The “Trump Effect” has sent Bitcoin to an unimaginable high, with proponents betting on a price of $95,000 to $100,000, while critics warn of the risks of cryptocurrencies linked to geopolitics and how far Donald Trump will go in fulfilling his promises to cryptocurrencies.

The “Trump Effect” has sent Bitcoin to an unimaginable high, with proponents betting on a price of $95,000 to $100,000, while critics warn of the risks of cryptocurrencies linked to geopolitics and how far Donald Trump will go in fulfilling his promises to cryptocurrencies.

|

Trump takes Bitcoin to a new page

More than 10 days since Donald Trump was elected the 47th President of the United States, Bitcoin price has continuously broken new records and peaked on November 13, the price jumped over the 93,000 USD mark in a short time when the market expected the US Federal Reserve (Fed) to continue lowering interest rates, which would promote President-elect Donald Trump's stance in favor of virtual currency.

Bitcoin, the world’s oldest and most valuable cryptocurrency, has risen 30% in the past week alone. In the US, Bitcoin rose nearly 6% on November 13 to a record high of $93,462, but the rally fizzled out and fell to $91,300.

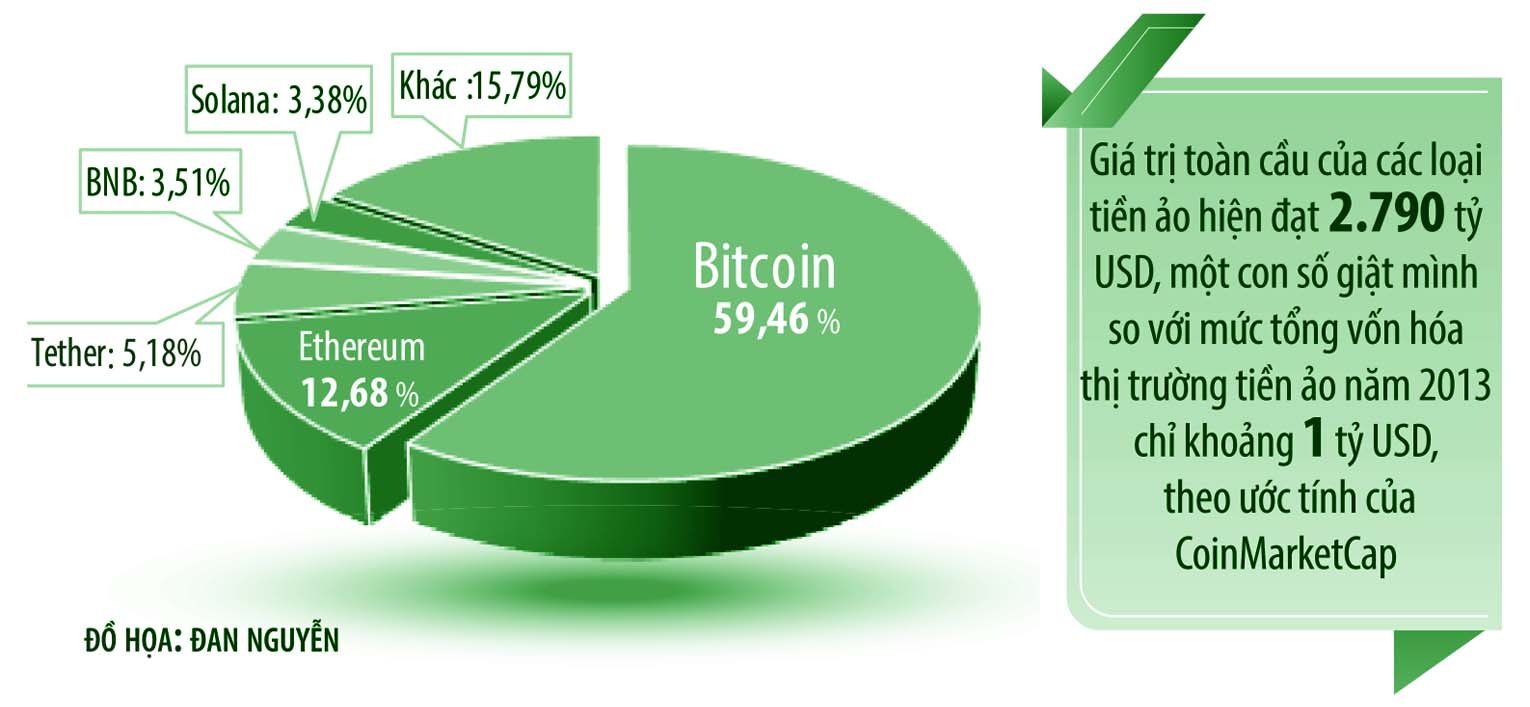

In general, the cryptocurrency market has been operating in a “when the water rises, the duckweed rises” manner in recent days. Bitcoin is not the only cryptocurrency that has increased in price; when it increases in price, its siblings such as Ethereum and Dogecoin also increase. Notably, Dogecoin - a cryptocurrency strongly supported by billionaire Elon Musk, a “hero” in Mr. Trump’s 2024 election campaign, has seen its price jump 152%.

The reason Bitcoin and other virtual currencies have reached record prices is due to the expectation that, in his 47th term as President, Mr. Trump will loosen legal regulations related to virtual currencies and realize his promise to turn the US into the "virtual currency capital of the planet".

It should be recalled that, during his 45th term as President, Mr. Trump once considered virtual currencies a threat to the USD. “I am not a fan of Bitcoin and other virtual currencies, which are not money and whose value is highly volatile, based on thin air. Unregulated virtual assets can facilitate illegal behavior, including drug trafficking and other illegal activities,” Mr. Trump posted on Twitter (now X social network) in 2019.

However, Mr. Trump, who was elected the 47th President of the United States, made a 180-degree turn, placing his trust in virtual currencies such as Bitcoin and Ethereum.

At the Bitcoin 2024 conference in July this year, Mr. Trump became the center of attention when he made a bold statement about potential policies. “If I am elected President, my policy is to retain 100% of the Bitcoin that the United States Government currently holds or purchases in the future,” Mr. Trump declared, while affirming: “If virtual currency is the future, I want it mined, minted, and manufactured in the United States.”

Then, in late September, Mr. Trump and his three sons (Donald Jr, Eric and Barron) delighted cryptocurrency enthusiasts by announcing the establishment of the World Liberty Financial joint venture, a decentralized finance (DeFi) platform and focused on trading a proprietary cryptocurrency called $WLFI.

Many cryptocurrency enthusiasts see this as a sign of support from the Trump administration, but the World Liberty Financial venture has come under fire from some DeFi experts for its potential conflict of interest.

“There are already so many undesirables in the world of cryptocurrency and DeFi that adding Trump to that list is unlikely to spur adoption or excitement,” Michael Dowling, a finance professor at Dublin City University Business School, warned in a recent interview with Newsweek. “Remember, the early cryptocurrency markets began by facilitating drug trafficking.”

|

Bubble Risk, Avoid Illusions with Cryptocurrency

A second term for President Trump is expected to cause significant fluctuations in the USD against other major currencies. These may come from the trade policy that Mr. Trump announced during his re-election campaign, applying tariffs of 10-20% on all imports into the US and 60% on Chinese goods.

New or increased tariffs could lead to trade tensions, which could impact currency markets. This could temporarily strengthen the dollar, making U.S. goods more expensive, but such uncertainty could also fuel market speculation and volatility in the greenback.

If the USD weakens, investors looking for alternatives may turn to cryptocurrencies as a hedge against inflation or currency devaluation.

On the other hand, analysts say that the Trump 2.0 administration could increase geopolitical and domestic political tensions. So is cryptocurrency a safe haven in times of rising tensions? Some of its early supporters have referred to it as a kind of “digital gold.”

In fact, at times during President Trump’s first term, it seemed like cryptocurrencies were acting like digital gold. Bitcoin’s price spiked in 2019 as trade tensions between the United States and China escalated. It also briefly spiked in early 2020 when Iran attacked two U.S. military bases in retaliation for the killing of Gen. Qassem Soleimani.

However, studies have shown that Bitcoin and Ethereum are not safe havens from international stock markets. When included in investment portfolios, they have increased downside risk.

It should be noted that Bitcoin has experienced many strong fluctuations in the past 4 years, with "ups and downs" following economic events, market psychology and legal actions of some countries. Specifically, in March 2020, the price of Bitcoin dropped dramatically to below 5,000 USD, when the global market was shaken by the Covid-19 pandemic, but then turned around and increased to a historical high of nearly 69,000 USD. However, the cryptocurrency market continued to face storms after the collapse of the FTX cryptocurrency exchange in November 2022, pulling Bitcoin down below 16,000 USD, while Ethereum fell below 1,100 USD.

The recent excitement in the cryptocurrency market following Trump’s election victory is therefore understandable. The cryptocurrency community sees a “powerful new friend” in Trump, as he has pledged to create a more business-friendly environment if elected.

Trump has mentioned a series of pro-cryptocurrency policies, including building a US government Bitcoin reserve, preventing the government from selling existing cryptocurrency holdings, and even using cryptocurrency to pay down the national debt. To solidify his pro-Bitcoin stance, Trump has spoken out against “central bank digital currencies,” or CBDCs.

Mr. Trump even "pointed his spear" at the Chairman of the US Securities and Exchange Commission (SEC) Gary Gensler, who has harshly criticized virtual currency.

“On my first day in office (January 20, 2025 - Editor's note), I will fire Gary Gensler,” Trump said at this year's Bitcoin conference.

While the public support of the Trump 2.0 administration may attract more institutional investors to enter the cryptocurrency market, the potential risks cannot be overlooked if the Trump 2.0 administration abolishes regulations related to cryptocurrencies, which may increase investor speculation, causing the market to fall into a bubble and become more prone to collapse.

Taking a cautious stance on the level of support Mr. Trump has for virtual currencies, Mr. Mauvis Ledford, CEO of technology start-up Sogni AI (Singapore), said that the Trump 2.0 administration could use virtual currencies to stimulate economic growth.

Ledford predicts that the Trump administration will likely explore the use of blockchain technology to increase transparency and efficiency in government operations, especially with Elon Musk as an advisor. However, the Sogni AI representative added: “I personally don’t believe anything Trump says, and blockchain technology allows for the creation of rules that everyone has to follow, which I don’t think Trump would like in a government that he runs.”

So, nothing is certain at this point and markets could have a tough time ahead.

Source: https://baodautu.vn/tien-ao---vang-so-hay-canh-bac-duoi-thoi-ong-donald-trump-d230604.html

Comment (0)