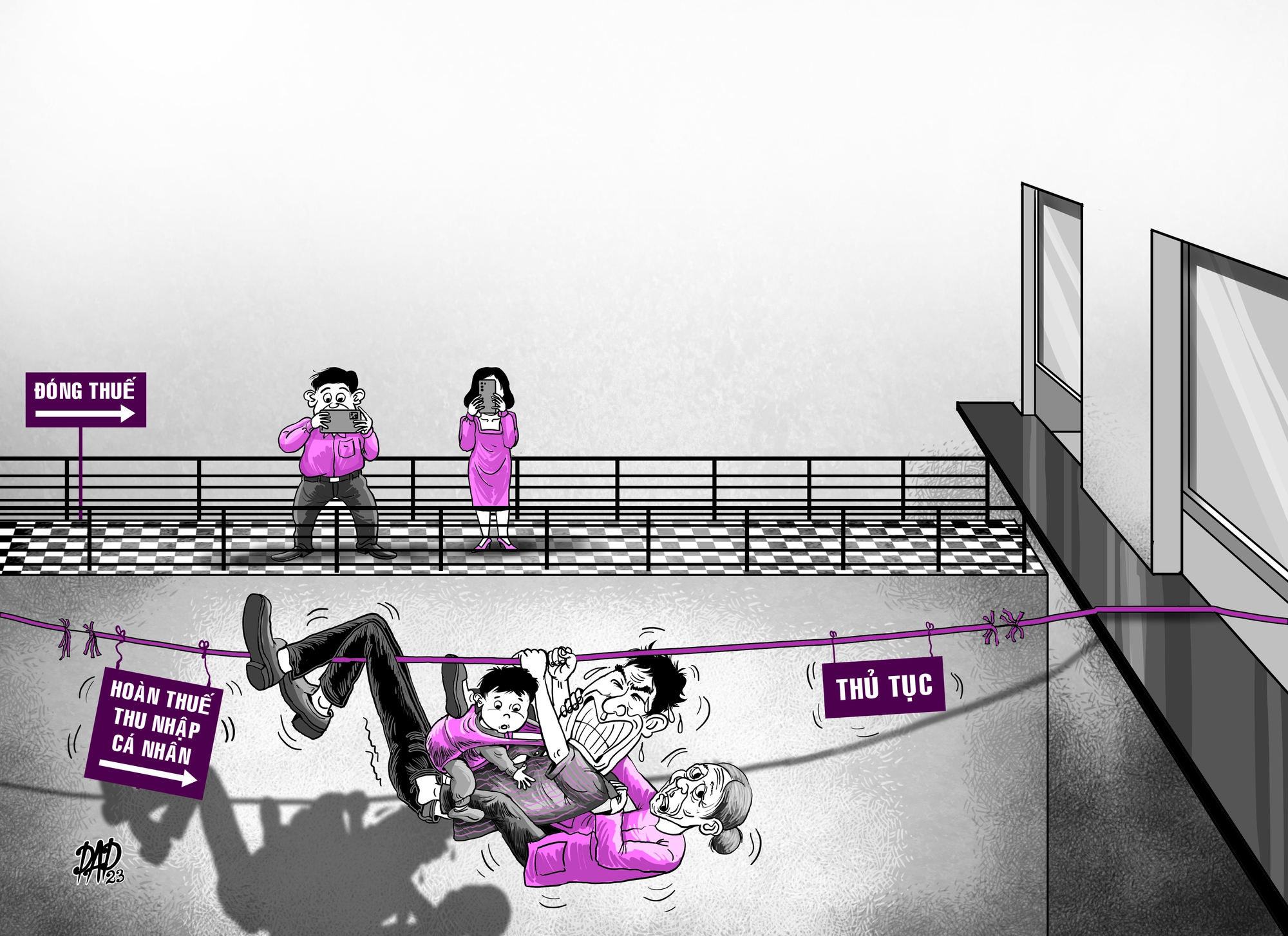

Afraid of procedures, even spend money to get a tax refund

According to regulations, dependents of personal income tax (PIT) payers include spouses, biological parents, parents-in-law, stepfather, stepmother, adoptive father, adoptive mother, and homeless individuals (siblings, grandparents, grandchildren, etc.). However, in many cases, taxpayers have a hard time getting the tax authorities to agree to cases of siblings.

Speaking of this, Ms. Thanh Thuy (temporarily residing in Hanoi) sighed in frustration. Ms. Thuy said that because she quit her job at her old company, she had to do the 2022 tax settlement herself. She had submitted a personal income tax refund application of more than 70 million VND paid in 2022 to the tax authority in March but had not received any response. "In previous years, I declared 5 dependents to reduce my family circumstances, including my biological father, younger sister and 3 nephews (calling Ms. Thuy her aunt) and the tax authority accepted. However, this year, for some reason, the tax authority suspected the nephews and asked where their parents were. While my younger sister has been suffering from schizophrenia for many years, she has a hospital certificate from 2020-2021, but the tax officer said that this paper was old and required a new confirmation. I had to go back to my hometown to do additional paperwork, which was time-consuming, laborious and costly," Ms. Thuy said, sharing that in a family with a high-income earner, helping those less fortunate is normal. "My younger brother doesn't have a job, and my sister-in-law is at home taking care of her sick father and three small children, so how can she go to work? The whole village and neighborhood knows about our family's situation in the countryside. With the same tax documents, a few years ago the tax authority accepted the tax refund, but this year they are suspicious and require verification. Meanwhile, every month, I have documents to transfer money to take care of my family," Ms. Thuy was upset.

Lawyer Tran Xoa, Director of Minh Dang Quang Law Firm

Because the paperwork has not been completed in more than a month, Ms. Thuy withdrew to submit it to the tax office in Ha Tinh with the hope that "local officials will also understand the family's situation and resolve it faster". If the tax office accepts, she will be refunded more than 70 million VND, but if the tax office does not accept, the tax refund will only be 40 million VND. "If they still require additional documents proving the 3 grandchildren to reduce family circumstances, I will probably give up because where do I have the time to run back and forth from Hanoi to my hometown to do the paperwork? The cost of going back and forth, plus the loss of a few days off (Ms. Thuy is currently on probation at a new company), is more than the refunded amount. But if I do not do it, next year it will be considered that the 3 dependents will be eliminated, and I will have to pay more tax even though I am still worried about the grandchildren," Ms. Thuy said tiredly.

Delegate Doan Thi Thanh Mai: "Especially propose to soon amend the Law on Personal Income Tax"

Mr. NMQuan (residing in Tan Phu District, Ho Chi Minh City) said frankly: "It's too tiring, too troublesome, so I haven't done tax refunds for the past few years. I've given up." The story is that 5 years ago, Mr. Quan went to do personal income tax refund procedures to receive back the 20 million VND in overpaid tax, but it was very difficult. He went back and forth 5-6 times to do the paperwork, procedures, and waited almost half a day for his turn. "The tax officer reviewed the file and did not accept my declaration of 4 dependents, which were 2 children and biological parents, but only accepted to count 2 dependents as 2 children. The reason is that when adding more dependents, I had to declare from the beginning of the year and not wait until the time to complete the tax settlement file. At that time, I had to go back and declare again. The next time I submitted the file, the tax officer pointed out that I had declared income but lacked invoices, so I went back and redid the file. After completing the file, I went back to submit it, but the tax officer looked up the information from my personal tax code and discovered that I had generated income in a place but did not declare it... But in this place during the year, I had absolutely no income and people arbitrarily used my tax code to declare personal tax. To prove it, I had to go to the place where the business (DN) declared tax and asked them to confirm. I had to travel for more than a week to get the paper with no income because this unit made a mistake... In general, because "I've already gone to the trouble of doing it, so I'll do it all the way. I thought it would be done once, but unexpectedly the following year, the same situation happened again, I had to go back and forth many times to complete the application," Mr. Quan recounted his tax refund journey and concluded: "Even though I received the tax money back, I was "fed up". That's why, for the past 3 years, Mr. Quan has given up on filing for a personal income tax refund, even though he knows that if he did, the tax refund would be around 20 million VND, not a small amount in these difficult times.

Need to soon increase family deduction for personal income tax payers

Not yet taxable, still have to pay

The most miserable are workers whose casual income is not yet taxable but still have to pay taxes. Ms. Ut (District 3, Ho Chi Minh City) works as a janitor for a company based in Phu Nhuan District, with a salary of 7 million VND/month, not including insurance or other expenses. Each time she receives money, the company deducts 10% tax, losing 700,000 VND, so the amount she receives is only 6.3 million VND. Ms. Ut said that she heard that when she goes through tax refund procedures, she will receive a few million VND that she has paid, but she does not know the procedure, so she is having to ask the company for instructions. "We are manual workers, we do not know the procedure. But it is a pity for our money, we have to wait and see what they say and then do it," she said. According to current regulations, for casual income of 2 million VND or more, the income-paying unit deducts 10% tax. This is only the provisional tax payment, when tax settlement is made, the family deduction for the taxpayer will be calculated at 11 million VND/month and the dependents at 4.4 million VND/month. In Ms. Ut's case, the monthly income is less than 11 million VND, which is not yet taxable. However, due to the regulation that the amount received over 2 million VND is subject to a 10% tax deduction, she is still deducted first and refunded later. Many freelancers like Ms. Ut are in this situation and going through the procedures to get back the overpaid tax is quite difficult for them. Many people, because they are not familiar with the procedures, do not do it, even though that amount of money is very valuable to them.

Personal income tax collection rate increased to record level

The growth rate of personal income tax revenue has been increasing over the years. In 2022, personal income tax revenue reached a record high of nearly VND 167,000 billion (exceeding the estimate by VND 50,000 billion) and increased nearly 17 times compared to the time of promulgation of the Personal Income Tax Law in 2007. In the first 4 months of 2023, personal income tax was one of the taxes with a collection rate far exceeding the estimated plan, at 42%. According to the estimated figures submitted to the National Assembly in October 2022, personal income tax revenue in 2023 was over VND 154,600 billion. Based on this estimate, individuals have contributed nearly VND 65,000 billion to the state budget in the past 4 months. This tax mainly comes from salaried workers.

This regulation also causes trouble for the paying unit. In 2022, thousands of workers at Pou Yuen VN Co., Ltd. lost their jobs due to the company's lack of orders. However, workers also have to pay personal income tax on the subsidies they receive. The company supports workers with 0.8 months' salary for each year of work, the highest level receiving 379 million VND. The average level that workers receive is 116 million VND/person and the lowest level is 12 million VND. However, according to regulations, the company deducts 10% of the support amount. This has caused public outrage. At that time, the Ho Chi Minh City Tax Department explained that according to regulations, when a company terminates a labor contract, expenses according to the provisions of the Labor Code and the Social Insurance Law (SI Law) are not included in taxable income. In case the excess expense is higher than the provisions of the Labor Code and the SI Law, the excess must be included in taxable income. But how many of this company's unemployed workers will file their taxes in 2022?

Salaried workers suffer

According to lawyer Tran Xoa, Director of Minh Dang Quang Law Firm, enterprises have accounting departments, are knowledgeable about accounting and taxes, but when making tax refund applications, it is still difficult, let alone individuals who have to make tax refund applications. Many people are PhDs and professors, but when they touch the declaration documents, they still find it complicated. For taxpayers who are laborers and workers, it is even more difficult. People are not familiar with the procedures, so they have to go back and forth many times to get documents, submit documents... and this is a barrier for them. According to Mr. Tran Xoa, when paying personal income tax, taxpayers are deducted at the source and the enterprise paying the income will pay the employee's tax to the state budget. Tax payment must not be delayed and "cannot escape anywhere". Meanwhile, the tax refund must have full documents proving dependents, invoices and documents... In principle, the declarant is responsible for the documents. Therefore, the tax authority guides taxpayers to have full documents for tax refund. In case of suspected fraud, you can go for an inspection later. But with the current practice, many people do not know so they do not do it, many people are afraid of the procedure so they give up. No one can count the amount of tax refunds that taxpayers do not receive, but this number is certainly not small.

"I also do not understand why in recent years, the proposal of the General Department of Taxation and the Ho Chi Minh City Tax Department to increase the casual income level from VND 2 million to VND 5 million has not been accepted by the Ministry of Finance. The longer this problem is left, not only will the rights of taxpayers be affected, but the state will also have to spend a lot of money," said Mr. Tran Xoa. Because of this regulation, the number of personal income tax refund applications is increasing. For example, in 2022, the Ho Chi Minh City Tax Department received 23,545 personal income tax finalization applications, an increase of 21% in the number of applications compared to the same period in 2021. The tax authority has processed personal income tax refunds for 22,893 applications with an amount of VND 150.4 billion, an increase of 20% in the number of applications and 11.7% in the refund amount. Thus, on average, each personal income tax refund application is nearly VND 6.6 million in tax. Not to mention, a tax refund dossier in accordance with regulations must go through dozens of signatures before being sent to the State Treasury to refund the taxpayer.

More importantly, while tax refunds are difficult, taxpayers are currently at a great disadvantage because the personal income tax threshold is outdated.

On the morning of May 25, discussing at the socio-economic group, National Assembly delegate Doan Thi Thanh Mai (Hung Yen delegation), Deputy Head of the Economic Committee, said that the family deduction level maintained since July 2020 is no longer consistent with the continuous fluctuations in the general price level, creating unfairness for taxpayers. Most consumer goods and services for all sectors have increased, causing people's living expenses to increase. It is estimated that expenses have increased by 20-30% since the Covid-19 pandemic due to the increase in prices of goods and consumption while income has not increased, or even decreased. For many families, especially in big cities, the current family deduction level is not enough to meet basic expenses.

Obviously, personal income tax payers are suffering double losses.

Increase family deductions and taxable income

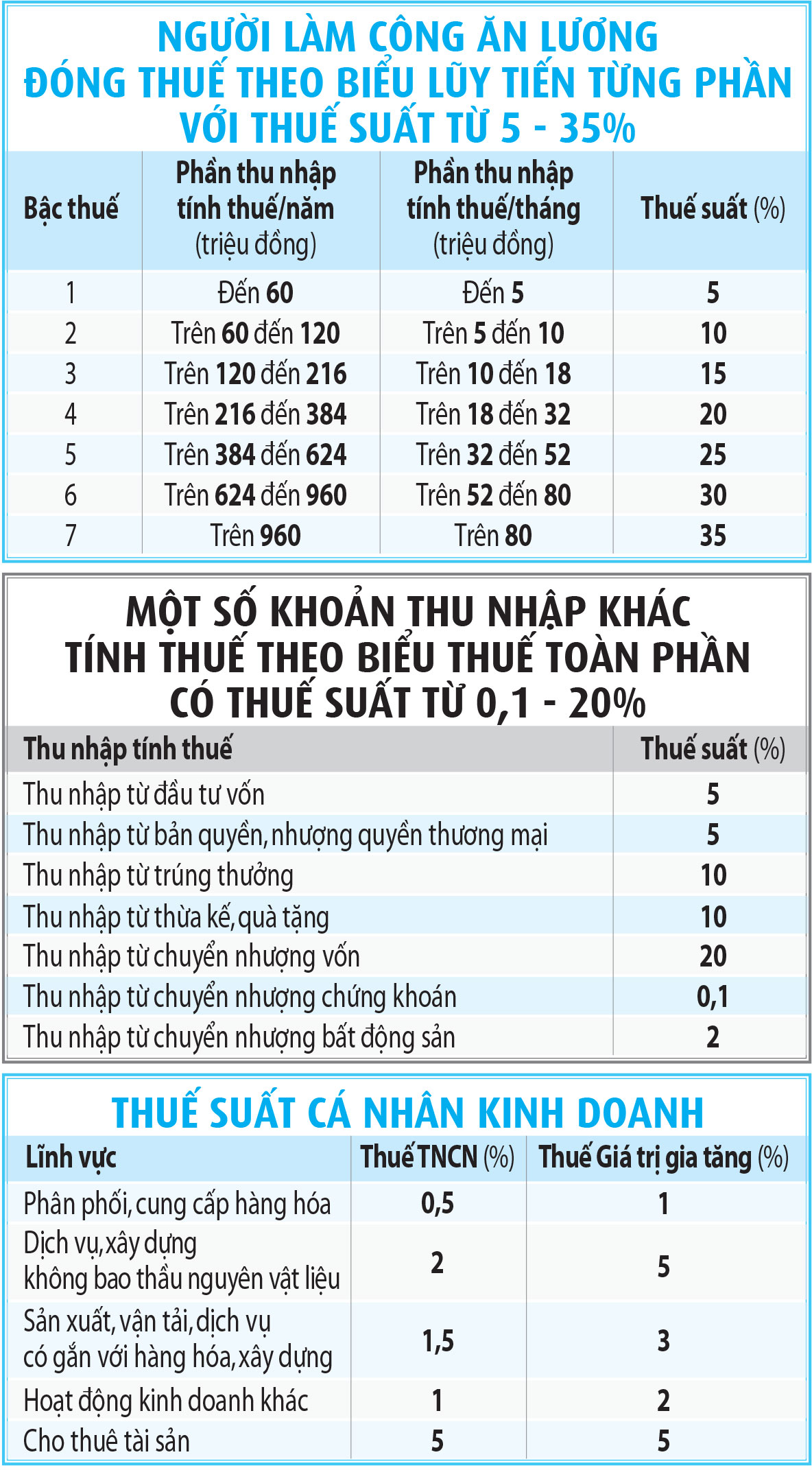

The reason why personal income tax is often criticized is because the family deduction for salaried employees is low, leading to a high tax payable. In the personal income tax collection rate, salaried employees pay more than 70% of the tax. In 2020, the family deduction increased from 9 million VND/month to 11 million VND/month for taxpayers and from 3.6 million VND/month to 4.4 million VND/month for dependents. This increase is not satisfactory in 2020. If calculated fairly, it should be 19 million VND/month. In addition, the regulation that individuals doing business from 100 million VND/year or more must pay personal income tax is increased because this level is lower than that of salaried taxpayers who earn 132 million VND/year (family deduction of 11 million VND/month x 12 months) or more must pay tax...

Mr. Tran Xoa , Director of Minh Dang Quang Law Firm

Need to simplify personal income tax settlement records

Personal income tax settlement dossiers are very complicated. There are many specialized and difficult-to-understand terms that only those with expertise in this field can properly follow the requirements of the tax authorities. Therefore, it is normal for many individuals to have to declare and re-declare many times. In the context of the Government moving towards simplifying administrative procedures and moving towards e-government, the tax sector must review related procedures, especially in the personal income tax settlement stage. It must be simple and easy to understand from documents, forms or sentences, eliminating cumbersome and complicated regulations or sentences that are too difficult to understand.

Lawyer Bui Quang Nghiem , Director of Nghiem & Chinh Law Firm

Need to pay first, check later

Tax refunds, whether for businesses or individuals, are almost never easy or can be done in one go. Meanwhile, tax authorities are quite active in collecting income from individuals who have income in many places but do not make tax settlements. With just a tax code and ID card, the tax authorities have a clear understanding of each individual's income. Therefore, for individuals who pay taxes, when they make personal income tax settlements, it means that they have estimated that the tax they have paid is higher than the tax rate and they want to receive the excess tax amount back. Tax authorities need to apply the spirit of refund first, check later to encourage taxpayers to comply with legal regulations. If the inspection is made after a mistake, the taxpayer himself will be charged more and fined more. At the same time, this also helps avoid overloading the tax authorities so that they can focus resources on checking suspicious records, increasing the efficiency of handling related work.

Dr. Le Dat Chi , Head of Finance Department (Ho Chi Minh City University of Economics)

Source link

Comment (0)