Buy recommendation for IDC stock

Vietcap Securities Company (VCSC) maintains its buy recommendation for IDICO Corporation (IDC) but reduces its target price by 1.3% to VND70,600/share.

The lower target price is mainly due to VCSC's 2% reduction in its IP cash flow forecast for 2025-28F, partly offset by higher net cash at end-2024F.

VCSC slightly reduced its 2025/2026 profit after tax (PAT) forecast by 3%/2%, mainly due to lower-than-expected sales/handovers of the urban area (KDT) segment, due to lower-than-expected unrecorded backlog at Bac Chau Giang KDT by the end of 2024.

For 2025, VCSC forecasts net profit after minority interests to increase slightly by 4% YoY to VND2,100 billion, mainly due to higher average selling price (ASP) and IP land handover volume YoY, while VCSC forecasts revenue from residential real estate to decrease YoY.

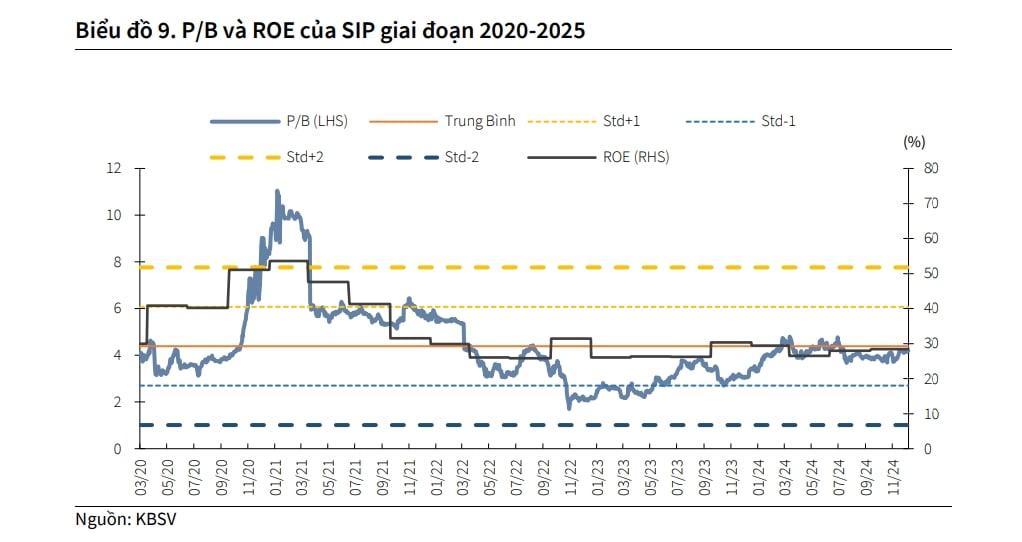

Neutral recommendation for SIP stocks

According to KB Securities Vietnam (KBSV), in 2024, the revenue and profit after tax of Saigon VRG Investment Joint Stock Company (SIP) will reach VND 7,804/1,278 billion (up 17%/up 27% over the same period). Of which, revenue from electricity and water supply will reach VND 6,548 billion (up 15%); the area of industrial park land handed over will increase sharply to 74 hectares (up 251%), but revenue will only increase slightly by 4%, reaching VND 389 billion, because SIP recorded it according to the allocation method.

In the first quarter of 2025, Phuoc Dong Industrial Park will hand over 15.5 hectares to Hailide and Beauty, and sign an MOU (50 hectares) with Global Hantex, all of which are textile and garment enterprises, showing that Phuoc Dong Industrial Park is taking advantage of abundant water resources and competitive prices to catch the wave of FDI in the textile and garment industry shifting to Vietnam.

Long Duc Industrial Park Phase 2 Project (294ha) - SIP owns 69.5%, has been approved for investment policy in February 2025. KBSV expects Long Duc Industrial Park to start leasing in 2026 with an area of 10 - 20 ha/year.

KBSV estimates that SIP's revenue in 2025/2026F will reach VND9,036/10,348 billion (up 16%/up 15%), after-tax profit will reach VND1,421/1,562 billion (up 11%/10%), contributed by electricity output reaching 3,910/4,418 million Kwh (up 15%/13%); Industrial park land area handed over will reach 80/90ha (up 8%/12%).

SIP's share price has increased by 18% since the beginning of the year, partly reflecting the company's growth potential. Therefore, KBSV recommends neutral on SIP, with a reasonable valuation of VND98,000/share.

► Stock market commentary March 25: The market may continue to rise

Source: https://vov.vn/thi-truong/chung-khoan/mot-so-co-phieu-can-quan-tam-ngay-253-post1163532.vov

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)