On the afternoon of April 11, the Provincial Tax Department held a conference to review the implementation of electronic invoices (E-invoices) with codes generated from cash registers in 2023 and deploy solutions for implementation in 2024 .

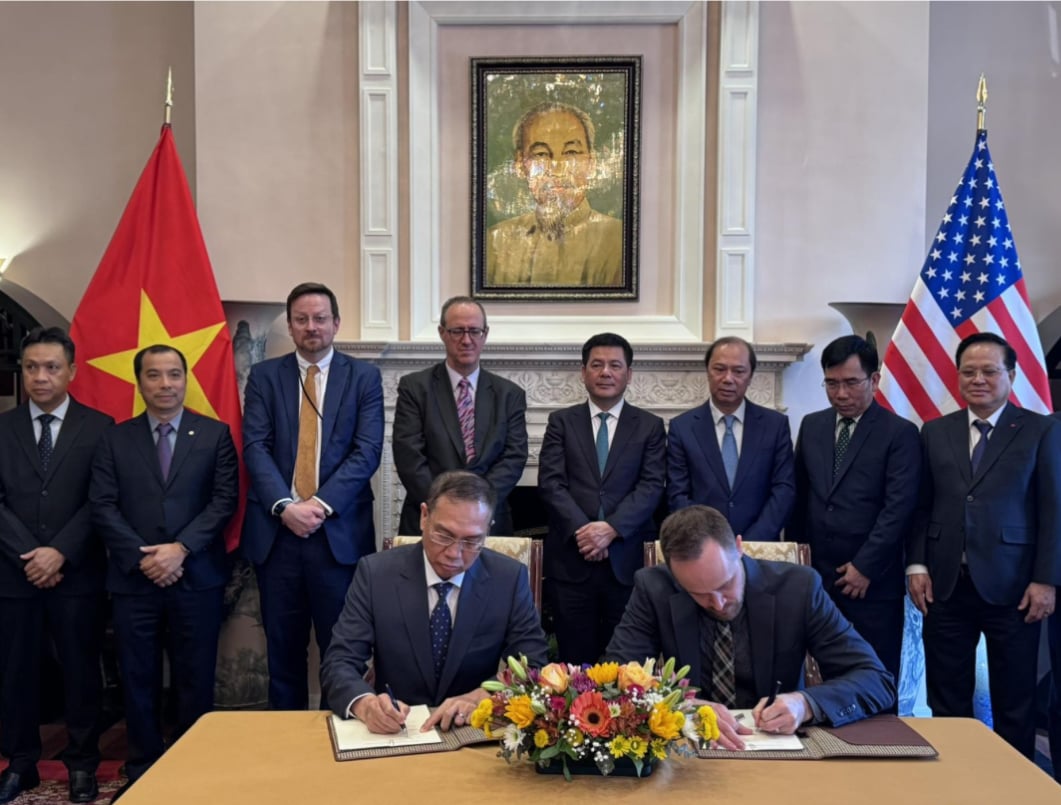

Conference delegates.

Electronic invoices generated from cash registers are a solution to provide invoices connected to tax authorities, bringing many benefits. Taxpayers can be proactive in creating invoices when there are sales of goods and services; saving time and costs. Consumers can receive electronic invoices immediately upon payment. For tax authorities, this type of invoice will support the database of goods and service transactions, prevent commercial fraud and tax evasion.

By the end of 2023, Thanh Hoa province had over 1,500 taxpayers successfully registering and using electronic invoices generated from cash registers, including over 1,000 organizations, enterprises and over 500 business households, reaching 137% of the number assigned by the General Department of Taxation. The total number of electronic invoices generated from cash registers used was over 700,000 invoices, with an average usage rate of 465 electronic invoices/taxpayer.

According to the General Department of Taxation, Thanh Hoa is one of the units with the highest number of business establishments registering to use electronic invoices generated from cash registers, ranking 4th nationwide.

However, in terms of the number of electronic invoices generated from cash registers used, Thanh Hoa is one of the provinces with a high percentage of registered businesses that do not use electronic invoices from cash registers, up to over 70%.

The representative of the Provincial Tax Department presented a report on the results of implementing electronic invoices with codes generated from cash registers in 2023.

There are currently many obstacles in implementing electronic invoices generated from cash registers, such as no regulations requiring taxpayers in industries and sectors that sell goods and provide services directly to consumers to apply electronic invoices generated from cash registers; measures to encourage consumers to get invoices are not strong enough; businesses are still afraid of incurring additional compliance costs and will have their revenue monitored more closely...

To expand the implementation of the e-invoice solution initiated from cash registers, in 2024, Thanh Hoa tax sector will focus on implementing a special topic to review and handle violations against businesses that do not issue invoices to buyers on time; assign targets for implementing e-invoices with tax authority codes initiated from cash registers to each department, team, and each manager.

Director of Thanh Hoa Tax Department Ngo Dinh Hung spoke at the conference.

At the same time, continue to improve the legal basis, review data, monitor, supervise and evaluate the issuance of electronic invoices initiated from cash registers; encourage consumers to get invoices; remove difficulties in application solutions, conversion and usage costs.

Thereby, creating favorable conditions for taxpayers to apply the electronic invoice solution initiated from cash registers, contributing to supporting people and businesses in using electronic invoices quickly, conveniently and economically.

Khanh Phuong

Source

Comment (0)