Previously, most economists participating in the survey predicted that the Fed would make a move to loosen monetary policy in March.

Economists have revised up their inflation forecasts since Donald Trump was re-elected as US President, amid concerns that his policies, particularly tariffs, could add to inflationary pressures in the economy.

After cutting interest rates by a total of 100 basis points in April 2024, Fed officials recently signaled that they are in “no rush” to cut rates further.

With a strong labor market and steady consumer spending, many economists say the world's largest economy is performing well and does not need to cut interest rates at this time.

New tariffs have been announced every week so far. Trump recently said he would impose a 25% tariff on all steel and aluminum imported into the US. The White House had previously delayed plans to raise trade barriers with Mexico and Canada until March 1, but still imposed an additional 10% tariff on goods imported from China.

Tariffs could be inflationary and hurt economic growth, said James Knightley, international economist at financial services firm ING. The uncertainty, he said, means the Fed will have to wait and see what actually happens.

Mr. Knightley also commented that President Trump's policies include many different elements. This causes many challenges, and reduces confidence in any forecast about the US economy in particular and the global economy in general.

In a January survey, nearly 60% of economists expected the Fed to cut rates in March. However, in a February 4-10 survey, experts were divided on when the Fed would make its next move.

Of the 101 respondents, 67 forecast at least one rate cut by the end of June, with 22 predicting a cut in March and 45 predicting a cut in the second quarter.

Economists, however, appear more confident about inflationary pressures. More than 90% of respondents in both the October survey (conducted just before the US presidential election) and the most recent survey raised their annual inflation forecasts for 2025 by an average of about 40 basis points.

Nearly 60% of respondents (27/46) to the supplementary question said the inflation risk from US tariffs has increased recently.

The uncertainty is likely to keep Fed officials on the sidelines in the coming months, said Neil Shearing, an economist at Capital Economics. He also said that if higher taxes are eventually imposed, the resulting surge in inflation would prevent any further monetary policy easing for the rest of 2025.

According to the survey, experts forecast that after growing 2.3% last quarter, the US economy will grow 2.2% this year and 2% in 2026. The unemployment rate is forecast to be 4.2% this year and 4.1% next year.

Source: https://doanhnghiepvn.vn/quoc-te/lam-phat-va-tang-truong-bai-toan-kho-cho-fed/20250211035242419

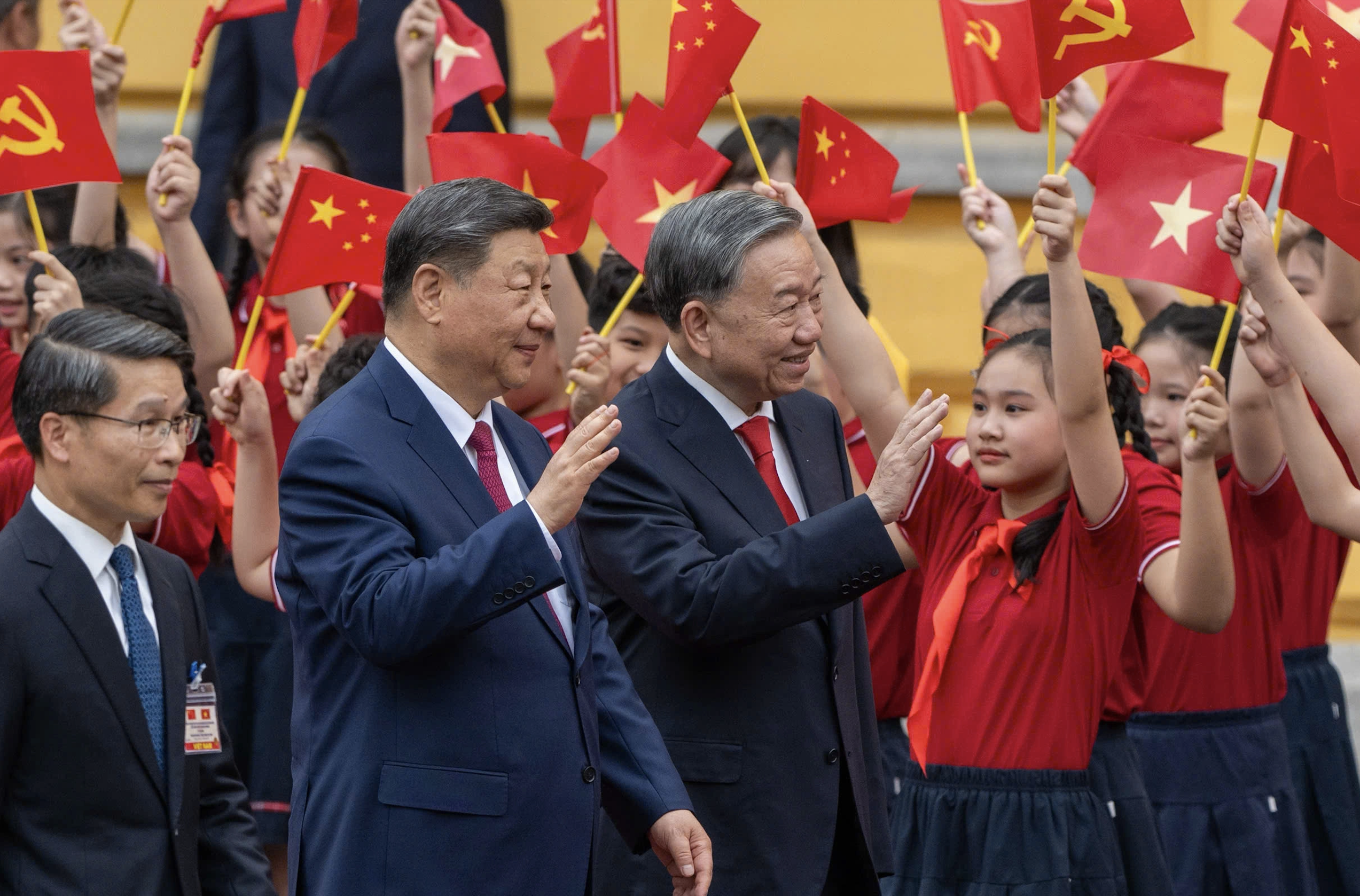

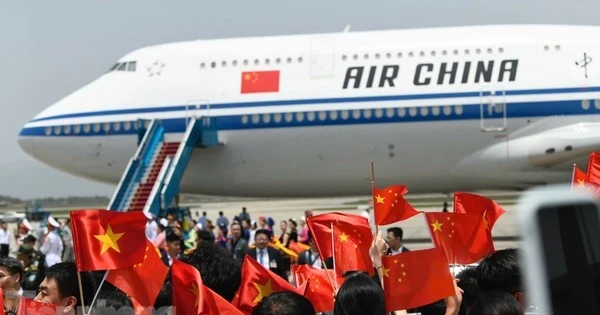

![[Photo] Hanoi people warmly welcome Chinese General Secretary and President Xi Jinping on his State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/d6ac6588b9324603b1c48a9df14d620c)

![[Photo] Ceremony to welcome General Secretary and President of China Xi Jinping on State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/5318f8c5aa8540d28a5a65b0a1f70959)

![[Photo] Prime Minister Pham Minh Chinh chairs conference to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/dcdb99e706e9448fb3fe81fec9cde410)

Comment (0)