The financial sector recorded the most active mergers and acquisitions (M&A) activity last year. M&A deals in this group continued to be “hot” in the first months of 2024.

|

| With the purchase of 75% of shares, DB Insurance Co., Ltd becomes a major shareholder of Aviation Insurance Corporation. |

Big deals

DB Insurance Co., Ltd - one of the leading non-life insurance companies in Korea, quickly disbursed a total of nearly VND 2,900 billion on the Vietnamese stock exchange in just over half a month. On January 31, this foreign investor received the transfer of 75,006,358 AIC shares on the UPCoM exchange, thereby owning 75% of the capital of Aviation Insurance Corporation. On February 19, through transactions on the stock exchange, DB Insurance Co., Ltd bought 75 million BHI shares of Saigon - Hanoi Insurance Corporation through many negotiated orders in the first 15 minutes of the session, also increasing the ownership ratio to 75%.

The two transactions have helped the Korean insurance company gain control of two non-life insurance companies on the stock exchange, and at the same time initiated a major M&A deal in the insurance industry in particular and the financial industry in general. The deal had actually been prepared by the parties in advance. All insurance companies had to submit requests to the Ministry of Finance regarding the transfer of shares for nearly half a year.

Many other deals in the financial industry were also completed in the first days of the year. PYN Elite Fund - a Finnish investment fund with many years of operation in Vietnam, completed the transaction to purchase shares of DNSE Securities Company on January 26. The signing ceremony of the cooperation agreement between DNSE Securities Company and PYN Elite Fund took place at the end of December 2023, before which PYN Elite Fund agreed to invest with a value equivalent to 12% of DNSE's equity. Although the ratio is quite modest, it has also made the above foreign fund the second largest shareholder of DNSE Securities Company, after domestic shareholder Encapital Holdings. The investment ratio in DNSE has quickly accounted for more than 5% of the total portfolio value of PYN Elite Fund.

The M&A trend of securities companies will continue in the coming time and may become stronger when the Vietnamese stock market is upgraded from a frontier market to an emerging market.

In mid-February, Tien Phong Commercial Joint Stock Bank (TPBank) completed its acquisition of 75% of Viet Cat Fund Management Joint Stock Company by becoming the sole investor in the private placement of shares. Viet Cat's charter capital increased from VND25 billion to VND100 billion, entering the top 20 companies with the largest charter capital in the fund management industry.

Another bank, HDBank, is also preparing to contribute capital to HDB Securities Joint Stock Company in a similar manner. According to the plan approved by HDB Securities Company shareholders at the end of January 2024, HDBank is the only investor participating in the private offering of 43.8 million new shares. At a price of VND15,000/share, HDBank will spend VND657 billion and own nearly 30% of the charter capital after the issuance. The capital increase will help this securities company increase its charter capital from VND1,023 billion to VND1,461 billion. The issuance is expected to be carried out in the first half of 2024.

Expected to be completed later (in the first half of 2025), the acquisition of Home Credit Vietnam by The Siam Commercial Bank Public Company Limited, a member of SCB X Pcl (SCBX Public Company Limited - SCBX), which was officially announced in late February, is also heating up the M&A market.

Lots of potential

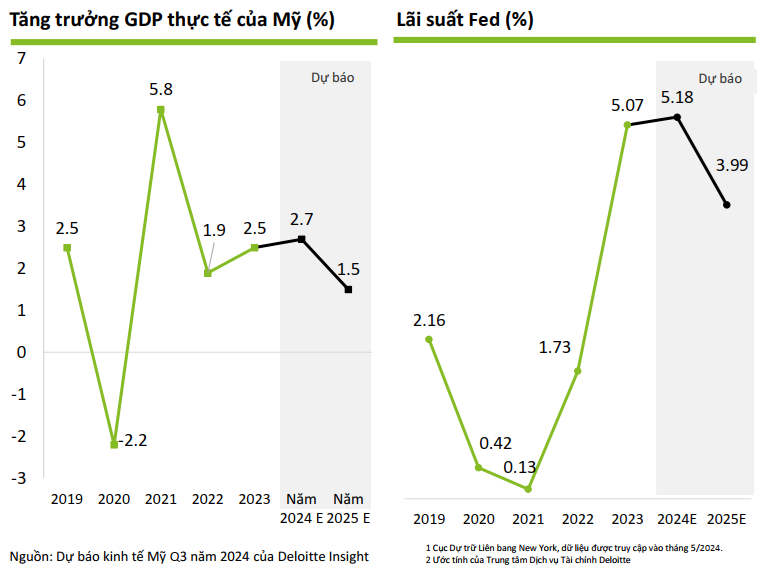

In 2023, the M&A market recorded a clear decline in the general global context. The reason is that foreign investors have become more cautious in the face of many political and macroeconomic instabilities in the world, causing activities and transaction values to stagnate. High interest rates, even in developed countries due to tight monetary policies to control inflation, have made the cost of conducting transactions expensive. Fluctuating exchange rates also make it difficult to price and decide on cross-border investments.

However, in the financial sector, according to KPMG statistics, transactions are still strong, accounting for 47% of the value in the first 10 months of 2023. Foreign investors are leading in major deals in 2023. Of which, the largest deal in 2023 is SMBC spending 1.45 billion USD to buy 15% of shares of Vietnam Prosperity Joint Stock Commercial Bank (VPBank).

In the recently released M&A Market Outlook Report 2024, Kirin Capital assessed that the banking sector is always among the top sectors sought by foreign institutions. However, it is not easy for foreign investors to find a destination in this sector, especially for weak bank M&A deals due to the consideration between the initial investment to help revive a bank, along with the ability to grow in the future.

Meanwhile, Kirin Capital predicts that the M&A trend of securities companies will continue in the coming time and may become stronger when the Vietnamese stock market is upgraded from a frontier market to an emerging market.

In fact, foreign securities companies have been continuously increasing their financial capacity. However, with the rise of many domestic companies, especially from the wave of expanding the banking ecosystem, not many foreign securities companies have been operating prominently. However, according to Kirin Capital, this has not stopped international investors from continuing to seek to buy domestic securities companies, mainly for the purpose of acquiring operating licenses.

Source

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)