The market closed the last trading session of the week with an explosion in both liquidity and scores. The VN-Index closed the session on August 16 with a strong increase of 28.67 points, equivalent to 2.34%, to 1,252.23 points; the HNX-Index increased by 6.61 points, equivalent to 2.89%, to 235.15 points, and the UPCoM-Index increased by 1.26 points, equivalent to 1.36%, to 93.44 points.

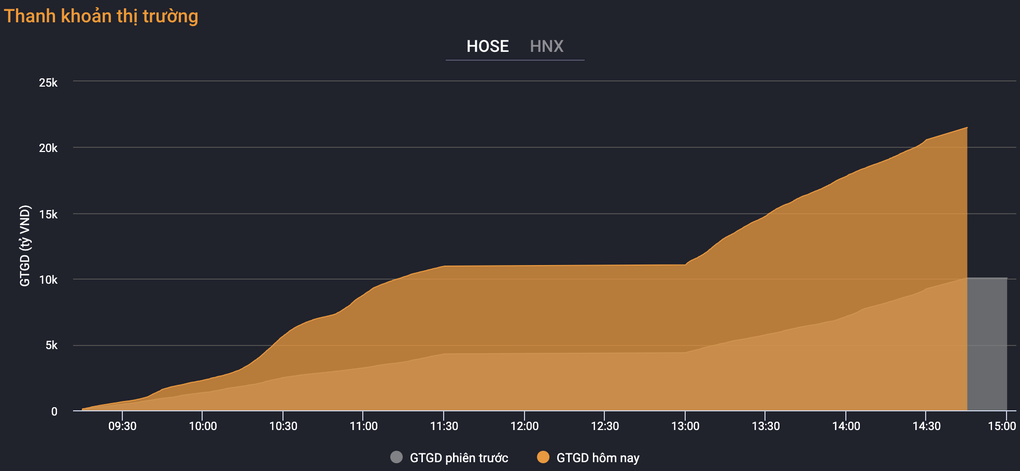

Trading volume on the HoSE floor skyrocketed to 965.06 million shares with a trading value of VND23,013.93 billion. The HNX-Index had 86.9 million shares traded, equivalent to VND1,717.01 billion, and the figure on UPCoM was 69.03 million shares, equivalent to VND1,026.9 billion.

Market liquidity skyrocketed in the session of August 16 (Source: VNDS).

The trading pace is very fast. Investors are willing to pay high prices to own stocks, ceiling price buy orders are piling up on many stocks but there is no corresponding sell volume to match the orders.

The market witnessed a paradox, that is, while the market fell, trading was very modest, many stocks fell deeply but investors still decided to hold on to cash, not daring to disburse. However, in this session, there was a situation of chasing to match orders at all costs.

The entire HoSE floor had 413 stocks increasing in price, 10 times the number of stocks decreasing, of which no stocks hit the floor but 28 stocks hit the ceiling. Notably, many stocks hit the ceiling in the session before falling at the closing time.

HNX has 153 stocks increasing in price and 20 stocks hitting the ceiling compared to 33 stocks decreasing and only 3 stocks hitting the floor. UPCoM has 263 stocks increasing, 36 stocks hitting the ceiling, overwhelming 86 stocks decreasing, 18 stocks hitting the floor.

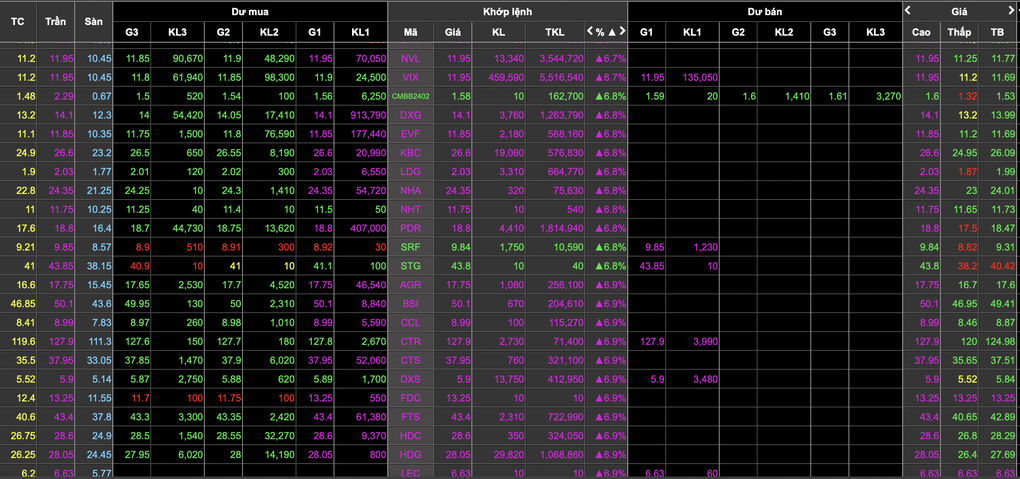

Stocks hit the ceiling price massively on the market (Screenshot of VDSC price board).

The increase was widespread and relatively even among industry groups, but the most sensitive were still financial services stocks. This group had EVF, AGR, BSI, CTS, FTS, VDS hitting the ceiling and no sellers, with a large ceiling price buy surplus. VIX also hit the ceiling, with a huge matching order of up to 55.2 million units.

Many other stocks also increased strongly: HCM increased by 6.7%, approaching the ceiling, with 18.8 million units matched; SSI increased by 5.8%, with 27.3 million units matched; VCI increased by 5.4%; VND increased by 5.3%, with 18.1 million units matched...

A series of real estate stocks "exploded" with good liquidity, many codes had large ceiling price buy orders. DIG hit the ceiling, matched orders of more than 28 million shares, ceiling price buy orders of 1.7 million units; PDR hit the ceiling, matched orders of 18.1 million shares and ceiling price buy orders of 4.1 million units; DXG hit the ceiling, matched orders of 12.6 million shares, ceiling price buy orders of 9.1 million units; NVL also hit the ceiling with 35.4 million units matched orders, with ceiling price buy orders; HDG hit the ceiling, matched orders of 10.7 million shares.

A series of other stocks, although not hitting the ceiling, also increased in price very high, such as TCH increased by 6.5% with 17.8 million units matched; HTN increased by 6.4%; ITA increased by 6.2%; SGR increased by 6.1%; NLG increased by 6%. Quoc Cuong Gia Lai's QCG stock recovered strongly, increasing by 5.1% to 6,200 VND, although at one point in the session it decreased to 5,880 VND/unit.

It is worth noting that foreign investors turned to net selling this session. In previous sessions, when the market fell, many stocks faced strong selling pressure, but foreign investors were net buyers.

Specifically, this session, foreign investors net sold nearly 87 billion VND in the whole market and broke the 5-session net buying streak. Net selling activities focused on VHM with 316 billion VND, HPG with 181 billion VND; TCB with 108 billion VND. In contrast, foreign investors net bought 101 billion VND of MWG shares.

Source: https://dantri.com.vn/kinh-doanh/nghich-ly-chung-khoan-che-gia-thap-tranh-mua-gia-tran-20240816154555016.htm

![[Photo] President Luong Cuong receives Kenyan Defense Minister Soipan Tuya](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0e7a5185e8144d73af91e67e03567f41)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Warm meeting between the two First Ladies of the Prime Ministers of Vietnam and Ethiopia with visually impaired students of Nguyen Dinh Chieu School](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/b1a43ba73eb94fea89034e458154f7ae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Photo] Prime Minister Pham Minh Chinh and Ethiopian Prime Minister visit Tran Quoc Pagoda](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/18ba6e1e73f94a618f5b5e9c1bd364a8)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)