Businesses need capital

As a local startup nearly 10 years ago, Dak Nong Basalt Coffee Company Limited's products are now present in many major markets.

Mr. Le Van Hoang, Director of the Information Company, said that currently, there are strong opportunities for agricultural products to develop. Through trade promotions in other countries, it has been shown that consumers here highly appreciate the quality of the company's products.

The company's products are always at the top when appearing at major events. In particular, cocoa products are highly appreciated by partners for their quality. The products are now available in demanding markets such as: Japan, Korea, Belgium...

Hopefully in the near future, the company's agricultural products will be connected in many different countries around the world.

To develop this orientation well, Mr. Hoang hopes to connect more deeply with banks, creating more opportunities to access loans for businesses to expand production and business.

Chairman of the Dak Nong Young Entrepreneurs Association Nguyen Ngoc Chinh said that the association currently has nearly 300 members participating in its activities. The member businesses are mainly startups, so the biggest difficulty is still capital.

In addition to investment capital for construction, factory and warehouse expansion, and machinery and equipment purchases, young businesses need working capital to stockpile raw materials, maintain production, and develop orders, etc.

Meanwhile, the assets of enterprises are almost non-existent or very little, making it difficult to access loans from credit institutions.

In the coming time, the association will be more proactive in organizing activities connecting members with provincial leaders and banks to support preferential loans, creating conditions for business development.

Sharing the same view, Mr. Nguyen Tri Ky, Chairman of Dak Nong Business Association, said that the business community is currently in dire need of connecting with banks to unblock credit.

According to Mr. Ky, in the current period, when agricultural product prices increase, capital flow must increase accordingly to help businesses have enough cash flow to operate.

In particular, some export enterprises in the province need credit through the form of unsecured loans to be able to import large quantities of goods from abroad to serve production.

However, currently, many businesses are thirsty for capital, partly because they do not meet the conditions or have to mortgage assets. This greatly limits development.

Proactively connect

Implementing the direction of the State Bank of Vietnam, credit institutions in the province are promoting the program of connecting banks and businesses through many forms.

The program has helped businesses access more information on business support mechanisms and policies; new credit programs and policies; activities to support product development, expand consumption markets and export key products, etc.

At the Credit Connection Conference between banks and Dak Nong enterprises held last October, Dak Nong credit institutions focused on introducing many loan packages for enterprises with preferential interest rates.

Specifically, Agribank Dak Nong Branch has a preferential loan program for small and medium-sized enterprise customers in 2024, with interest rates from 3.5%/year; a preferential loan program to finance investment projects for enterprises with interest rates from 6%/year; a preferential short-term loan program for legal entity customers of corporations/general companies under the State Capital Management Committee with interest rates from 2.5%/year...

BIDV Dak Nong Branch also launched a short-term credit package for businesses with a scale of 300,000 billion VND, with interest rates from 5.5 - 6%/year; a short-term credit package for small and medium enterprises with a scale of 80,000 billion VND, with interest rates from 5.5 - 6%/year...

In addition, other banks such as Vietinbank, Vietcombank, Nam A bank... also have attractive preferential loan packages for businesses.

Mr. Pham Ngoc Ha, Chairman of Dak Glong Business Association, said that currently, there are 5 credit institutions operating in the district.

Recently, the association has proactively organized 5 dialogues between businesses and banks and authorities to resolve difficulties and problems, especially regarding credit.

Thanks to this, some businesses in the area have the opportunity to share difficulties, update information and easily access preferential capital sources. Loan support helps businesses promptly invest in expanding factories, purchasing more machinery and equipment for production.

According to Mr. Ha, another advantage is that these credit institutions are currently members participating in the association's activities. This has helped banks directly have the opportunity to contact, introduce and develop effective and practical products and services.

Commercial banks also have the advantage of better grasping business information, supporting the process of information processing and customer appraisal. Thereby improving the efficiency and quality of credit appraisal.

In practice, through the program, businesses have access to loans with reasonable interest rates, reducing difficulties in capital and interest costs.

Not only do businesses receive preferential interest rates, they also receive consulting support on cash flow management, operations management, and building production and business development strategies that adapt to the actual situation...

Supporting loans from bank-business connection programs is an important solution, both helping to increase the economy's capital absorption rate and helping banks achieve their credit growth targets.

Source: https://baodaknong.vn/ngan-hang-va-doanh-nghiep-dak-nong-ket-noi-de-cung-thang-234943.html

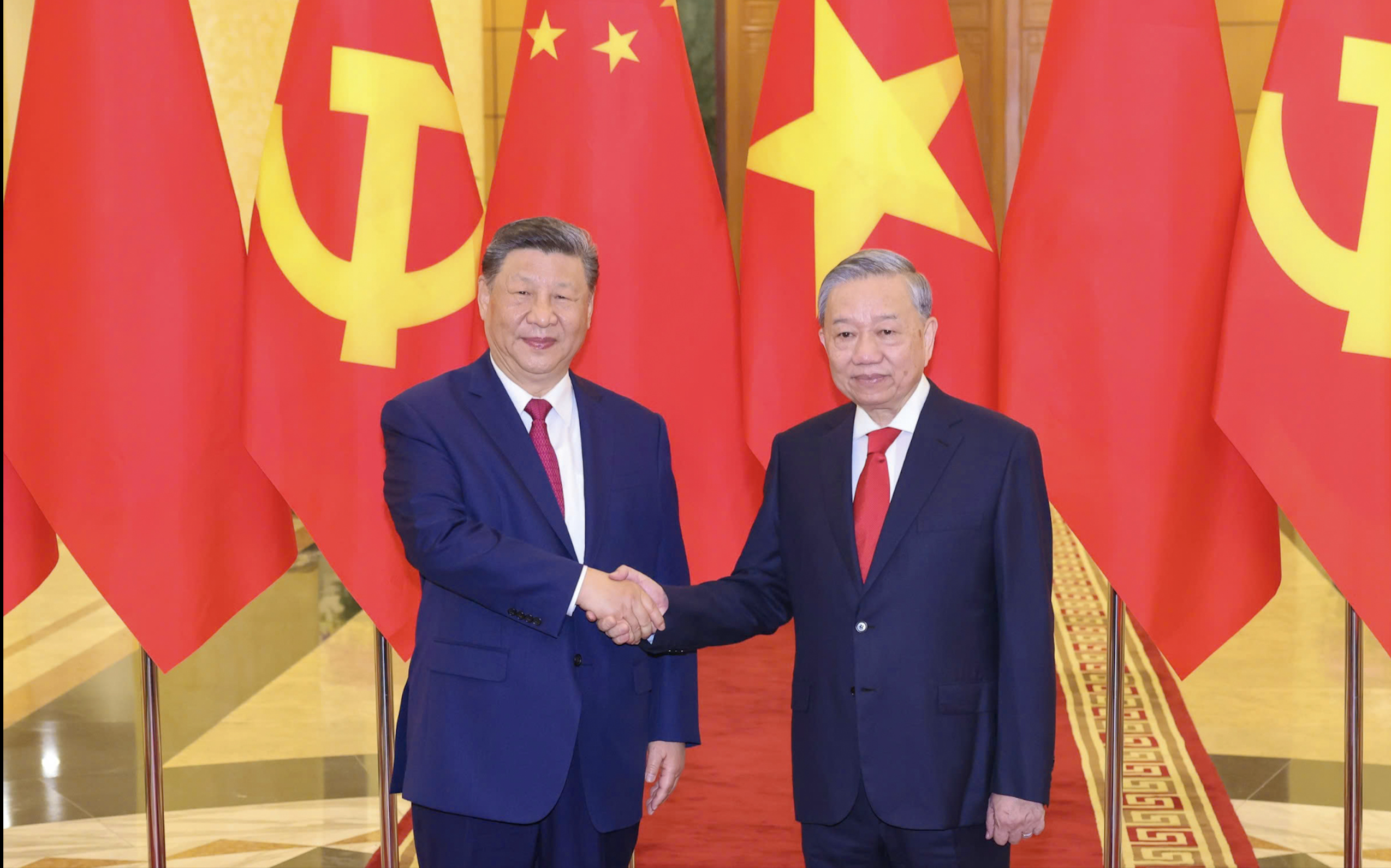

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

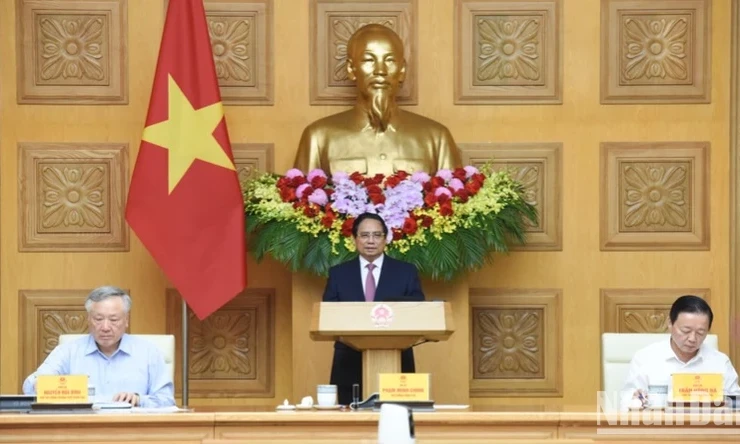

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)