Recently, according to statistics from the State Bank, the average overnight interbank interest rate increased by 0.17% in the session on September 22, 2023. The increase was higher than the 0.14% increase in the session on September 21, 2023. Interbank interest rates for other terms also tended to increase slightly.

The upward trend in interbank interest rates began after the State Bank of Vietnam (SBV) took action to absorb VND from the market through two issuances of treasury bills. In the sessions of September 21, 2023 and September 22, 2023, nearly VND 20,000 billion of 28-day treasury bills were successfully bid. This move has withdrawn a large amount of cash from the system's liquidity.

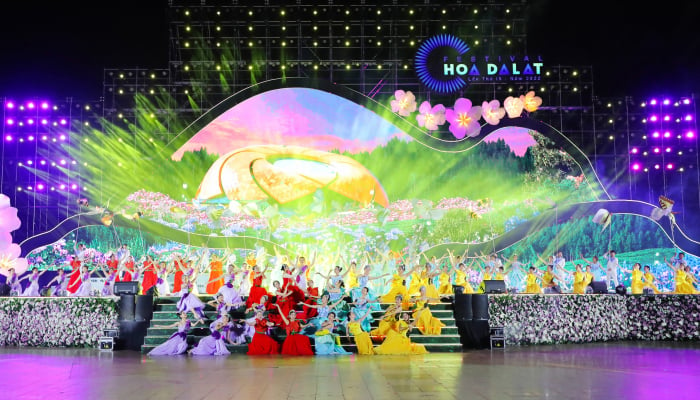

Interbank interest rates increase again after the State Bank issues credit notes (Photo TL)

In the context of excess liquidity in the system, interbank interest rates continuously maintained at low levels after 4 adjustments, the State Bank of Vietnam issued credit notes after more than 6 months of suspension.

Many economic experts consider this a move to stabilize the USD/VND exchange rate. In recent times, the USD/VND exchange rate has increased as the Fed continues to raise interest rates while Vietnam's monetary policy is still maintaining low interest rates.

In the session on September 25, 2023, the State Bank continued to offer 28-day treasury bills under the interest rate bidding mechanism with a volume of VND 10,000 billion, interest rate of 0.49%.

Including the trading session on September 25, 2023, the State Bank of Vietnam has withdrawn a total of VND 30,000 billion from the system through the treasury bill channel to reduce pressure on the USD/VND exchange rate. This is expected to support export enterprises from now until the end of the year.

Source

Comment (0)