According to the US government, the new tax policy aims to limit the country's trade deficit, promote domestic production and reduce dependence on foreign supplies. However, this move has met with fierce opposition from regions, countries, territories and many businesses.

As one of the parties most affected by the new US tariffs, the European Union (EU) has strongly condemned this move, saying that Washington's move is "unilateral and damaging" to global trade. According to the New York Post, European Commission President Ursula von der Leyen has announced that the EU will take appropriate countermeasures.

The EU is currently considering imposing countermeasures, including increasing retaliatory tariffs of up to 26 billion euros on imports from the US, especially targeting key industries such as: Technology (major US technology companies such as Apple, Google and Microsoft), agricultural products (increasing tariffs on soybeans, corn and meat products), luxury goods (cars and whisky).

French President Emmanuel Macron has even called on major European businesses to “pause investment in the US” as a way to put pressure on the White House.

Similarly, China - one of the main targets of the new tariffs - has reacted strongly. Beijing has declared that it does not accept the US imposition and will take corresponding retaliatory measures.

Measures China is considering include: Increasing tariffs to 54% on cars and semiconductors imported from the US; restricting exports of rare earths, an important material in high-tech manufacturing; tightening regulations on US businesses operating in China, especially in the financial and technology sectors...

China's Ministry of Commerce stressed that if the US does not withdraw the new tax policies, they will apply these measures in the second quarter of 2025.

Japan and South Korea, two important US allies in Asia, also strongly oppose the new tax policy. Tokyo considers this move "unfair and extremely regrettable" and may impose retaliatory tariffs on the US aerospace industry and technology products. Meanwhile, South Korea may restrict imports of natural gas and crude oil from the US and file a lawsuit against the country at the World Trade Organization (WTO).

In North America, Canada and Mexico - two important partners of the US in the USMCA Trade Agreement - are also seriously affected by President Donald Trump's new tax policy. Canada may impose tariffs on US dairy products, aluminum, steel and lumber.

According to The Times, Prime Minister Mark Carney pledged to protect the rights of Canadian workers and was ready to take countermeasures on trade. Mexico could impose heavy tariffs on US corn, beef and consumer goods. In South America, Brazil has just passed a bill allowing it to respond to tariffs imposed by the US.

The countries’ retaliatory moves have raised concerns about a full-blown trade war. This is at a high risk as, in addition to the new wave of tariffs, the US government has actually imposed many types of tariffs on certain products, such as a 25% tax on cars and light trucks from 0:00 on April 3 (local time), 10 times higher than before.

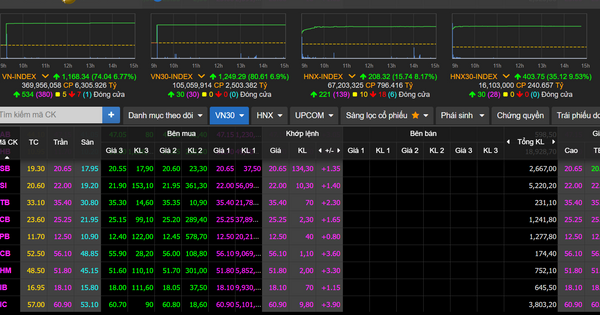

Economists warn that once the countermeasures get out of control, inflation could skyrocket as imported goods become more expensive; global supply chains are disrupted, affecting manufacturing businesses; and a plummeting stock market could have a profound impact on many sectors.

Overall, while still leaving a negotiating exit open for all parties, President Donald Trump's new tax policy in 2025 clearly increases global trade tensions, as many countries are ready to retaliate strongly.

In this context, the risk of a full-blown trade war is increasingly present, which could have a negative impact on the global economy in the near future. Without a solution of dialogue and concessions, the situation could continue to escalate and have a long-term impact on international economic relations.

(According to NBC News, The Guardian)

Source: https://hanoimoi.vn/nhieu-nuoc-tra-dua-thue-quan-moi-cua-my-gia-tang-cang-thang-thuong-mai-toan-cau-697969.html

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)