At the end of the session on June 13, the VN-Index closed at 1,301 points, up slightly by 1.3 points, equivalent to 0.1%.

At the opening of trading, although many stocks increased in price, due to the tight trading of large stocks, the upward market trend was not strong.

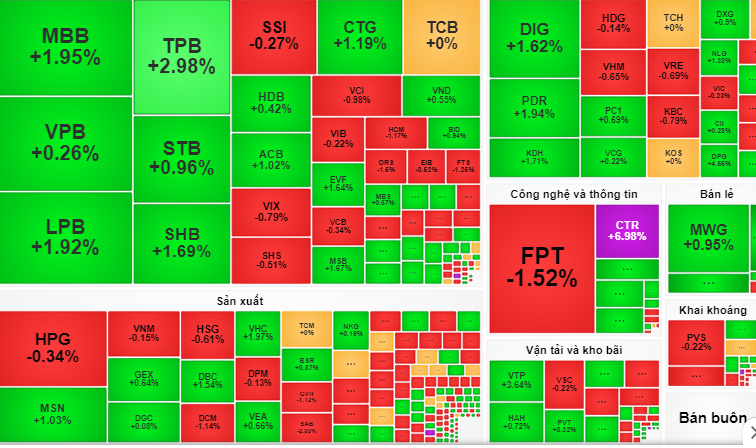

Next, the pressure to sell stocks appeared. The red color in the market tended to spread. As a result, in the morning session, no group of stocks really stood out in terms of points. Cash flow mainly focused on a few individual stocks such as PDR, MBB, CTR...

Active selling liquidity continued to increase in the early afternoon session, causing great pressure. However, thanks to increased demand during the session, the market gradually regained the points lost earlier.

At the end of the session, the VN-Index closed at 1,301 points, up slightly by 1.3 points, equivalent to 0.1%.

The notable point of this session is that foreign investors bought 1,645 billion VND but sold 3,058 billion VND of stocks. They focused on selling VRE, FPT, HPG. In total, foreign investors net sold 1,413 billion VND. Many people are worried that foreign investors will not stop selling stocks in the next session.

Given the above developments, Dragon Viet Securities Company (VDSC) commented that liquidity on June 13 increased compared to the previous session. This shows that the supply of shares is gradually increasing.

VCBS Securities Company recommends that investors stay calm, maintain their current portfolio with stocks attracting cash flow in the banking and steel groups, etc., and wait for more stable signals from the market to decide on trading.

Source: https://nld.com.vn/chung-khoan-ngay-14-6-khoi-ngoai-co-the-manh-tay-ban-co-phieu-196240613180809391.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

Comment (0)