In recent days, a story has been circulating on social media about scanning QR codes causing phones to freeze and losing all the money in bank accounts. However, technology experts have confirmed that this is just a false rumor, causing public confusion.

False rumors and the dangers of fear

Recently, a video circulating on social media has caused a stir with the story of "losing more than 100 million VND after scanning a QR code". According to the story, this QR code caused the phone to freeze and the money in the account to "evaporate" immediately after. This information quickly attracted thousands of shares, fueling concerns about cyber security in online transactions.

However, according to Mr. Vu Ngoc Son, Technology Director of Vietnam National Cyber Security Technology Company (NCS), QR codes are essentially just an intermediary tool to transfer information, not a malware that causes loss of money. The risk only occurs when users scan QR codes that lead to malicious links, install fake software or transfer money according to fraudulent instructions. This rumor has taken advantage of users' panic to create unnecessary fear.

A video with the content "losing hundreds of millions of dong after 5 seconds of scanning a QR code to transfer money" has caused confusion for many people, but experts say this is fake news. (Illustration photo).

The spread of this false information not only causes confusion but also makes many people afraid of online transactions, unintentionally losing the benefits of QR code technology in modern life.

This expert also recommends that users can check information through official channels such as websites of police agencies, banks, newspapers, and official television. Follow warnings from cybersecurity associations or reputable cybersecurity companies. Do not share unverified information to limit the spread of baseless rumors that cause panic.

Beware of scams using QR codes and account numbers

While QR codes are not a direct attack tool, they can still be used by criminals to steal information. Some entities create QR codes that contain links to fake websites, tricking users into entering account information or installing malware.

According to Mr. Ngo Minh Hieu (Hieu PC), the scam also takes advantage of publicizing bank account information and phone numbers on social networks. The subject will enter the wrong password many times to lock the account, then impersonate a bank employee and ask the user to install malware to "restore the account". Once this software is installed, the scammer can take control of the device and steal data.

To prevent this, experts recommend that users do not click on strange links, do not install files from unknown sources and absolutely do not provide OTP codes over the phone. When having account problems, you should go directly to the transaction point or contact the bank's official hotline.

Source: https://www.baogiaothong.vn/thuc-hu-viec-ma-qr-tro-thanh-vu-khi-cua-tin-tac-192250115222023642.htm

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

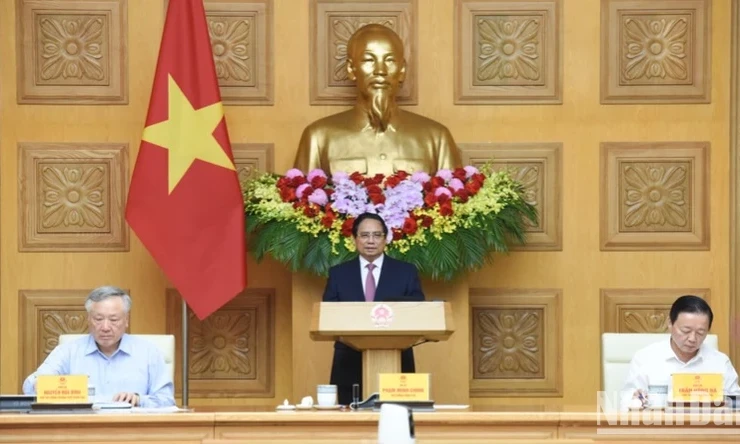

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)