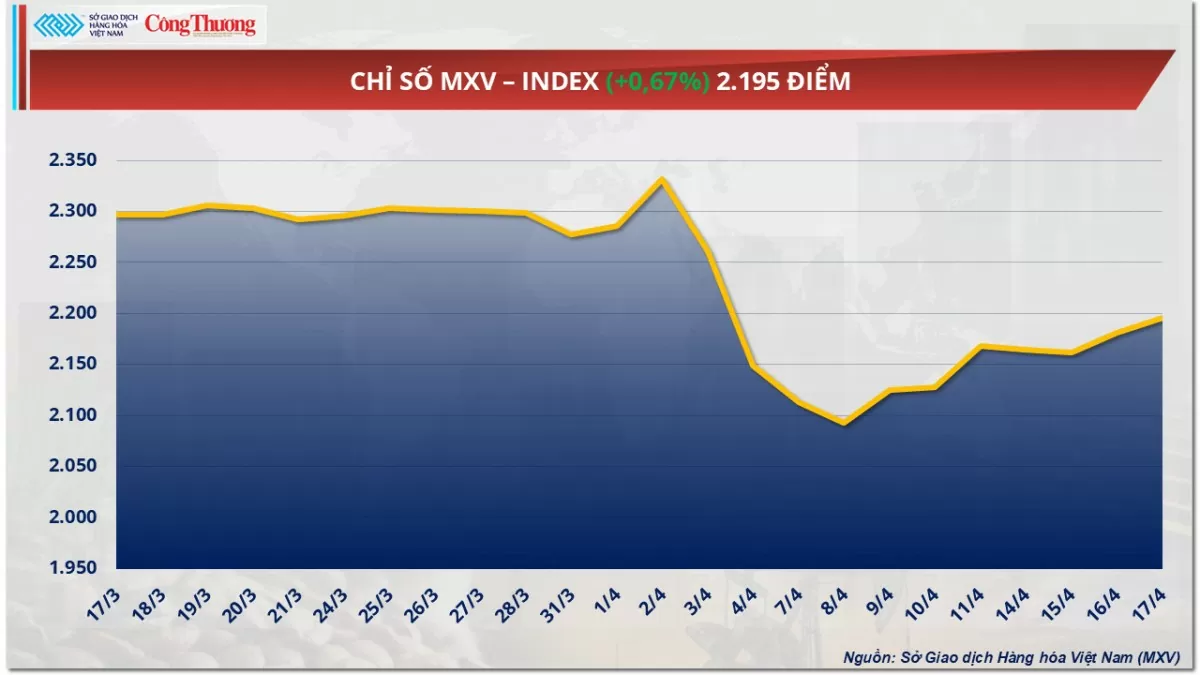

The Vietnam Commodity Exchange (MXV) reported mixed developments in the world energy and agricultural markets during yesterday's trading session (April 17). While strong selling pressure occurred in the energy market due to positive reactions to the prospect of a new trade agreement between the US and the EU, agricultural products had a quiet trading session. Closing, the MXV-Index increased by another 0.67% to 2,195 points.

MXV-Index |

Oil prices continue to rise more than 3%

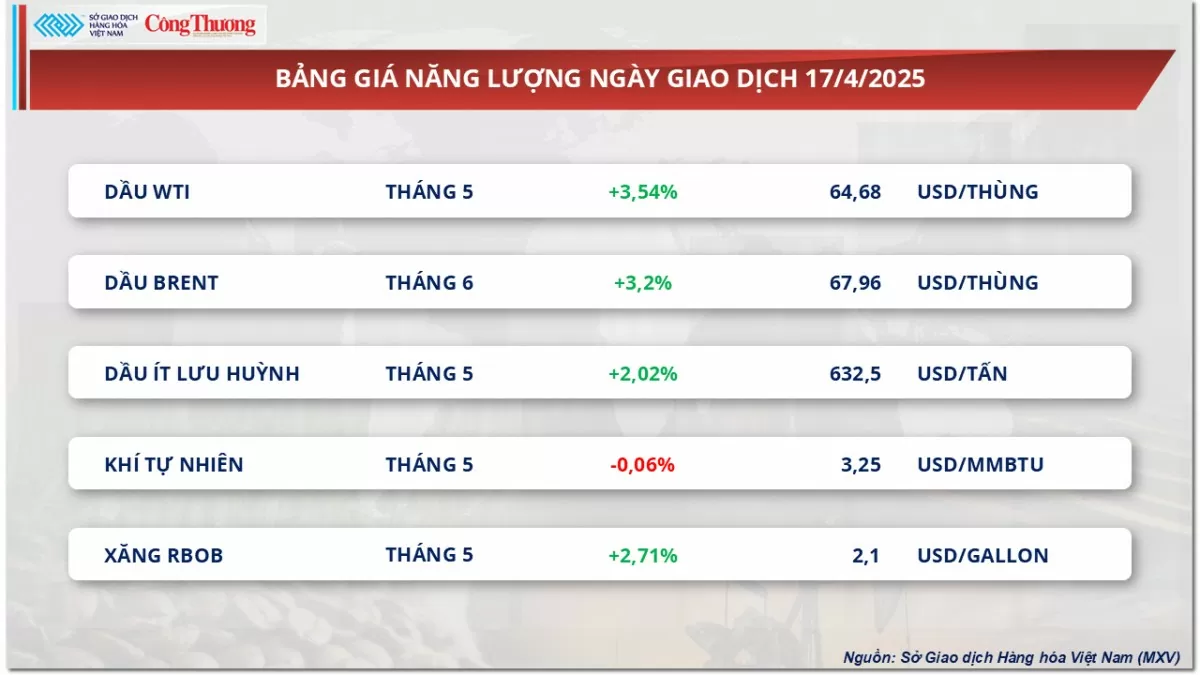

According to MXV, the green color dominated the energy market in yesterday's trading session, except for natural gas, which slightly decreased, the prices of all four remaining commodities in the group increased sharply. In particular, oil prices suddenly increased when the market reacted positively to the prospect of a new trade agreement between the US and the European Union (EU), along with previous concerns about global supply.

At the end of the trading session, Brent crude oil price reached 67.96 USD/barrel, corresponding to an increase of 3.2%. Similarly, WTI crude oil price also increased by 3.54%, stopping at 64.68 USD/barrel. Both commodities continued to record new highs since April 3.

Energy price list |

On April 17 local time, US President Donald Trump held talks with Italian Prime Minister Giorgia Meloni at the White House. During the meeting, both leaders expressed optimism about the possibility of reaching a new trade agreement between the US and the EU.

President Trump expressed great confidence that the two sides could reach an agreement, adding that his administration was looking forward to more trade deals in the future. Meanwhile, Prime Minister Meloni said that open dialogue would help resolve long-standing trade disputes, while emphasizing his commitment to promoting unity between the US and the EU.

Optimism from the statements of the leaders of the US and Italy has contributed to strengthening the market's confidence in the stable outlook in the coming time. However, on the other hand, investors are still cautious about risks to global supply, in the context of OPEC+ continuing to maintain the production cut plan and new sanctions applied to Iranian and Venezuelan crude oil.

According to the latest OPEC+ production cut plan, seven member countries including Saudi Arabia, Russia, Iraq, the United Arab Emirates (UAE), Kuwait, Kazakhstan and Oman will implement mandatory cuts, while Algeria will only receive a recommendation for non-mandatory cuts. Notably, Iraq and Kazakhstan are the two countries that must implement the deepest cuts in the group.

Meanwhile, Iran and Venezuela continue to face US sanctions on crude oil exports. While the US and Venezuela have yet to make any new moves to ease tensions, a second round of US-Iran talks is set to take place this weekend in Rome, Italy, with hopes of new progress toward a consensus on both sides, especially on Tehran’s nuclear program.

Agricultural markets quiet ahead of US holiday

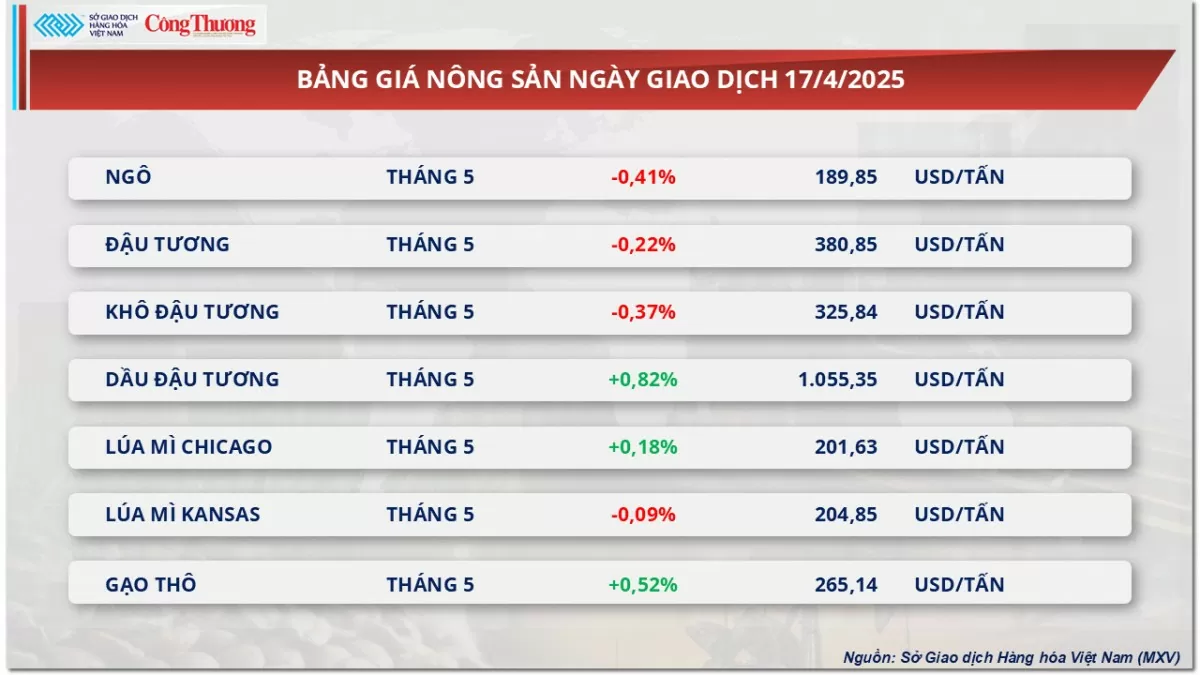

In the agricultural market, soybeans ended the pre-Good Friday trading session on a gloomy note with low trading volume. Soybean prices opened slightly higher but failed to maintain the upward momentum, reversing to the downside towards the end of the session as selling pressure prevailed.

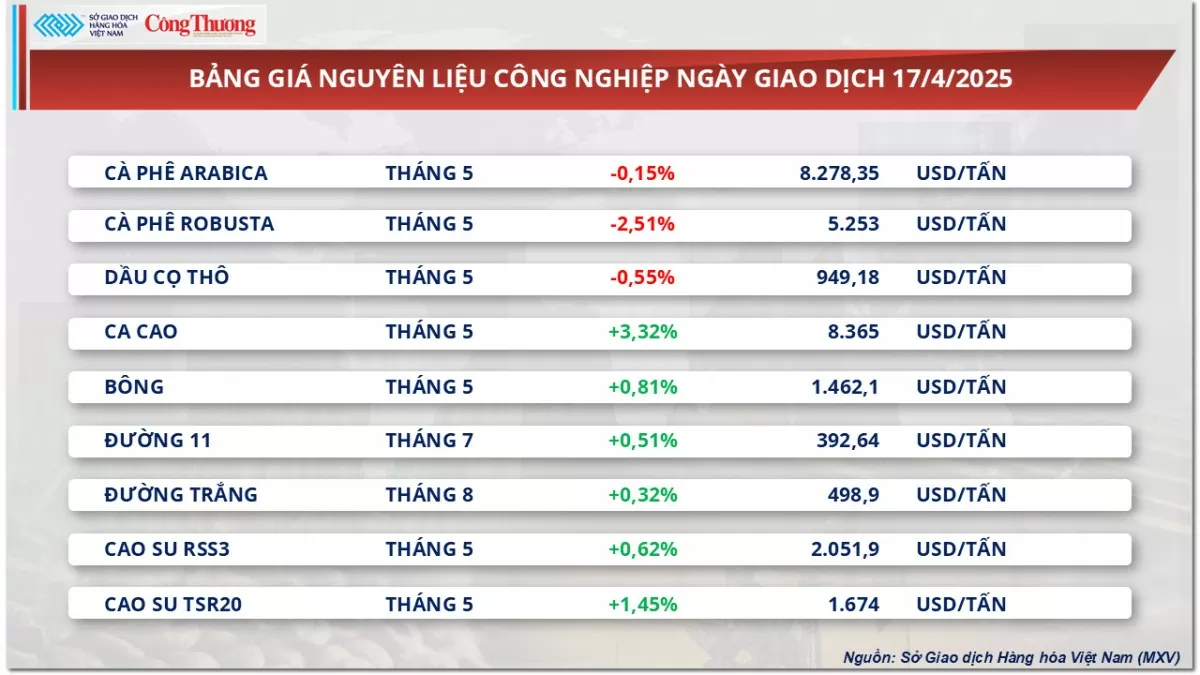

Agricultural product price list |

On the trade front, tariff news continues to surface regularly but is not strong enough to cause a spike in prices. President Trump recently said he had a “productive” phone call with the Mexican president and made progress in negotiations with Japan, but has not yet released specific details. Meanwhile, China continues to maintain a tough stance, demanding that the US stop pressuring in trade negotiations. The proposed fee on Chinese ships may be delayed until mid-May to finalize the details, with the possibility of an official implementation in November.

In South America, Argentine farmers have harvested nearly 5% of their soybean area, behind the five-year average, but yields were better than expected, averaging 3.9 tons per hectare. Argentina's soybean output is forecast at 48.6 million tons. Meanwhile, the Brazilian Oilseed Exporters Association (Abiove) raised its 2025 soybean export forecast to a record 108.5 million tons, while lowering ending stocks to 5.4 million tons, down more than 40% from its previous estimate. These developments strengthened the position of sellers in the market in the last session.

On the other hand, in the weekly Export Sales report, the US Department of Agriculture (USDA) said that US soybean sales for the 2024-2025 crop year are currently at 554,806 tonnes, up 222% from the previous week. Since the beginning of the 2024-2025 crop year, the US has exported a total of 46.8 million tonnes, up 13.3% from the same period last year. Active exports are the factor that has restrained the decline in prices.

Meanwhile, prices of soybean products fluctuated in opposite directions. Soybean oil prices increased by 0.82% to $1,055/ton, marking the third consecutive increase, mainly due to technical factors and support from positive developments in crude oil and palm oil prices in the international market.

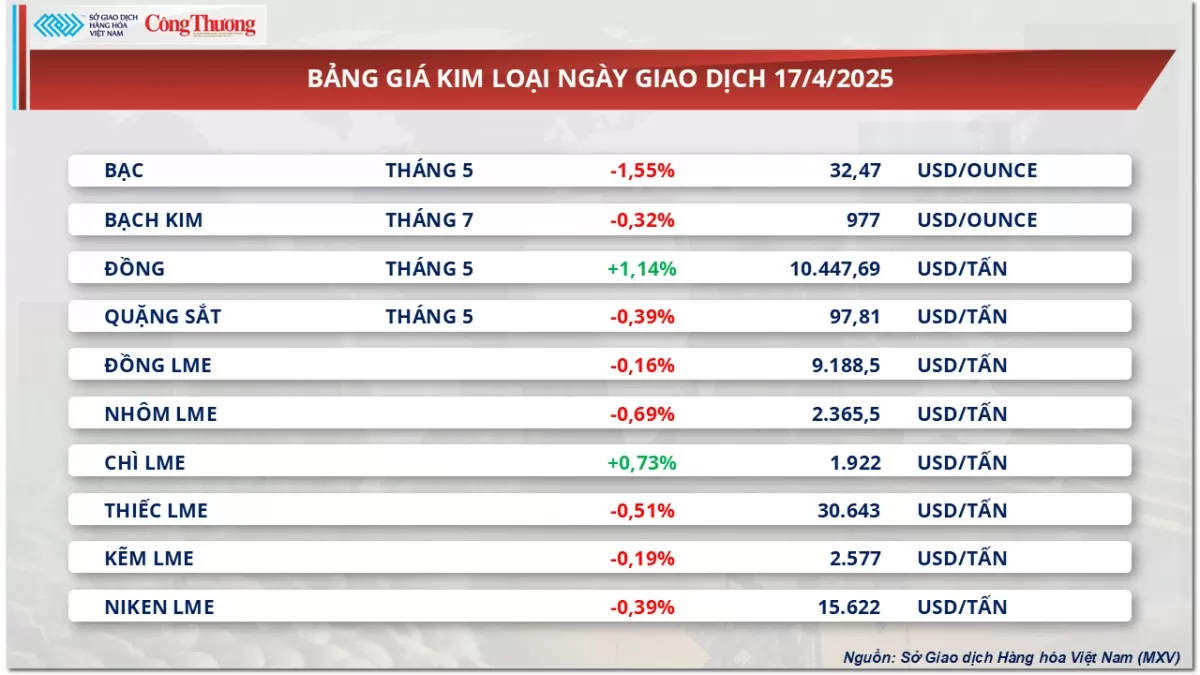

Prices of some other goods

Metal price list |

Industrial raw material price list |

Ngoc Ngan

Source: https://congthuong.vn/gia-dau-the-gioi-tiep-tuc-da-tang-hon-3-383636.html

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Prime Minister Pham Minh Chinh meets with US business representatives](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/5bf2bff8977041adab2baf9944e547b5)

Comment (0)