Vietnam's economy grew 6.4% in the first half of 2024, after reaching a positive 5.1% in 2023. The recovery of the global economy and effective solutions for the domestic real estate market will create momentum for Vietnam's economic growth, which Fitch predicts will fluctuate around 7% in the medium term. This is also considered a favorable condition for the banking sector.

According to Fitch, Sacombank's asset quality score is 'b+'/stable. Its mobilization and liquidity score is 'bb-'/stable. The loan portfolio structure is expanded to serve production and business and stimulate consumption, so the risk portfolio score is 'b+'/stable.

Sacombank's equity and profitability are expected to improve significantly in the coming years as the bank completes restructuring and increases core business activities.

Sacombank representative said that after more than 7 years of implementing the restructuring project, the bank has completely resolved most of the existing problems and basically completed the key objectives. The bank has recovered and processed more than 80% of bad debts and backlog assets; fully set aside provisions in accordance with regulations, of which 100% of provisions were made for debts sold to VAMC that have not been processed.

In addition, Sacombank's asset quality has also improved with the proportion of profitable assets in total assets increased to more than 91%; business scale has been continuously promoted, increasing by an average of 10 - 13%/year; digital transformation has been accelerated to increase management capacity and develop multi-utility products and services, meeting customers' digital banking needs; profit has increased 62 times from VND 156 billion in 2016 to VND 9,595 billion in 2023.

The Dinh

Source: https://vietnamnet.vn/sacombank-lan-dau-duoc-fitch-ratings-xep-hang-tin-nhiem-2302696.html

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

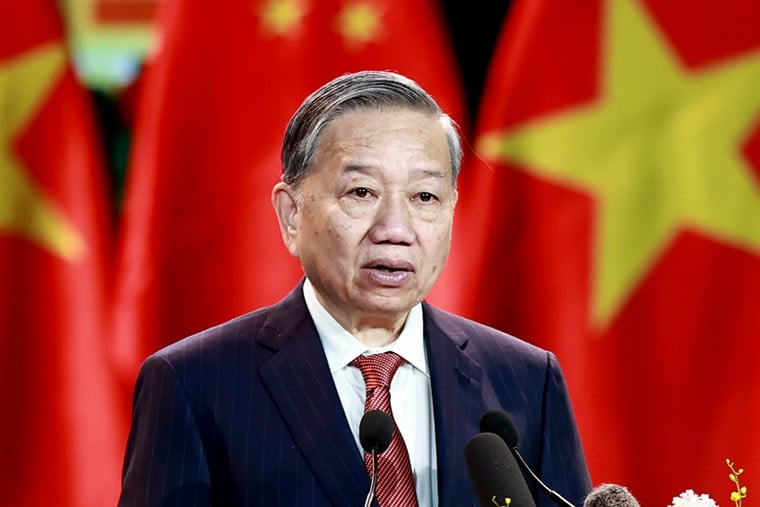

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)