According to economic experts, reducing value-added tax to 8% is meaningful and affects most people and businesses, is a solution to support businesses and stimulate consumer demand.

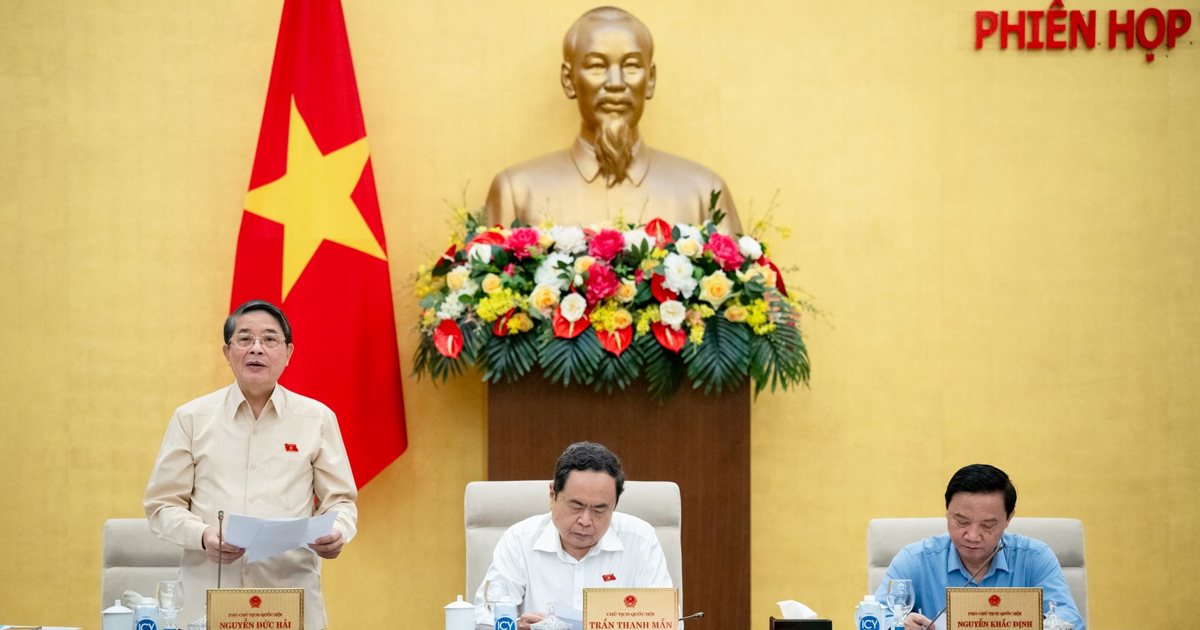

The Resolution of the 7th Session of the 15th National Assembly, which was just passed by the National Assembly, allowed a further reduction of 2% in value-added tax rates for a number of groups of goods and services currently subject to a 10% tax rate from July 1 to December 31 this year.

Immediately, the Government has also issued Decree No. 72 regulating the policy of reducing value added tax according to the Resolution of the National Assembly. This is also the 4th time the National Assembly and the Government have decided to reduce value added tax, in order to support people and businesses in production and business.

Mr. Nguyen Van Phung - former Director of the Department of Large Enterprise Tax (General Department of Taxation), commented that reducing value added tax is one of the important measures to help businesses partially overcome fluctuations in import prices from abroad.

According to Ms. Nguyen Thi Cuc, Chairwoman of the Vietnam Tax Consulting Association, reducing value added tax will contribute to reducing the cost of goods and services, thereby promoting production and business and creating more jobs for workers, contributing to stabilizing the macro economy and economic recovery.

From a consumer's perspective, Ms. Truong Hong Hanh (Hanoi) said that a 2% reduction may seem small, but in reality it adds up to a lot of money. "My family often goes to the supermarket on weekends to buy things for the whole week, and the bill is usually more than 2 million VND. So with this reduction, I will save about 40 thousand VND. Adding it up for the whole year is also a large amount of money in the current economic conditions," Ms. Hanh shared.

Meanwhile, Mr. Nguyen Thanh Trung, director of a design and construction company, said that reducing value added tax will help some products have lower prices, so profits can also increase.

“This is a very valuable source of support for our company at the present time,” said Mr. Nguyen Thanh Trung.

A representative of the General Department of Taxation said that in order to help people and businesses promptly enjoy the 2% value-added tax reduction policy for the last 6 months of this year, the agency has just sent an urgent dispatch to local tax departments, requesting them to proactively disseminate and guide taxpayers.

Mr. Ha Van Khoa, Director of the Thua Thien - Hue Provincial Tax Department, said that as soon as there was information about the reduction of value added tax, the Provincial Tax Department promoted the dissemination of new tax policies in many appropriate and accessible forms, so that people and businesses could grasp and benefit promptly; in which, diversifying the forms of dissemination and support; disseminating and guiding tax policies to taxpayers quickly and effectively; improving the quality of news and articles on the Tax Department's Electronic Information Page, the Website Supporting Startup Enterprises, the Tax Department's Fanpage and Zalo, considering this an effective and practical form of dissemination for taxpayers.

According to Ms. Pham Thi Minh Hien, Deputy Director of the Tax Policy Department (General Department of Taxation), the policy of reducing value added tax by 2% has just been issued for the 4th time, and the policy of extending tax payment has just been issued for the 5th time, implemented from Resolution 42 of the 15th National Assembly, are unprecedented fiscal policies, implemented over a long period of time. This shows the companionship of the National Assembly and the Government with the people and businesses in any circumstances, to complete the country's socio-economic development goals. True to the spirit of Resolution 93 of the Government on removing difficulties and promoting production and business activities for people and businesses.

The Ministry of Finance estimates that implementing the policy of reducing value-added tax by 2% in the last 6 months of 2024 is expected to reduce state budget revenue by about VND47,000 billion.

Accordingly, the value added tax reduction has been implemented in 2022, 2023 and the first 6 months of 2024. If in 2021, the 2% value added tax reduction policy has not been applied, the total retail sales of goods and consumer service revenue is estimated to reach over 4,789,000 billion VND. In 2022, after applying the 2% tax reduction, this figure has increased to 5,679,000 billion VND, an increase of 19%. In 2023, it will continue to increase to 6,231,000 billion VND...

Source

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

Comment (0)