Attracting foreign capital into the corporate bond market: Lack of both goods and mechanisms

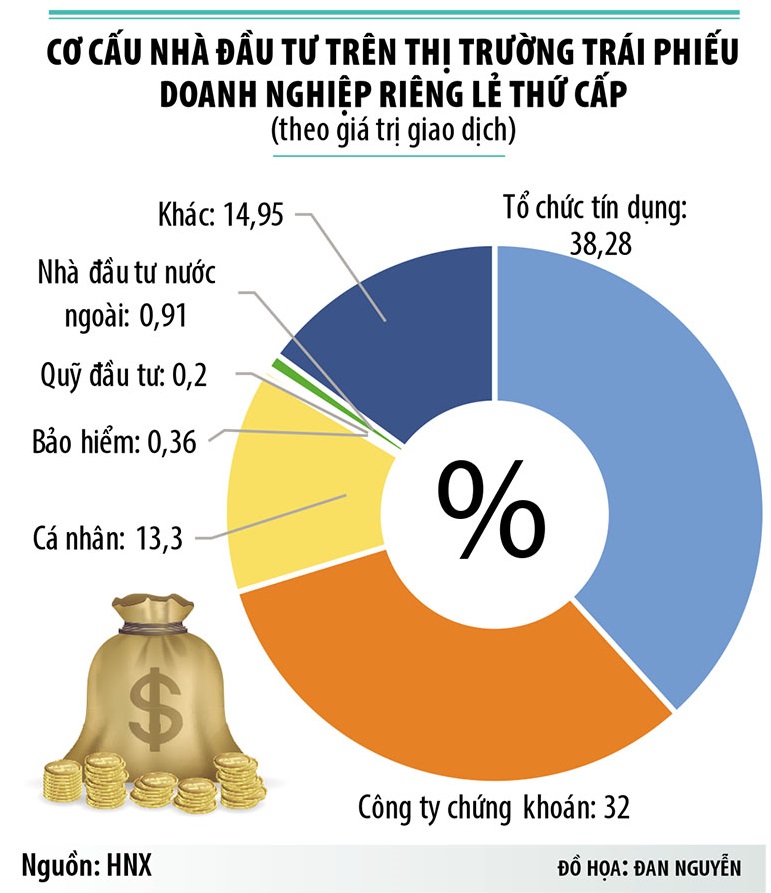

Liquidity in the corporate bond market is gloomy, as individual investors have sharply declined, while institutional investors are still limited to banks and securities companies.

|

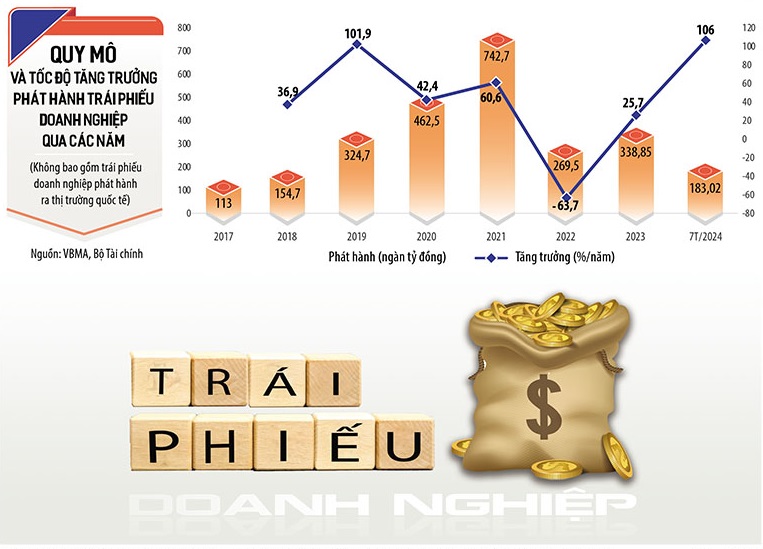

| The corporate bond market, despite its impressive growth, lacks mechanisms and quality products to attract foreign investors. Graphics: Dan Nguyen |

Without ratings, even the "sharks" are helpless

Experts say that the corporate bond market lacks both mechanisms and quality goods to attract "sharks", especially foreign investment capital.

Currently, the buyers in the private corporate bond market (secondary) are mainly banks and securities companies (accounting for about 80%). Other institutional investors such as investment funds account for only 0.2%, insurance companies account for 0.36%. Notably, foreign investors account for only 0.91%.

According to intermediaries in the bond market, there are many financial institutions worth tens of billions of USD that want to invest in the Vietnamese bond market, but cannot invest capital due to the lack of both mechanisms and good quality goods.

“There are many pension funds and mutual funds interested in the Vietnamese bond market, but they cannot invest,” said Mr. Nguyen Quang Thuan, General Director of FiinRatings.

According to Mr. Thuan, the reason for this situation is that when investing in bonds of each country, these foreign funds base their investment on the credit rating of the bonds. This is an international practice, but issuers in Vietnam do not have this habit. According to the Vietnam Bond Market Association, in the first 7 months of this year, the number of bonds with credit ratings only accounted for 7% of the value.

Ms. Duong Kim Anh, Investment Director of Vietcombank Securities Company Limited (VCBS), also said that when foreign insurance companies want to invest in bonds in Vietnam, the first thing they care about is data on bonds, especially data on the default probability of the issuing company. This is a must for businesses to manage risks for their investments.

“Almost every foreign fund that contacts VCBS asks if there is such data, and if there is any independent party that provides such data to carry out their risk management activities,” said Ms. Duong Kim Anh.

Currently, licensed life and non-life insurance companies in Vietnam are managing investments of about 30 billion USD, but only a very small portion of their investment assets are allocated to corporate bonds.

The Law on Insurance Business, which took effect in early 2023, does not allow investment in corporate bonds issued for the purpose of debt restructuring, limiting the participation of this group of investors in the corporate bond channel.

|

Opportunity to attract foreign capital at home

Recently, many businesses have had to issue international bonds to raise capital with interest rates of 8-10% per year, not to mention costs and risks of exchange rate fluctuations. Meanwhile, if they raise capital at home, the costs will be significantly reduced.

“However, to develop and attract investors, especially institutional investors, the main infrastructure (policies, legal framework, transparency) is important, but the soft infrastructure (trading on the listed floor) must follow international practices, especially credit ratings,” Mr. Nguyen Quang Thuan recommended.

In addition, to attract institutional investors and foreign investors, experts say the Government needs to consider some preferential solutions on taxes and refinancing mechanisms. There needs to be solutions to improve the quality and diversity of "goods" on the market, especially green bonds.

Mr. Vo Hoang Hai, Deputy General Director of Nam A Bank, recommended that one of the important solutions to attract foreign investors is that Vietnamese enterprises must increase the issuance of green bonds.

Currently, the Government has a policy to develop green bonds, the State Securities Commission has also issued a green bond handbook. However, the authorities have not yet issued a green classification list to serve as a basis for issuing green bonds.

In addition, many securities companies also recommend that Vietnam should consider establishing intermediary financial institutions for credit guarantee or bond guarantee services. This will restore confidence and diversify the bond products provided to the market. This guarantee organization can be established and operated by large financial and investment institutions in Vietnam and international organizations.

Source: https://baodautu.vn/thu-hut-von-ngoai-vao-thi-truong-trai-phieu-doanh-nghiep-thieu-ca-hang-hoa-lan-co-che-d222895.html

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Prime Minister Pham Minh Chinh commends forces supporting Myanmar in overcoming earthquake consequences](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/e844656d18bd433f913182fbc2f35ec2)

Comment (0)