Continuously increasing charter capital is an important part of SeABank's development strategy.

Recently, the State Bank of Vietnam issued Decision No. 2378/QD-NHNN on adjusting the charter capital on SeABank's Operating License. Accordingly, SeABank's charter capital increased by VND 3,393 billion, from VND 24,957 billion to VND 28,350 billion, equivalent to an increase of nearly 13.6%. SeABank's additional capital is implemented through the issuance of shares to pay dividends in 2023 and the issuance of shares to increase equity capital from equity capital. This plan is part of the capital increase roadmap approved by SeABank's 2024 Annual General Meeting of Shareholders. Continuously increasing charter capital is an important part of SeABank's development strategy, helping the Bank increase its capital and financial capacity to continue improving capital adequacy indicators, supplementing operating capital scale, investing in technology, etc. Thanks to that, SeABank will have a solid and comprehensive foundation to create momentum for development and complete growth targets, promoting a sustainable development strategy in the direction of Governance - Environment - Society (ESG). At the end of the first 9 months of 2024, SeABank affirmed its position and operational efficiency with pre-tax profit of VND 4,508 billion, up 43% over the same period. Along with that, the Bank received many positive indicators thanks to maintaining solid and effective risk management, typically the capital adequacy ratio (CAR) at 12.85%, higher than the minimum requirement of Basel III (10.5%); the bad debt ratio was controlled at 1.87%. Adhering to the sustainable business strategy, SeABank continues to comprehensively consolidate its foundations and financial potential to enhance competitiveness, promote development, and aim to become the most favorite retail bank. Source: https://nhandan.vn/seabank-chinh-thuc-tang-von-dieu-le-len-28350-ty-dong-post843199.html

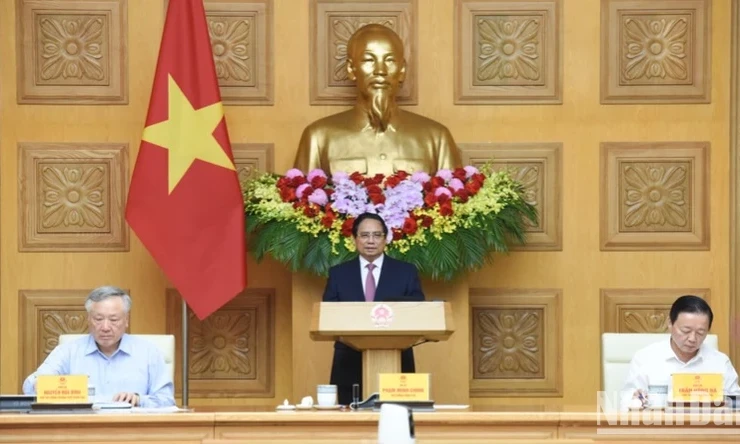

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

Comment (0)