth of auto products in 2024, including $220 billion worth of passenger cars, with Mexico, Japan, South Korea, Canada and Germany being the largest suppliers.

On March 26, Canadian Prime Minister Mark Carney said that the country will soon respond to the 25% tax that US President Donald Trump imposed on imported cars.

Meanwhile, Mexico's economy minister said on March 27 that Mexico is also working to significantly reduce the impact of tariff policies on its auto industry.

In contrast, the euro rose in the last trading session, ending a six-day losing streak against the greenback. The currency rose 0.38% to $1.0793, after falling to a three-week low of $1.0731.

The euro rallied earlier this month as German government bond yields jumped on plans to boost spending, but the euro has since retreated slightly this week.

Central banks including the European Central Bank (ECB) are also signaling that they are less likely to cut interest rates in the near term and will focus on assessing the economic impact of tariffs, which could hurt economic growth but also increase inflation.

Economists at Wells Fargo said on March 27 that they now expect the ECB to cut interest rates to a low of 2.0% in September, up from a previous forecast of 1.75%.

The dollar rose 0.35% against the Japanese yen to 151.1 yen, its highest in three weeks, as the benchmark 10-year U.S. Treasury yield also hit a one-month high of 4.40%.

The pound rose 0.52% against the greenback to $1.2953, recovering from a decline in the previous session. British finance minister Rachel Reeves said the country was working to secure exemptions from U.S. auto tariffs.

USD exchange rate today domestic

In the domestic market, at the beginning of the trading session on March 28, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD decreased by 5 VND, currently at 24,846 VND.

* The reference exchange rate at the State Bank's transaction office has slightly decreased, currently at: 23,654 VND - 26,038 VND.

USD exchange rate at commercial banks buy and sell as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,360 VND | 25,750 VND |

Vietinbank | 25,250 VND | 25,830 VND |

BIDV | 25,400 VND | 25,760 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 25,396 VND - 28,070 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 26,838 VND | 28,309 VND |

Vietinbank | 26,733 VND | 28,233 VND |

BIDV | 27,107 VND | 28,314 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 157 VND - 173 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 164.09 VND | 174.52 VND |

Vietinbank | 165.51 VND | 175.21 VND |

BIDV | 166.63 VND | 174.41 VND |

Source: https://baolangson.vn/ty-gia-usd-hom-nay-28-3-dong-usd-giam-sau-muc-thue-quan-o-to-5042374.html

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)