Focus resources on implementing wage reform policies, social security policies and regimes, and poverty reduction as required by the Prime Minister.

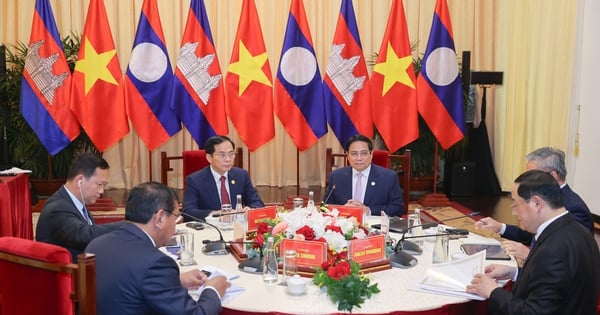

Prime Minister requests savings to implement salary reform and reserve for urgent tasks - Photo: N.TRAN

Research to perfect tax regulations on houses and land

However, production and business activities of a number of enterprises are still facing difficulties, inflationary pressure is still high, and some revenue items have low collection progress, especially land use fees. Disbursement of development investment expenditure in the first 8 months of the year only reached 40.49% of the plan assigned by the Prime Minister. Compliance with financial discipline and order in some places is still not strict, there are still violations of the law, fraud, tax evasion, management and use of the budget and public assets in violation of regulations, loss and waste in some units. Therefore, the Prime Minister requested synchronous implementation of solutions for revenue management, prevention of budget loss, drastic implementation of revenue collection, and completion of the highest budget estimate. Study and perfect tax regulations on houses and land; expand and prevent erosion of the tax base, exploit revenue sources with room for expansion, and expand new revenue bases. Apply technology to revenue management, especially e-commerce transactions and foreign suppliers. Deploying an information portal on e-commerce platforms and expanding the deployment of electronic invoices generated from cash registers for businesses and business households operating and providing goods and services directly to consumers, especially food and beverage services... Combating trade fraud, transfer pricing, import price fraud and cross-border smuggling, especially business activities on digital platforms and real estate transfers. Strengthening inspection and supervision of the implementation of regulations on price management, taxes, fees, and price stabilization of raw materials and essential goods. Regarding budget expenditures, it is necessary to cut and save 5% of the regular expenditure estimate. For 2025, in addition to the 10% savings in regular expenditures to create a source for salary reform according to regulations, it is necessary to review, restructure and arrange spending tasks, striving to save an additional 10% of the increased regular expenditures of the estimate, to reserve resources to reduce deficits or for urgent and arising tasks.Dedicate resources to salary reform

Focus resources on implementing salary reform policies, social security policies and regimes, hunger eradication and poverty reduction; cut down on regular expenditure estimates that have been assigned but have not been fully allocated by June 30. Invest in construction and purchase of public assets in accordance with the regime, standards and norms, ensuring savings. Organize the review and rearrangement of public assets, handle assets, resolutely recover assets used for the wrong subjects, for the wrong purposes, exceeding standards and norms, and wastefully... Review the entire legal framework to submit to competent authorities for consideration and decision on amending or abolishing the financial and specific income mechanisms of agencies and units that are being implemented appropriately before December 31, 2024. Review, arrange and adjust expenditure estimates according to regulations; proactively cut down on unnecessary expenditures; thoroughly save on regular expenses, especially expenses for conferences, seminars, celebrations, domestic business trips, research, and overseas surveys. To carry out the above tasks, the Prime Minister assigned the Ministry of Finance to operate a reasonable fiscal policy with a focus and key points, resolutely implement digital transformation, regulate invoices, and cut and save on regular expenses. The Ministry of Planning and Investment shall remove institutional difficulties and obstacles; urge and promptly guide the handling of arising issues to accelerate the disbursement of public investment capital. Tuoitre.vn

Source: https://tuoitre.vn/thu-tuong-nam-2025-tiet-kiem-10-de-cai-cach-tien-luong-them-10-cho-nhiem-vu-cap-thiet-20240903091211585.htm

Comment (0)