According to Reuters news agency, many large Chinese banks such as Industrial and Commercial Bank of China (ICBC) and Construction Bank of China (CCB) are expected to cut interest rates on more than 42,000 billion USD in deposits this week.

The reduction in one-year deposits by ICBC or CCB could be 0.2% or more. Longer terms could be cut by at least 0.25%. In September, People's Bank of China (PBOC) Governor Pan Gongsheng announced a plan to cut the deposit rate by another 0.2% to 0.25%. If implemented, it would be China's second major cut this year, following a cut in July. Reuters said the deposit rate cut is a move to ease pressure on banks' profits, as China has previously lowered lending rates as part of a stimulus package amid deflation in the world's second-largest economy.

Chinese banks are struggling with weak demand for loans and rising bad debts as most sectors of the economy slow down and the real estate crisis persists. Since late September, the PBOC has reduced the reserve requirement ratio for banks, lowered home loan interest rates and reference interest rates. Last week, the Economic Development and Reform Commission also said it would spend $28 billion on local investment projects this year, a year ahead of schedule. Meanwhile, the Chinese Ministry of Finance has pledged to increase fiscal support. Previously, in less than three weeks (from September 24 to October 12), China injected nearly $500 billion more to support the financial and real estate markets and stimulate demand.

According to expert Isabelle Feng of the Free University of Brussels (Belgium), China is mobilizing resources to maintain its growth target and bring new vitality to the economy. Reviving the stock markets, reviving the real estate industry, reducing the debt burden of local governments, increasing capital to loosen the credit capacity of state-owned banks... are the goals that have been repeated from the PBOC to the Chinese Ministry of Finance in press conferences.

However, Ms. Feng warned that the “arrows” launched by Beijing with the expectation of bringing growth worth nearly 500 billion USD, risk pushing the world’s second largest economy into a state of heavy debt, because people currently do not have enough confidence to continue shopping, especially to reinvest in real estate. “The problem in China is that people are like birds that have been shot, they do not dare to consume anymore. Chinese people are famous for being far-sighted, so they save a lot of money. Currently, about 40,000 billion USD is deposited in banks. If that money or part of it cannot be released to encourage consumption, it will be difficult for China to restart the economic engine,” Ms. Feng said.

China's 2023 statistics show that the amount of money entrusted to savings funds at banks increased by more than 15%. Only the Agricultural Bank of China collected more than 25,000 billion yuan ($3,500 billion) last year, 10 times larger than the "second stimulus" package announced by the Ministry of Finance on October 12. Therefore, although China has launched many monetary tools, observers say that it is not enough. This explains why in the first days of the week, the Hang Seng Index (HSI) in Hong Kong (China) fell 3%.

MINH CHAU

Source: https://www.sggp.org.vn/ky-vong-gi-o-nen-kinh-te-lon-thu-hai-the-gioi-post764147.html

![[Photo] Tan Son Nhat Terminal T3 - key project completed ahead of schedule](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/85f0ae82199548e5a30d478733f4d783)

![[Photo] Prime Minister Pham Minh Chinh works with state-owned enterprises on digital transformation and promoting growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/f55bfb8a7db84af89332844c37778476)

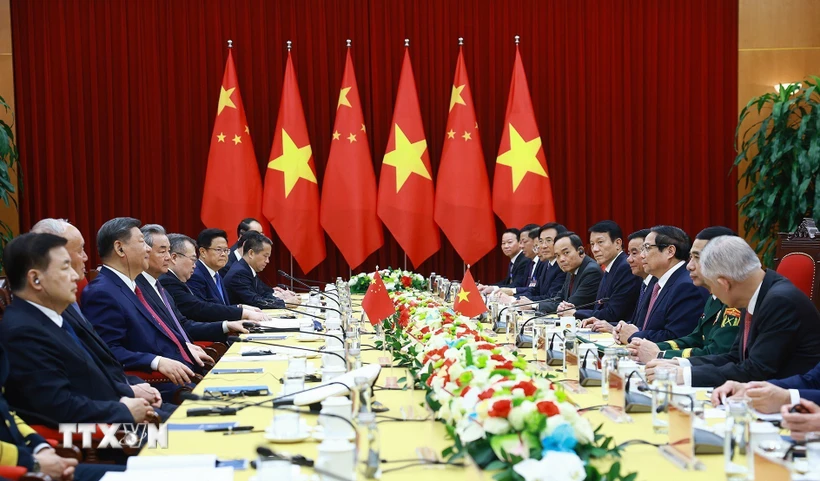

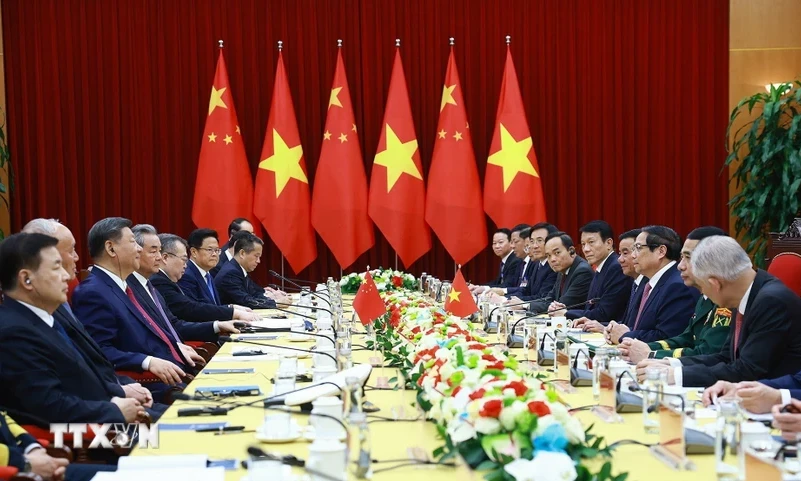

![[Photo] Vietnamese and Chinese leaders attend the People's Friendship Meeting between the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7d45d6c170034d52be046fa86b3d1d62)

![[Photo] Celebrating the 70th Anniversary of Nhan Dan Newspaper Printing House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/a7a2e257814e4ce3b6281bd5ad2996b8)

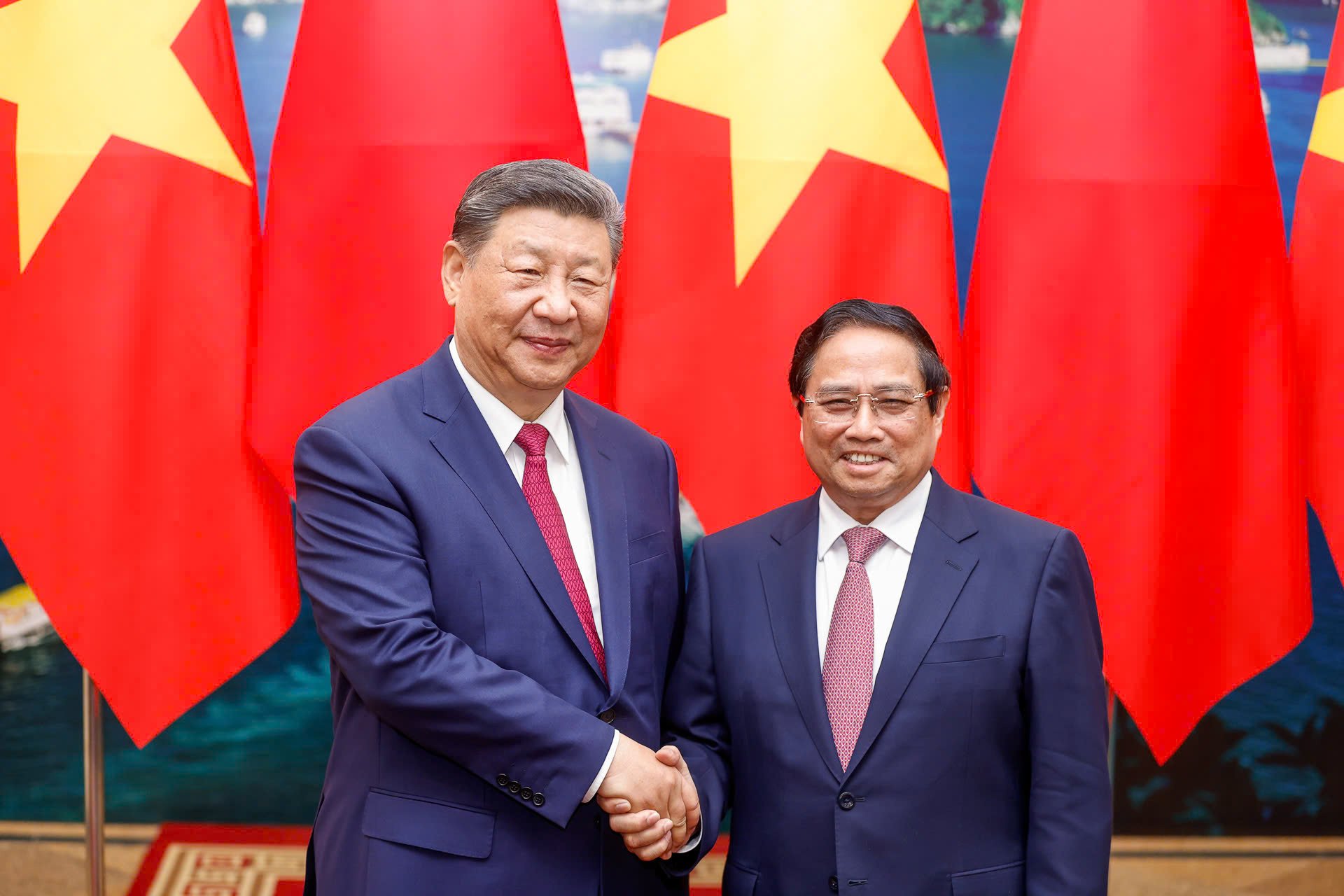

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/ef636fe84ae24df48dcc734ac3692867)

Comment (0)