The Vietnam Commodity Exchange (MXV) said that green continued to dominate the world raw material price list in yesterday's trading session (October 30).

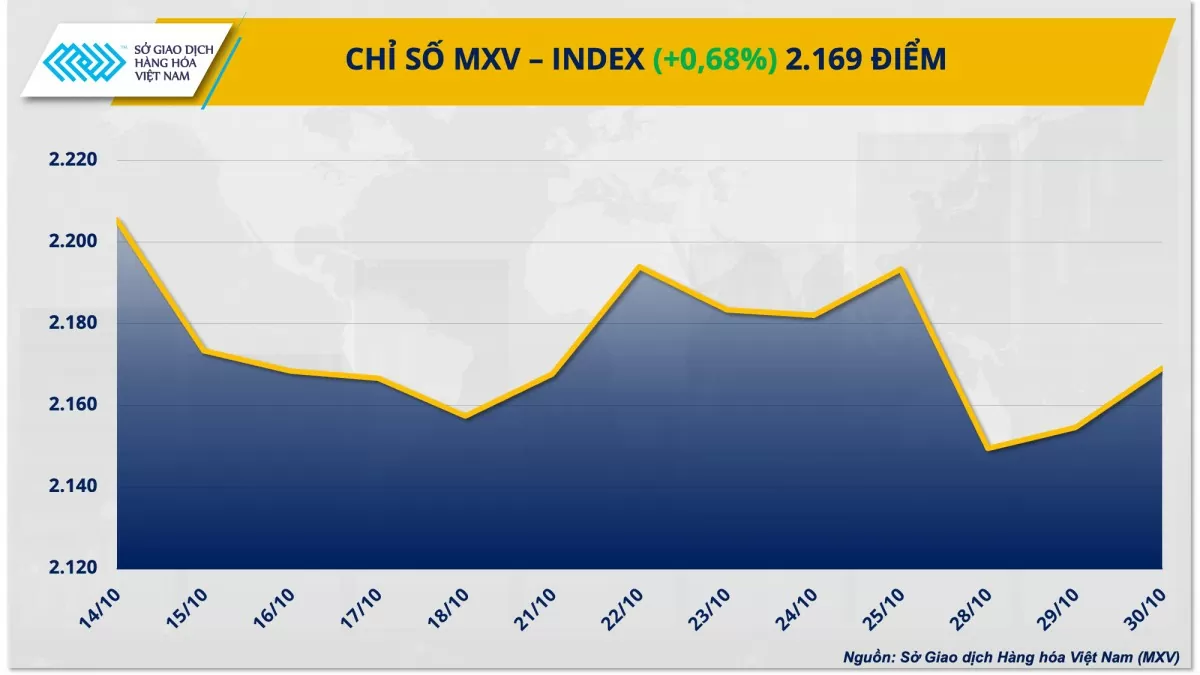

Closing, the MXV-Index increased by 0.68% to 2,169 points. Notably, the energy group led the recovery trend of the entire energy market when 4 out of 5 items increased in price. In addition, the industrial materials group also maintained its upward momentum when 7 out of 9 items closed in the green.

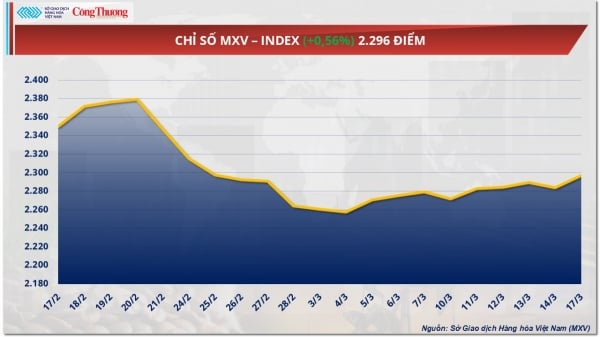

|

| MXV-Index |

World oil prices reverse to recover

At the end of yesterday's trading session, world oil prices reversed after plunging in the previous two sessions. The main reason was an unexpected decrease in US crude oil and gasoline inventories and the news that the Organization of the Petroleum Exporting Countries and its allies (OPEC+) postponed the previously planned production increase.

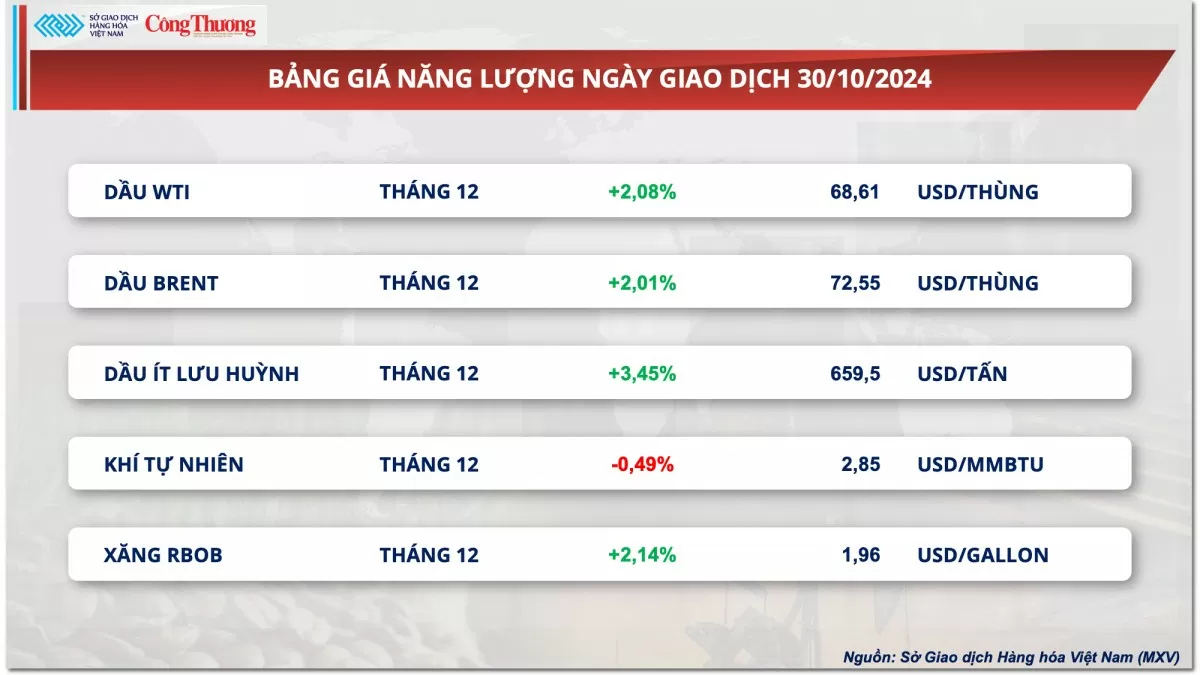

At the end of the trading session on October 30, WTI crude oil price increased by 2.08% to 68.61 USD/barrel. Meanwhile, Brent crude oil price increased by 2.01% to 72.55 USD/barrel.

|

| Energy price list |

According to the US Energy Information Administration (EIA), US gasoline inventories fell unexpectedly to their lowest level in two years last week, signaling an improvement in demand, thereby supporting the recovery of oil prices. In addition, crude oil imports into the US from Saudi Arabia, Canada, Iraq, Colombia, and Brazil all fell last week. Notably, oil imports from Saudi Arabia fell to their lowest level since January 2021, from 150,000 barrels per day (bpd) to 13,000 bpd. The sluggish import activity led to an unexpected drop in US crude oil inventories, while also easing concerns about a supply glut the previous week when US oil inventories jumped, thereby contributing to supporting oil prices.

In addition, according to Reuters, the planned increase in production in December by OPEC+ may be postponed for at least 1 month due to concerns about weakening oil demand and increasing supply. The extension of the production easing has helped the market reduce doubts about the risk of oil oversupply, thereby helping world oil prices reverse and increase again.

Previously, OPEC+ planned to increase oil production by 180,000 barrels per day by the end of this year, with the aim of gradually recovering previously cut oil production. Two sources from OPEC+ said that the decision to postpone the increase in production could be made as early as next week. In addition, the market is also paying attention to the Monthly Oil Market Report (MOMR) of the Organization of the Petroleum Exporting Countries (OPEC) to be released on November 12. Following that, Saudi Arabia will also announce the Official Selling Price (OSP) of its crude oil.

Cocoa prices extend gains to fourth consecutive session

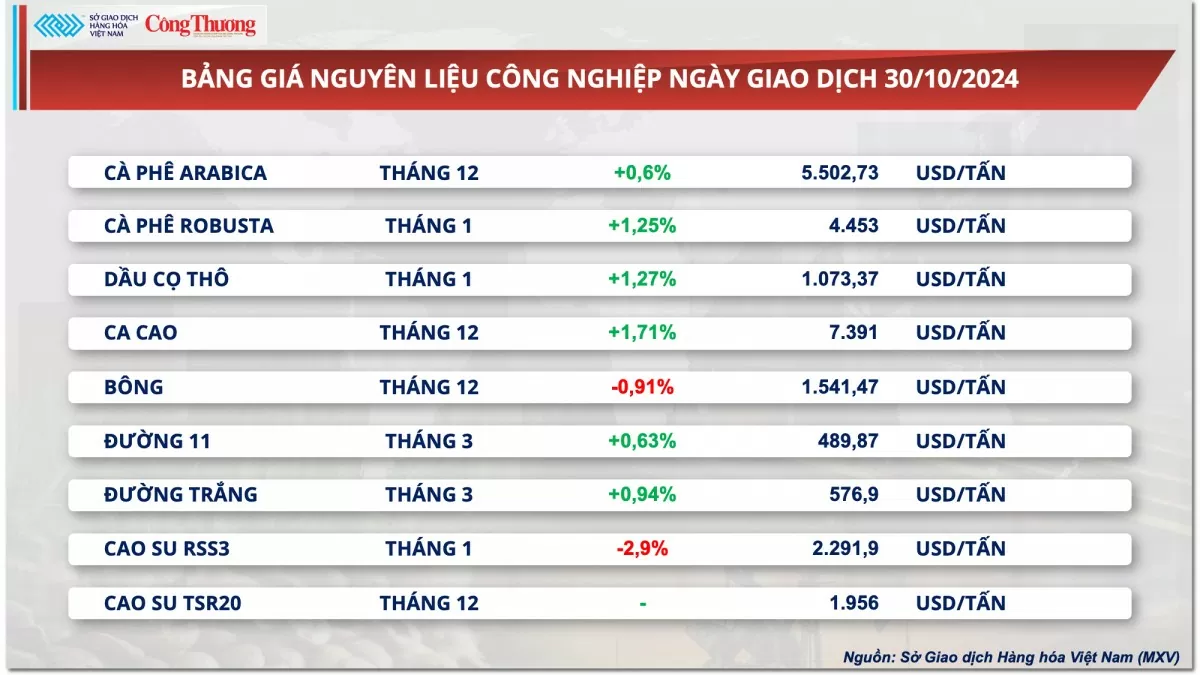

According to MXV, at the close of yesterday’s trading session, green dominated the price list of industrial raw materials. In particular, cocoa prices increased for the fourth consecutive session, reaching 7,391 USD/ton. The market continued to be supported by information about excessive rain in Africa as well as concerns about a global cocoa deficit.

Heavy rains in Africa’s cocoa plantations, the world’s largest producer, have raised concerns about flooding and disease outbreaks that could impact crops. This could lead to a sharp decline in cocoa yields, making the 2024-2025 supply outlook less optimistic than initially expected.

|

| Industrial raw material price list |

In addition, JPMorgan recently forecast that the global cocoa market will continue to have a deficit of 100,000 tons in the 2024-2025 crop year, contrary to the previous balance forecast as well as the market's expectation of a small surplus.

Notably, in the 2023-2024 crop year, the global cocoa market fell into a serious deficit due to a sharp decline in output in Ivory Coast and Ghana - two countries that account for nearly 70% of global output. This was the main reason for the spike in cocoa prices in the last months of 2023 and early 2024. Currently, cocoa prices remain high compared to the same period in previous years because production in major supplying countries has not fully recovered.

Prices of some other goods

|

| Metal price list |

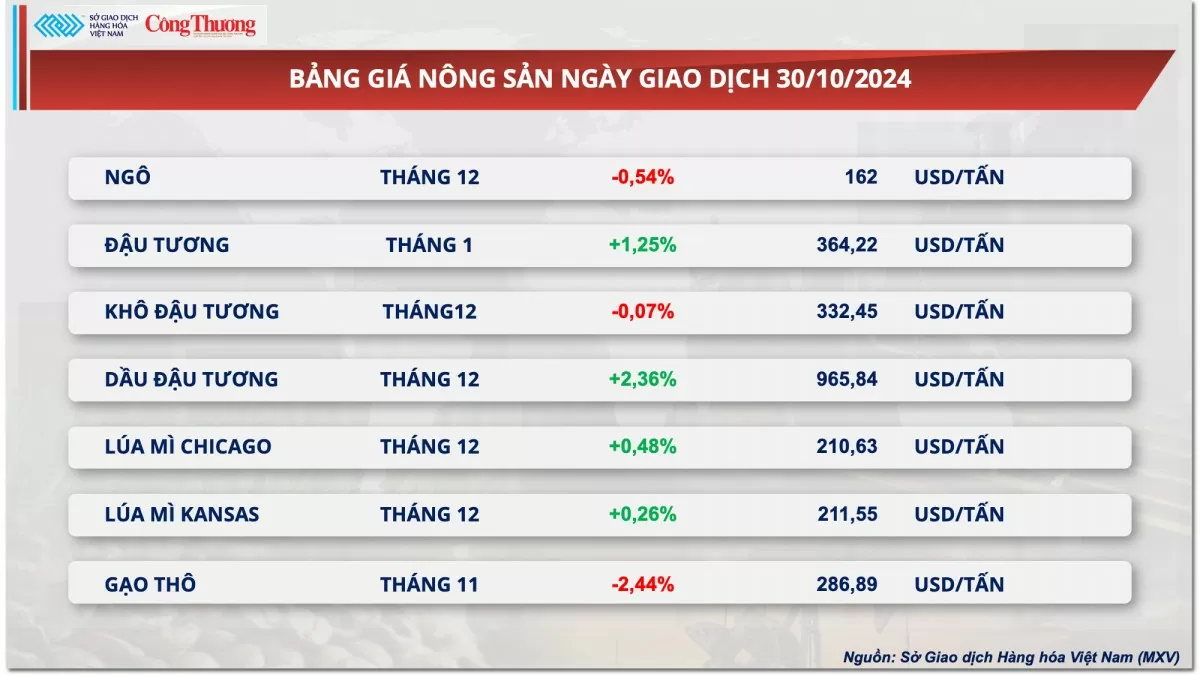

|

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-ngay-3110-thi-truong-hang-hoa-nguyen-lieu-the-gioi-dang-lay-lai-sac-xanh-355880.html

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)