The Ministry of Information and Communications is seeking opinions from relevant ministries, sectors and units to complete the draft Law on Digital Technology Industry. Notably, in this draft law, the issue of digital assets has been mentioned, aiming to create a legal framework for a rapidly developing field.

Transactions over 100 billion USD

The Government has assigned ministries and branches to complete the legal framework for digital assets and digital currencies (also known as virtual assets and virtual currencies), with a deadline of May 2025.

The development of a legal framework is one of the actions included in the national action plan to implement the Vietnamese Government's commitment to preventing money laundering, combating terrorist financing and financing the proliferation of weapons of mass destruction. On the other hand, with the strong development of digital assets and cryptocurrencies, the need for a legal framework is urgent. Although not yet recognized, in reality, the ownership and trading of digital assets and cryptocurrencies are quite common in Vietnam.

A recent report by CryptoCrunchApp shows that Vietnam ranks 3rd in the world in terms of the number of cryptocurrency holders (after India and the US). Mr. Phan Duc Trung, Permanent Vice President of the Vietnam Blockchain Association, said that in 2022, the flow of digital assets into the Vietnamese market will be about 100 billion USD. This figure will reach about 120 billion USD in 2023 and is expected to grow strongly in 2024.

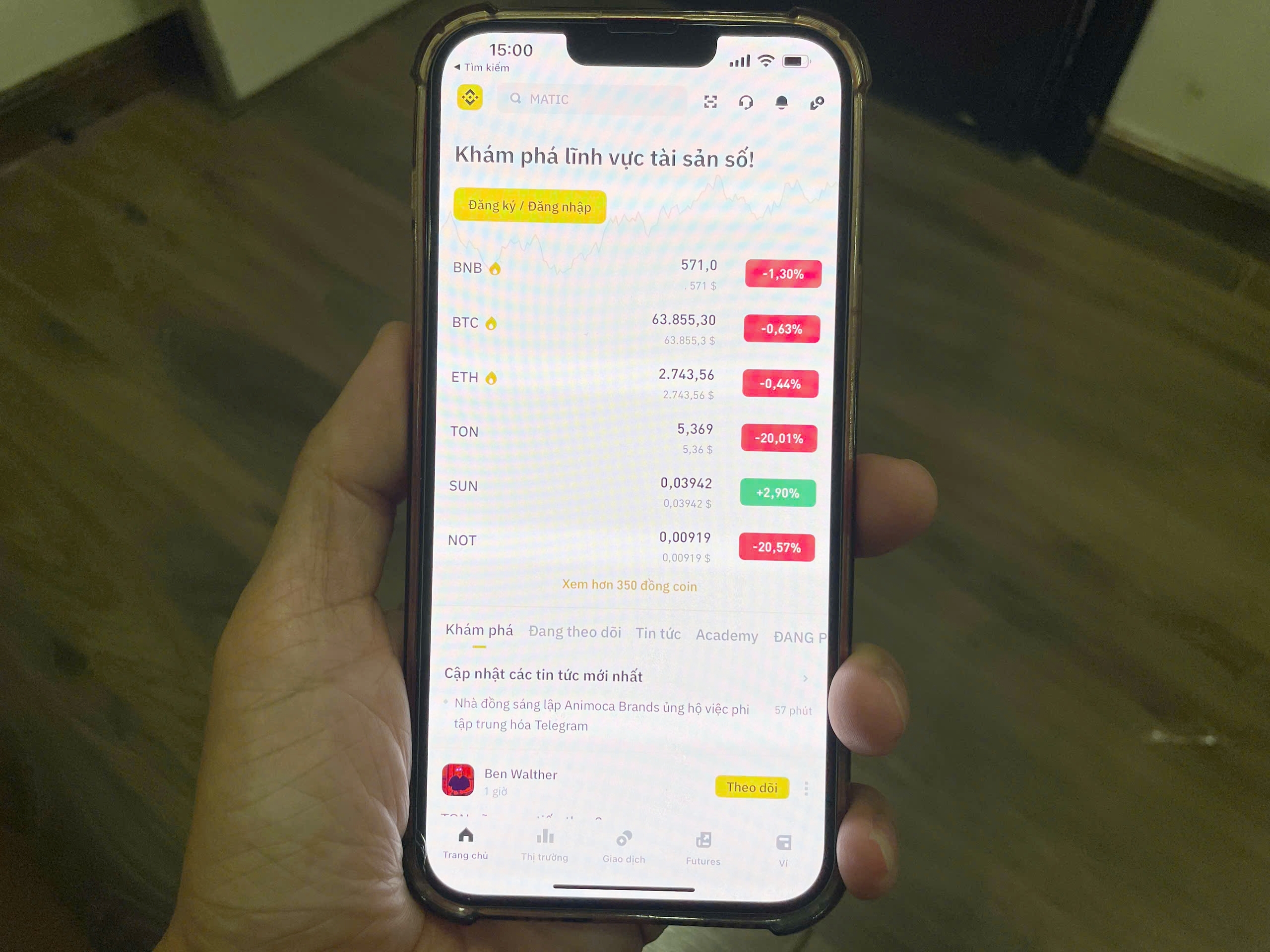

Currently, trading and investing in digital assets and cryptocurrencies is quite popular through international exchanges.

Mr. Le Viet Cuong (residing in Cau Giay District, Hanoi) - a person who owns cryptocurrency, said that trading and investing in cryptocurrency is currently quite easy through international trading floors. Buying and selling cryptocurrency usually uses peer-to-peer (P2P) trading methods. As digital assets and cryptocurrencies develop strongly, buying, selling and investing transactions are becoming more and more popular. The issue of a legal framework will resolve the requirements of ownership, disputes, especially tax management, which is increasingly urgent.

The draft Law on Digital Technology Industry clearly states that digital assets and digital currencies are digital technology products created, issued, stored, transferred and authenticated by blockchain technology, which people have the right to own according to the provisions of civil law and related laws. Thus, the draft law has mentioned the issue of ownership of this type of asset.

Tax management is essential

The draft Law on Digital Technology Industry has proposed assigning the Ministry of Finance to preside over and coordinate with ministries and branches to promulgate or develop and submit to competent authorities to promulgate regulations on digital asset management and organization of digital asset service provision.

Mr. Truong Ba Tuan - Deputy Director of the Department of Tax, Fee and Charge Policy Management and Supervision (Ministry of Finance) - acknowledged that in the process of perfecting the legal framework, it is necessary to determine what digital assets are; their legal status and how to manage them. The Ministry of Finance will work with ministries and branches to do this, including perfecting tax policies for digital assets.

In the case of digital assets and digital currencies being considered as a type of property, the current Civil Code has not yet regulated this content, so it needs to be considered. Mr. Truong Ba Tuan said that if digital assets are regulated in the Law on Digital Technology Industry, there will initially be a basis for implementing tax laws for entities participating in business and transferring this type of property.

Emphasizing the strong trading and investment activities in digital assets and cryptocurrencies in recent times, Dr. Le Dang Doanh, former Director of the Central Institute for Economic Management (CIEM), expressed concern that we do not have a legal framework to manage taxes, leading to revenue losses in recent years. This is an irreversible trend as technology continues to develop.

Dr. Le Dang Doanh said that the task of building a legal framework for digital assets to ensure state management on the one hand and promote the development of this field on the other hand is also a way to protect market participants.

Given that many people own digital assets and have income from digital assets, Mr. Dau Anh Tuan, Deputy General Secretary of the Vietnam Federation of Commerce and Industry (VCCI), emphasized that they must be responsible for paying taxes; the state needs to manage and collect taxes. However, the application of management policies will also encounter certain difficulties when it comes to defining what digital assets are.

Mr. Dau Anh Tuan said that Vietnam needs to refer to the experience of other countries to approach step by step. "When practice shows that this is a big need, occurring relatively commonly, it is time for us to have a legal framework and implement tax management and tax collection for digital assets and digital currencies" - Mr. Dau Anh Tuan commented.

Tax policy formulation requires caution

According to Mr. Phan Duc Trung, digital assets, when regulated in the Law on Digital Technology Industry, will be the basis for perfecting other policies, including taxes.

Tax regulations on digital assets need to be carefully studied and considered, and implemented step by step based on reality. Mr. Trung said that tax management ensures state management and prevents revenue loss, but also needs to create conditions for businesses to develop when the potential of this field is huge.

Source: https://nld.com.vn/se-danh-thue-tai-san-so-tien-so-196240825211740646.htm

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] The beauty of Ho Chi Minh City - a modern "super city" after 50 years of liberation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/81f27acd8889496990ec53efad1c5399)

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

Comment (0)