23 banks increased interest rates in June, with interest rates above 7%/year

According to Lao Dong, MSB is currently offering a special interest rate of 7.0%/year to customers with newly opened savings accounts or savings accounts opened from January 1, 2018, automatically renewed with a term of 12 months, 13 months and a deposit amount of 500 billion VND or more.

Dong A Bank currently lists a special interest rate of 7.5%/year for customers depositing for a term of 13 months or more, with interest at the end of the term for deposits of VND 200 billion or more, for a period of 365 days/year.

HDBank also listed a special interest rate of 8.1%/year for a 13-month term. Applicable to savings of at least VND500 billion/Savings Card, not applicable to mobilization in the form of initial interest or periodic interest.

Next is the interest rate of 9.5%/year listed at PVcomBank . PVcomBank customers will enjoy a special interest rate of 9.5%/year when having a new deposit balance of 2,000 billion VND or more.

Among international banks, Wooribank is also currently listing a savings package with the highest savings interest rate of 7.5%/year with a 3-year deposit term.

The highest interest rate at Wooribank for 24-month - under 36-month terms is 7%/year.

Interest rate for 12-month term - under 24 months, the current listed savings interest rate is 6.5%/year. The applicable condition is that the deposit amount does not exceed 100 million VND/month.

Deposit interest rates gradually recover, customer deposits increase

At the end of June, the market recorded 23 banks increasing interest rates, including: VIB, TPBank, Nam A Bank, LPBank, GPBank, BaoVietBank, OceanBank, MSB, Bac A Bank, ABBank, PGBank, VietBank, Eximbank, MBBank, VietinBank, NCB, OCB, BVBank, Viet A Bank, VPBank, PVCombank, Techcombank, ACB.

According to financial reports at banks, by the end of February 2024, people's deposits reached a record of 6.64 million billion VND, an increase of 1.6% compared to the end of 2023. People's bank deposits turned to increase after recording a decrease in the January 2024 update.

Since April 2024, deposit interest rates have shown a recovery trend after hitting rock bottom in the first months of the year. Interest rates at many commercial banks have recorded a sharp increase. For example, in June, ABBank increased by 1.6 percentage points for 12-month terms, MSB increased by 0.9 percentage points for 12-month terms, Oceanbank increased by 0.6 percentage points for 9-month terms..., all in just one adjustment.

However, in the June market assessment report of the ACBS research group (ACB Securities Company Limited), VND interest rates have increased, but are still at a low base. T-bill interest rates, OMO interest rates, VND interest rates on the interbank market and short-term VND deposit interest rates at many banks have increased in the past month. However, deposit interest rates have not increased significantly, 0.2-0.3% for short terms, and are still at a low base due to weak credit demand.

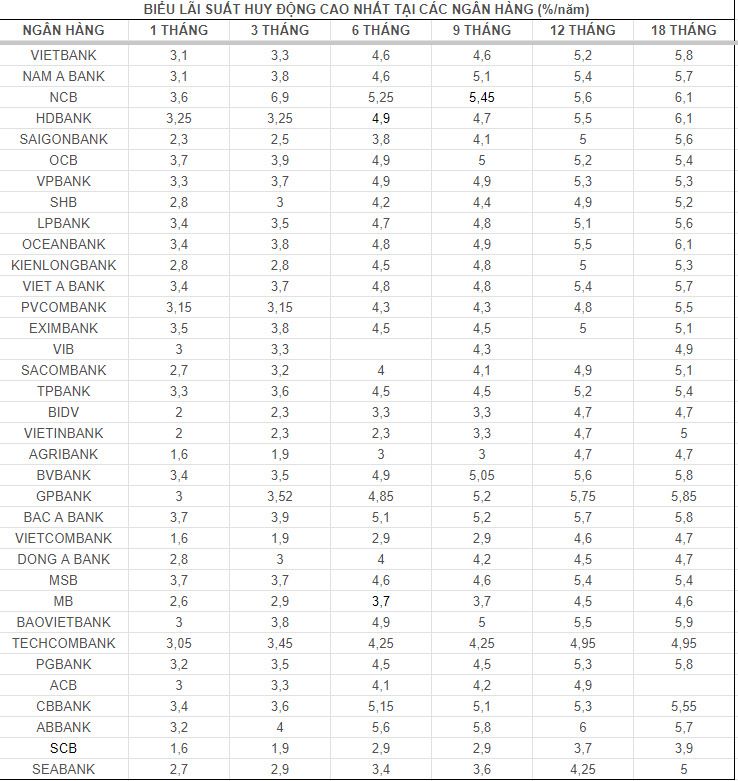

Details of deposit interest rates at banks, updated on June 29, 2024

* Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.

Readers can refer to more articles about interest rates HERE.

Source: https://laodong.vn/kinh-doanh/bien-dong-lai-suat-276-lo-dien-cac-moc-tren-7-sau-cuoc-dua-tang-lai-suat-1359302.ldo

![[Podcast] News on March 24, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/f5fa1c3a9ae14d4590ac6965d233586b)

![[Podcast] News on March 25, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/735b3003484942af8e83cbb3041a6c0c)

![[Podcast] News on March 26, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/c3d9c3c48b624fd9af79c13ff9e5c97a)

![[Podcast] News on March 27, 2025](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/de589137cda7441eb0e41ee218b477e8)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)