NDO - The subjects impersonated bank employees, offered to increase credit card limits, made fraudulent phone calls to refund account holders, asked customers to provide personal information and appropriated money at the bank. Technological criminals also used tricks to bypass biometric authentication.

|

According to Long An Provincial Police, there are currently many fraudulent and abusive methods of online payment transactions. Solutions are needed to protect people from increasingly sophisticated forms of fraud.

The subjects impersonated bank employees, offered to increase credit card limits, made fraudulent phone calls to refund account holders, asked customers to provide personal information and appropriated money at the bank. Technological criminals also used tricks to bypass biometric authentication.

Many users of fake applications with bad intentions also become victims of fraud. There are many scams and property appropriation through banking transactions.

In response to the above information, the Department of Information Security (Ministry of Information and Communications) recommends that people be cautious of calls claiming to be from bank staff providing online support.

Never follow instructions, provide sensitive personal information or OTP code, CVV code (short for Card Verification Value, a 3-digit number printed directly on the back of the visa card) to strangers. Note that the bank will never ask users to provide this code.

Do not access strange links or install applications of unknown origin; only download applications from reputable app stores to avoid device hijacking or information theft.

Do not enter credit card information on strange websites or sites where users have never made transactions. If you suspect you have been scammed, you should immediately report to the authorities or consumer protection organizations for timely support, resolution and prevention.

|

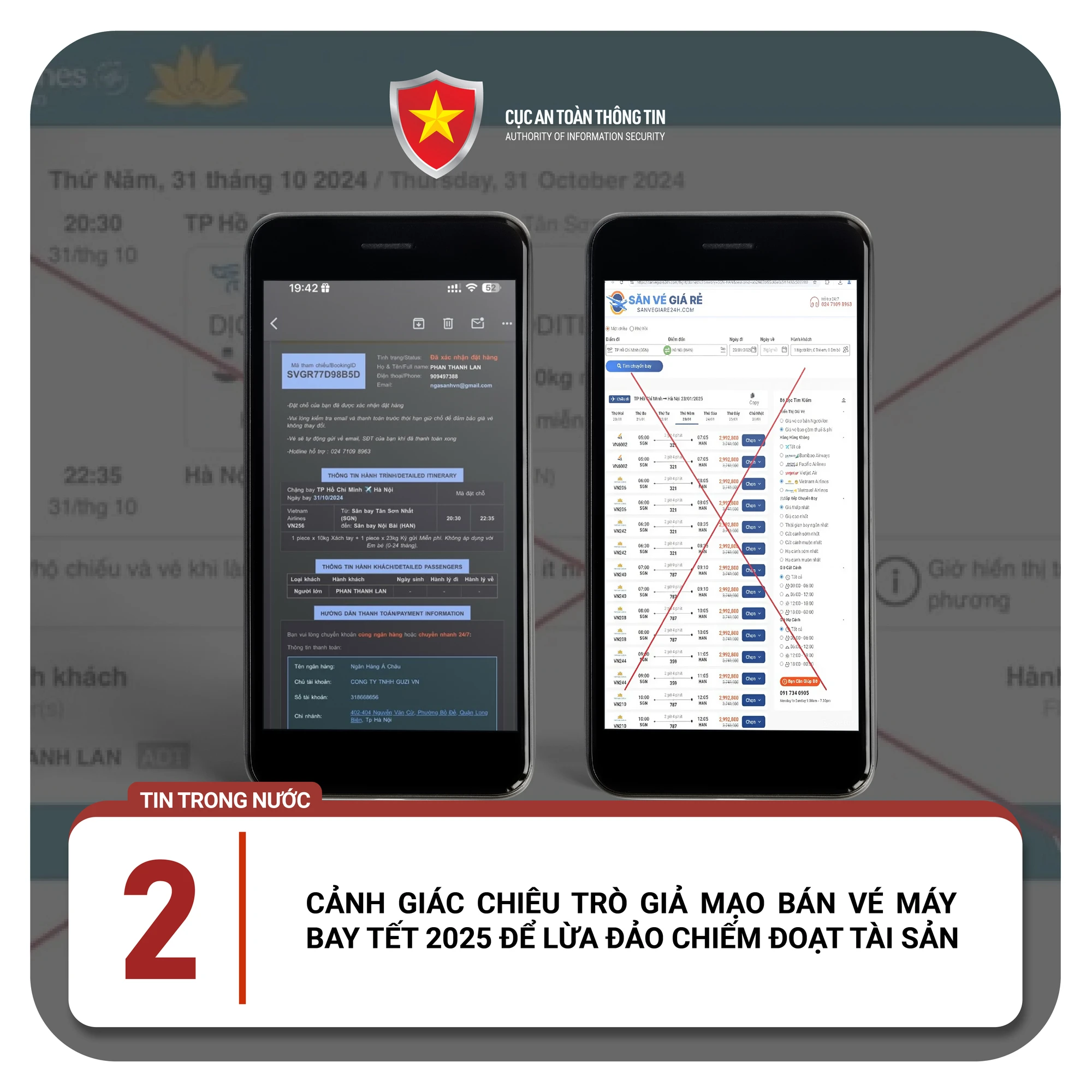

Vietnam Airlines warns of scammers using sophisticated tricks and tactics to sell cheap 2025 Lunar New Year flight tickets to deceive customers.

Recently, Vietnam Airlines and the authorities have recorded a number of cases of websites, organizations and individuals claiming to be agents of the airline. Specifically, some websites have similar domain names, which can easily confuse customers, such as: vietnamairslines.com; vietnamaairlines.com; vietnamairlinesvn.com; vemaybayvietnam.com. These websites have addresses, interfaces, colors and logos designed similarly to the official website of VNAs, so it is difficult to distinguish them from the official website of Vietnam Airlines (https://www.vietnamairlines.com).

The above-mentioned subject's method is usually to impersonate a level 1 ticket agent of Vietnam Airlines. When customers complete procedures to buy flight tickets, they will receive a booking code as a security deposit and a warning to pay immediately or the booking will be canceled. After receiving the money, the subject does not issue tickets and cuts off contact.

Transactions are made online, after payment customers only receive a booking code but the agent does not issue a ticket. Because the booking code has not been issued to the airline ticket, it will automatically cancel after a period of time and customers will only know about this when they arrive at the airport to check in.

In addition, some subjects send emails or text messages informing customers that they have “won” a prize or received a discount on airline tickets. When customers access the attached link and provide information, the scammers will steal credit card information or request payment.

In addition to the above method, many scammers, after receiving money from customers, still issue tickets but then refund the tickets (paying a refund fee) and taking most of the money the buyer paid.

Faced with the above sophisticated tricks, the Department of Information Security (Ministry of Information and Communications) recommends that people who need to book airline tickets, train tickets, etc. should conduct transactions through official websites, mobile applications or directly at ticket offices and official agents of the airline.

Customers who buy flight tickets on the website need to pay special attention to accessing the correct official address of the airline or contacting the hotline directly if they need answers or direct support related to booking and purchasing tickets.

If you receive offers for airline tickets that are too cheap compared to the airline's information, do not rush to book tickets but check again because it may be a trick of bad guys with the purpose of fraud. Do not access strange links or download applications of unknown origin to avoid device control and property theft.

In case of suspicion of being scammed, people need to immediately report to the authorities or report via the Vietnam Information Security Warning System (canhbao.khonggianmang.vn) for timely support, resolution and prevention.

|

Trusting two drug sales consultants who promised to help her buy insurance in exchange for monthly payments, a woman in Thai Binh province was scammed out of more than 200 million VND.

At the police station, the two scammers confessed that because they had no money for personal expenses, they searched for information about patients to call them to get acquainted, learn more, and advise them on selling medicine. If they saw that the victim was gullible, they would talk to them to gain their trust and promise to help them buy insurance to receive monthly payments. With this method, the scammers stole a total of over 200 million VND from Ms. M.

The common method of these scammers is to operate in groups, creating fake social media accounts and posting advertisements for "miracle" drugs at high prices. Many of these pages do not have a contact address, only a phone number for consultation.

In addition to those who call themselves "consultants", there will be other subjects whose job is to impersonate doctors at central hospitals to diagnose and prescribe drugs. These drugs cost from several hundred thousand to tens of millions of dong, with different uses such as: cancer prevention drugs, drugs to reduce the effects of chemotherapy, cancer radiotherapy... but in fact they are cheap drugs with ingredients of unknown origin.

More sophisticatedly, these groups also carry out the trick of "discounting" for the elderly, the poor, and the seriously ill, aiming to exploit the promotion-loving psychology of some consumers.

If the victim is found to be gullible, the subject will also entice them to buy insurance with super attractive incentives and policies to appropriate the victim's assets every month.

In the face of ongoing fraud, the Department of Information Security (Ministry of Information and Communications) recommends that people be cautious with information posted on social networking platforms, and verify the authenticity of information or subjects through official information sites.

Do not participate in groups providing services on social networks, especially services related to online medical consultation or selling special medicines. Do not buy or sell medicines of unknown origin, unverified, or transact with unknown parties.

In case it is not possible to go directly to the doctor for examination and treatment, people should only use official, licensed online platforms with a clear doctor identity verification system.

In addition, if people do not have enough understanding of insurance, they should absolutely not participate in buying and selling insurance on social networks to avoid having their property seized or their personal information stolen.

If you suspect you have been scammed, you should immediately report it to the authorities or consumer protection organizations for timely support, resolution and prevention.

|

On November 12, Japanese authorities arrested a Chinese man on charges of defrauding a 71-year-old woman of 809 million yen (equivalent to 134 billion VND). This is the largest-ever social media investment scam in Japan.

The man arrested is named Wen Zhuolin, 34 years old, claiming to be the director of a company, residing in Sumida Ward, Tokyo. Meanwhile, the victim is the CEO of a company in Ibaraki Prefecture.

It is known that Mr. Zhuolin created an advertisement about the investment program through the social networking platform Instagram. In this advertisement, he identified himself as Takuro Morinaga - a Japanese economic analyst to increase his credibility.

When the victim approached him and expressed his desire to invest, Mr. Zhuolin asked him to use the Line messaging app for convenient consultation and communication. After just over a month, the victim transferred 10 million yen (equivalent to 1.6 billion VND) after an individual claiming to be Mr. Morinaga's assistant convinced him to invest through an app.

Initially, the scammers showed the victim that the investment would generate profits. As a result, the woman went on to transfer or hand over a total of 799 million yen to unknown individuals through 47 transactions.

In light of the developments of the incident, the Department of Information Security (Ministry of Information and Communications) recommends that people be vigilant against advertisements or invitations to participate in financial investments. Carefully verify information of individuals, units or organizations calling for investment through official news sites.

Never transfer money without verifying the identity of the person. When detecting suspicious signs, people need to quickly report to the police to promptly prevent fraud.

|

The Sedgwick County Prosecutor's Office (Wichita City, USA) has issued a warning about fraud, appropriation of people's assets and information through fake text messages about social insurance policies.

The subjects claimed to be employees of a law firm and proactively approached the victims via email messages. The messages stated that a client of the company had died several years ago, leaving behind an unclaimed insurance sum, which the victim was likely to receive because he had the same name as the deceased.

The subjects added that between the company and the beneficiary, 90% of the money would be divided according to the agreement and 10% would be sent to local charity centers. The victims would then be asked to access a fake website, containing the company's logo and many images available online to increase credibility.

Here, the website will ask the victim to provide information such as full name, phone number, home address, bank card information, etc. to complete the procedure, promising that after 20 days the victim will receive the insurance money.

In the face of fraud, the Department of Information Security (Ministry of Information and Communications) recommends that people be vigilant when receiving messages notifying them of suspicious amounts of money. Carefully verify the identity and work unit of the sender through the phone number or official information portal.

Absolutely do not reply to messages or follow the instructions of the subjects without verifying their identity. When detecting suspicious messages, people need to quickly report to the competent authorities to promptly investigate the fraud and trace the subject.

|

According to the UK Cyber Security Center (NCSC) and the US Federal Trade Commission (FTC), QR code scams via text messages, emails or social media posts are becoming increasingly sophisticated, unpredictable and increasing at an alarming rate.

With QR codes becoming more and more popular due to their convenience, this easily creates conditions for bad guys to commit fraud. One of the scams that these guys have been using recently is to impersonate banks or financial companies, send email messages to people with requests to update or confirm personal information to increase account security, then attach a QR code leading to a fake website, created with the purpose of stealing users' information.

In addition, people can encounter fake QR codes through social networking platforms, appearing with posts advertising products at extremely preferential prices and limited quantities, urging victims to scan the code leading to websites or applications containing malicious code, allowing scammers to take control of the device.

Another reason why this scam is widely used is because QR codes can easily hide fraudulent links and website addresses, making it difficult for users and security systems of digital platforms to detect.

Faced with the complicated developments of fraud, the Department of Information Security (Ministry of Information and Communications) recommends that people be vigilant when encountering messages, emails or posts containing QR codes.

Carefully verify the information of the individual, unit or organization providing the QR code through the phone number or reputable information pages. Carefully check the domain name and website address after scanning the code, immediately exit the website if you find strange characters, no network credit certificates or do not match the legitimate domain name.

When detecting signs of fraud, users need to quickly report to the authorities to promptly prevent fraudulent behavior.

Source: https://nhandan.vn/toi-pham-qua-mat-xac-thuc-sinh-trac-hoc-de-lua-dao-post845520.html

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)