Confused by facial authentication regulations

According to Decision 2345/QD-NHNN (Decision 2345) of the State Bank, from today (July 1), customers must authenticate their faces when transferring money online with an amount of over 10 million VND/transaction and over 20 million VND/day.

However, many customers complain about not being able to make transactions, or having to patiently make them many times.

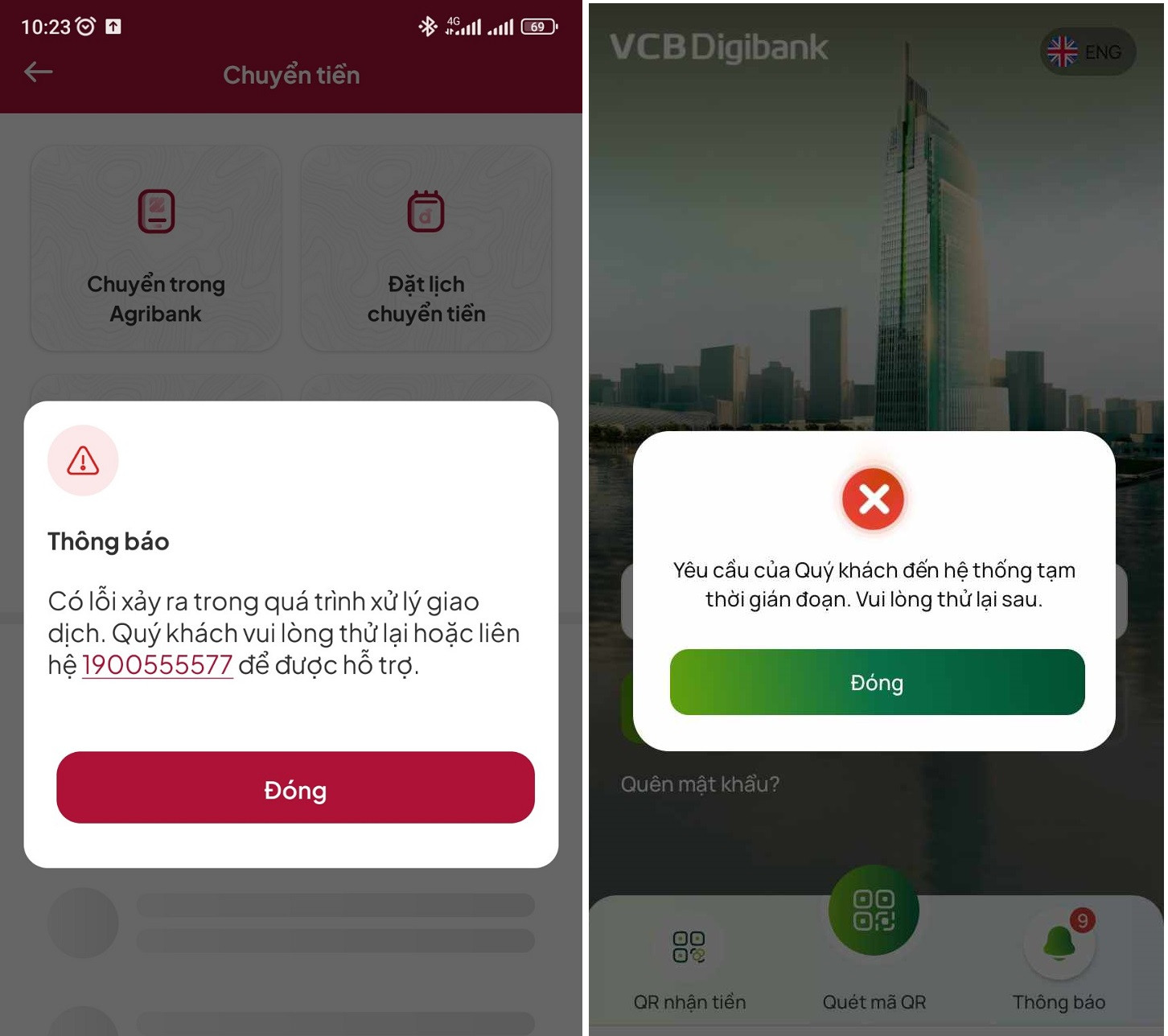

Mr. NMK, an Agribank customer, said that although he had registered for biometrics last week, this morning he still could not transfer over 10 million VND from the bank's app.

After he placed the money transfer order, the banking app displayed a message: “An error occurred while processing the transaction”, and asked the customer to try again or contact the bank's hotline.

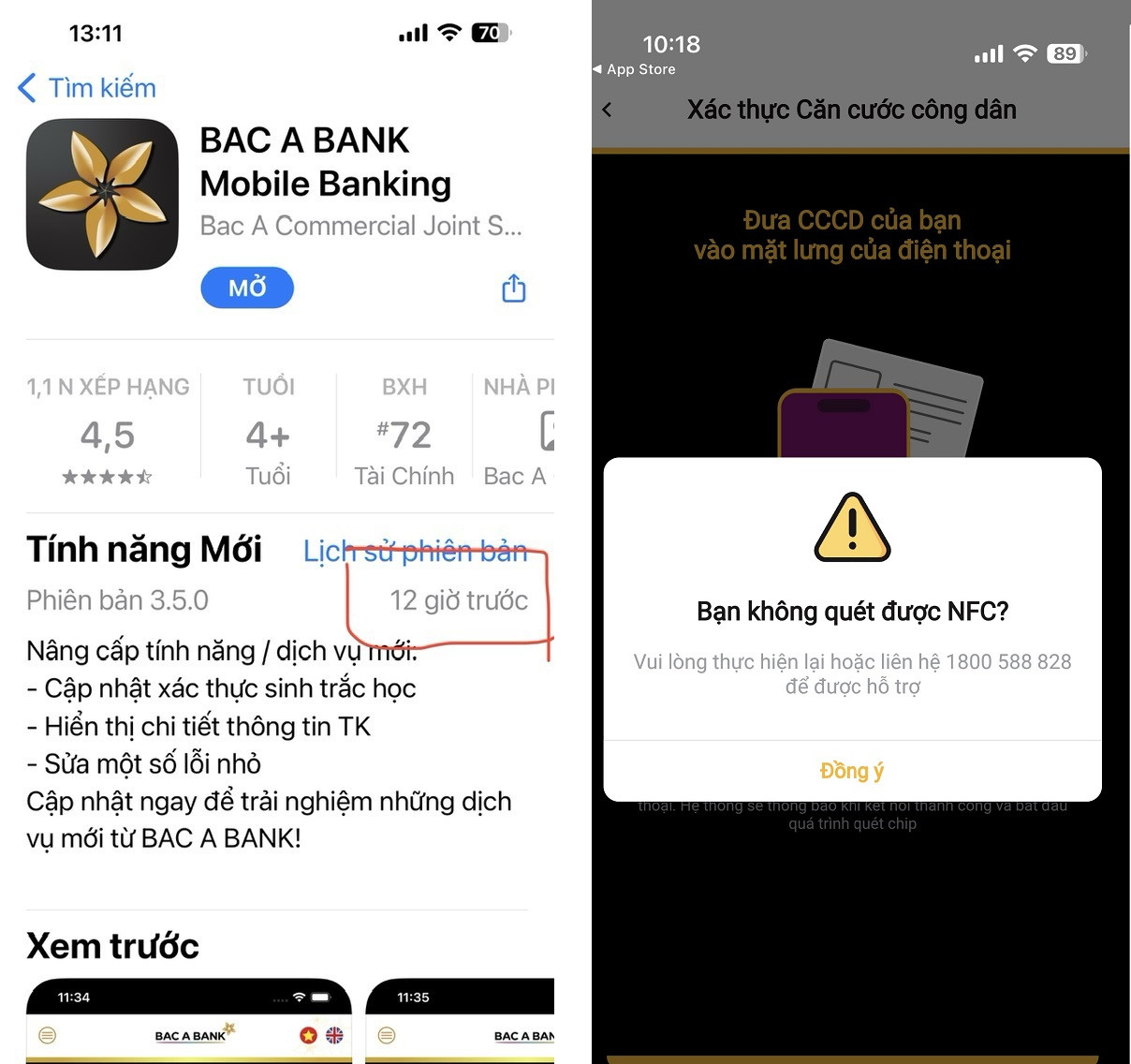

Meanwhile, a customer of Bac A Commercial Joint Stock Bank (Bac A Bank) shared that she was very impatient because in recent days she had not received any notification from the bank regarding the request for facial authentication. It was not until 0:00 a.m. on July 1 that she received the request (via the app) regarding this. However, after struggling all afternoon, she still could not successfully register for authentication.

“I was very conscious of doing biometric authentication, but the banking app only asked me to register today. I tried many times but still couldn’t do it successfully,” said a female customer of Bac A Bank.

Ms. H, a customer who opened an account at VietinBank and PVCombank, said: “This morning, I transferred more than 10 million VND on the VietinBank app without any problems. But with PVCombank, for unknown reasons, the PVCombank app kept reporting login password errors and asked to download the PVconnect app and could not log in. After doing it over and over again, the account was locked.”

For Vietcombank customers, many people cannot even log in to the bank's app to transfer money.

Mr. TDK, a Vietcombank customer, said that it was very difficult to successfully log into the bank's app this morning. Even when he was able to log in, he was still unable to make a money transfer, even though the amount to be transferred was less than 10 million VND.

Mr. TDK's case became common among Vietcombank users this morning and became a topic of discussion on social networking forums.

By noon of the same day, many Vietcombank customers were able to successfully transfer money.

On a social networking forum, account LTV reflected that she also could not make a money transfer via VPBank account so she had to go to the counter to ask for support.

However, the bank staff informed that the transaction point did not have an NFC scanner so they could not support the customer.

Luckily, most customers of the Military Commercial Joint Stock Bank (MB) had no problems making money transfers of over VND 10 million on the first day of implementing facial authentication.

However, Mr. HNT - an MB customer - said that because he could not register for facial authentication, he transferred 18 million VND one day before the debt repayment deadline yesterday afternoon (June 30). However, the 24/7 fast money transfer transaction could not be performed, the MB Bank app displayed the message: "The recipient's bank does not accept 24/7 fast money transfer at this time. Or the amount transferred exceeds the maximum limit on a 24/7 fast money transfer transaction of 499,999,000 VND".

“MB may have applied the facial authentication regulation earlier than the regulation, so I had to split the amount into 4 transfers. Luckily, it was successful,” said Mr. HNT.

Customers support facial authentication

Although they were not able to make transactions on the first day Decision 2345 took effect, many customers affirmed that they fully supported this decision of the State Bank, because it is the most effective way to protect users' assets against the increasing and constantly changing fraud situation.

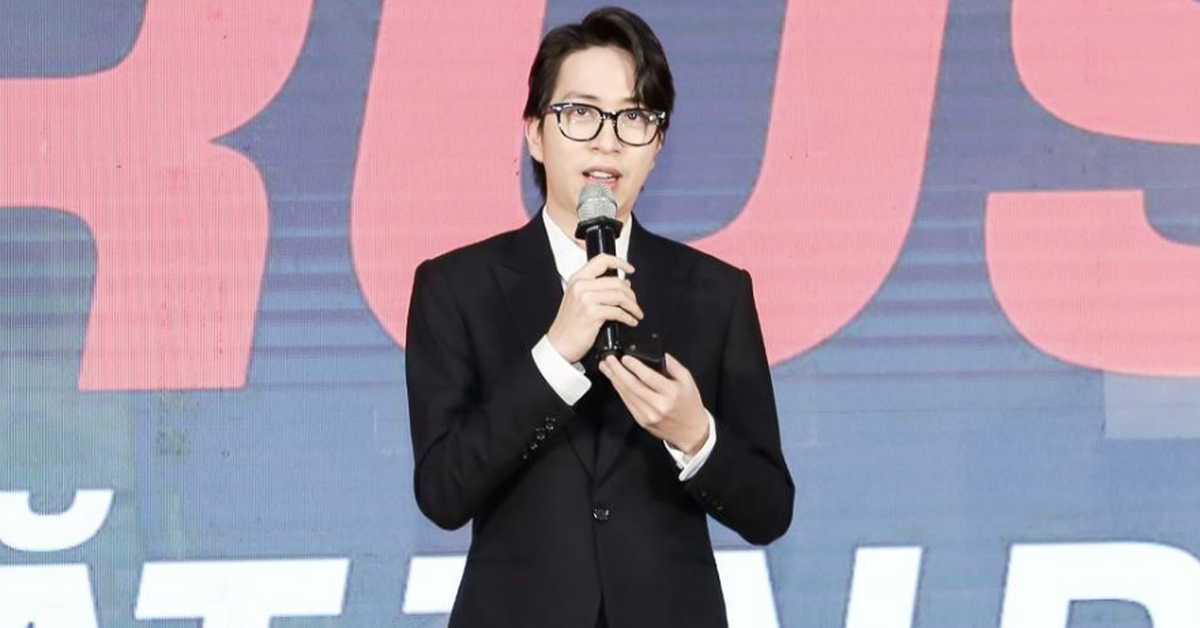

“It is possible that the banking system has not yet synchronized data, this will be quickly fixed to make payments easier. However, I think the requirement for facial authentication is extremely necessary to ensure transaction safety for customers,” said Mr. Tran Minh Quan, an Agribank customer.

Agribank Deputy General Director Le Hong Phuc assessed that Decision 2345 of the State Bank was issued very promptly and has a breakthrough nature.

In addition, this decision also makes banks improve their technological equipment and better protect customers, especially when Agribank is in the group of banks with the largest number of online transactions in the system, with about 254 thousand online transactions/day, accounting for 91.97% of the bank's total transactions.

Deputy Governor of the State Bank of Vietnam (SBV) Pham Tien Dung said that with the application of Decision 2345, when making transactions, faces must be matched and authenticated, so criminals cannot take money.

The important thing when appropriating information, criminals often install it on another machine to carry out the appropriation. But banks require biometric authentication. Therefore, criminals cannot install it on another machine to appropriate money. On the other hand, when making normal transactions, the account renter and the account lessor cannot use the transaction account.

Explaining why the State Bank chose the 10 million VND mark, a State Bank representative said that transactions over 10 million VND only account for 11% of total transactions. The total number of people with transactions over 20 million VND/day is less than 1%.

At 20 million VND, after verification is completed, no further verification is required until the next 20 million VND.

Source: https://vietnamnet.vn/truc-trac-kho-chuyen-tien-ngay-dau-bat-buoc-xac-thuc-khuon-mat-2297149.html

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)