| Does the decrease in the price of animal feed ingredients 'suggest' an increase in herd restoration? With the supply of raw materials increasing, why is the livestock industry still facing difficulties? |

In particular, world agricultural prices are always considered by businesses as the leading risk factor due to dependence on imported raw material supply. However, in 2024, the problem of reducing production costs, reducing prices, and increasing the competitiveness of goods is beginning to be solved...

Looking back at the livestock industry, after only a few years of consecutive shocks such as the Covid-19 pandemic, African swine fever, shortage of raw material supply, etc., the structure of our country's livestock industry has changed a lot. While the number of households is gradually shrinking, businesses, especially foreign-invested enterprises (FDI), are increasing. Currently, Vietnam is also aiming to build a large and modern livestock chain. Small, scattered facilities will be forced to relocate or cease operations from the beginning of 2025. Meanwhile, businesses are promoting, perfecting and optimizing the closed 3F process (Feed - Farm - Food), from farm to table.

On the way to large-scale, industrialized, and modernized production, there are many challenges and opportunities for Vietnamese livestock enterprises. 2024 is forecasted to have many positive signals for the animal feed ingredient market.

World agricultural prices cool down, businesses breathe easier

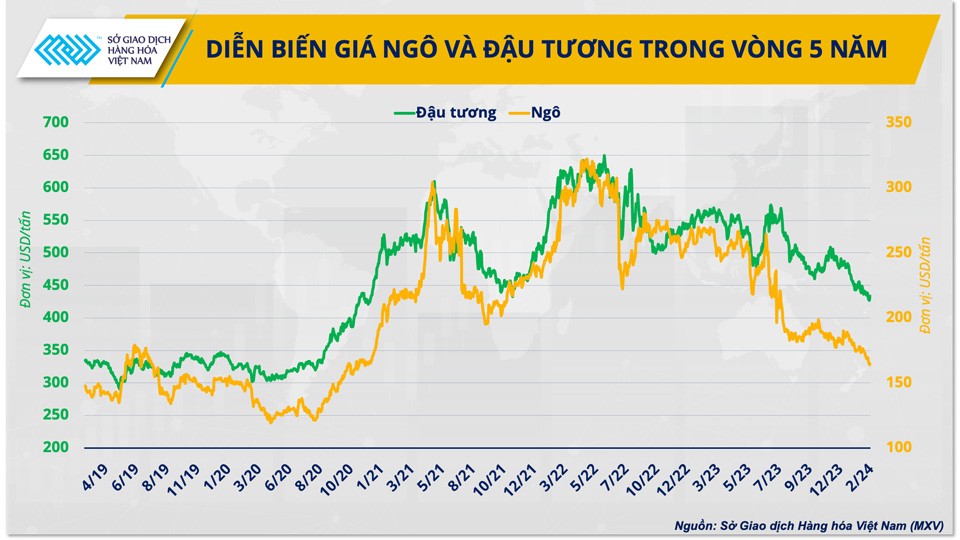

While for many years, Vietnamese livestock enterprises have been struggling to find solutions to reduce their dependence on imported raw materials with skyrocketing prices, the market has stabilized in the past few months. Chicago corn and soybean prices have fallen to their lowest levels in three years. The pressure on prices is reflected in the export activities of the US, one of the world's leading agricultural producers, which are weakening due to competition from South American and Black Sea supplies.

|

| Corn and soybean price movements over the past 5 years |

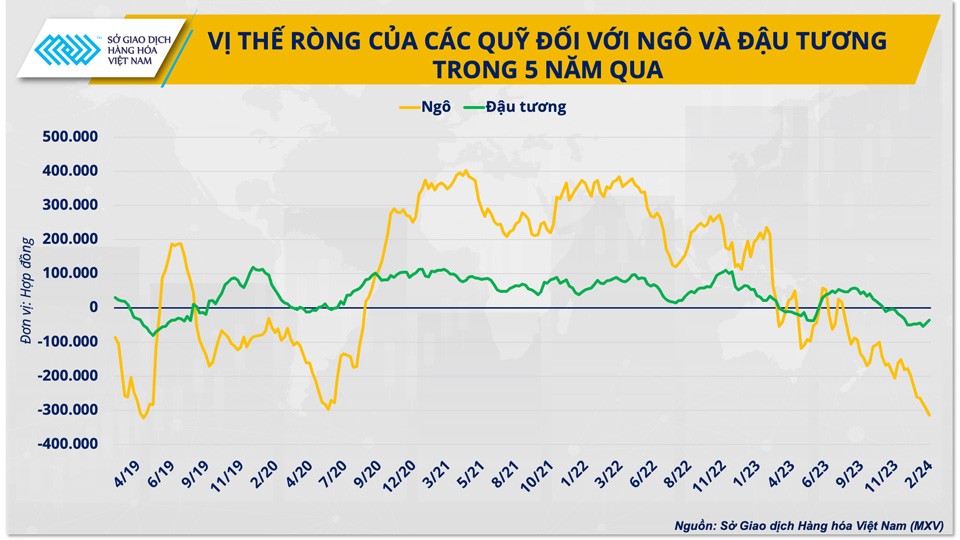

In addition to supply and demand factors, transaction cash flow figures also reflect market sentiment. In the international and Vietnamese agricultural markets, in addition to direct trading activities between producers and consumers, futures contracts are also an important and popular financial tool for exchanging, buying and selling and determining prices of commodities.

The CFTC’s investor volume report showed that as of February 13, the net short position in corn reached 314,341 contracts, the highest level compared to the same period in history and also close to the record of 322,215 set in April 2019. This is also the seventh consecutive week that funds have been net short in corn.

For soybeans, the selling streak has extended to 13 consecutive weeks, and the current net short volume has reached 134,500 contracts, the fifth highest level ever. This shows that exchange-traded funds expect the downward trend in agricultural prices to continue.

|

| Funds' net positions in corn and soybeans over the past 5 years |

Prospects for animal feed raw material supply in 2024

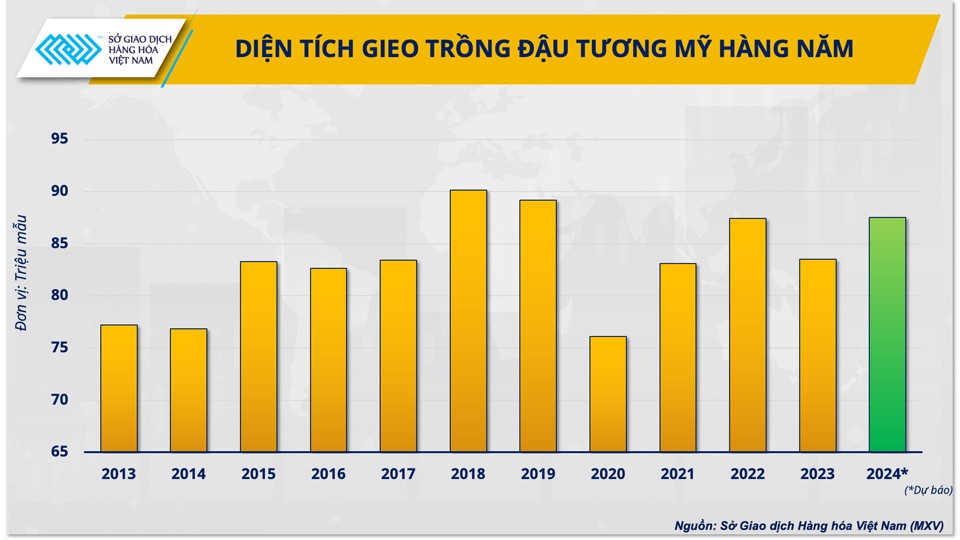

With the upcoming US crop season, the issue of supply and import prices of raw materials will no longer be a major concern for Vietnamese businesses in 2024. According to the first report on the crop season taking place in the next few months in the US, the US Department of Agriculture (USDA) forecasts that the supply of agricultural products in the 2024/25 crop year will increase and even record much higher levels than in previous years.

For soybeans, the forecast shows an 8% increase in production this year compared to last year. The USDA’s optimistic outlook is based on expectations of increased plantings and improved yields. U.S. corn ending stocks in 2024/25 could increase by more than 16% compared to last year, also reaching their highest level since 1987/88.

|

| Annual US soybean planting area |

Mr. Pham Quang Anh, Director of the Vietnam Commodity News Center, commented: “Global supply is gradually recovering after several consecutive years of being affected by climate change. With the crop situation in South America gradually becoming favorable, the output of the US in the upcoming crop season will be the decisive factor in this year's agricultural supply. If the weather is not too extreme, raw material prices will continue to weaken. This is a positive signal for livestock enterprises in our country.”

|

| Mr. Pham Quang Anh, Director of Vietnam Commodity News Center |

Unknown supply risks remain to be monitored

Given the market’s many unexpected fluctuations over the past few years, businesses should still monitor and be cautious of some risk factors, especially global geopolitics. The possibility of former US President Donald Trump returning to the White House and trade wars could create unpredictable fluctuations for leading agricultural trading partners such as China.

In addition, other ongoing issues such as the Gaza crisis, affecting transportation activities in the Red Sea, may also increase transportation costs, and hinder grain shipments to our country due to increased costs. In this scenario, although global output is still increasing, the problem of raw material supply that our livestock enterprises face is still there.

Thus, although the pressure to control agricultural import costs will be reduced this year, this is only one of the problems that our country's livestock industry needs to face to realize the goal of becoming a spearhead in agricultural production. Mr. Pham Quang Anh commented that in the near future, we cannot completely replace imported raw materials with domestically produced raw materials because the price of imported raw materials is cheaper. Moreover, to gradually realize the Livestock Development Strategy for the period 2021-2030, vision 2045 of the Prime Minister, including reducing raw material imports, also takes a long time. Therefore, in addition to closely monitoring market developments, businesses need to implement many solutions in parallel to remove each bottleneck such as searching for and making the most of domestic raw materials, closely linking in the entire chain, and maximizing the application of technical advances and high technology in production, etc.

Source

Comment (0)