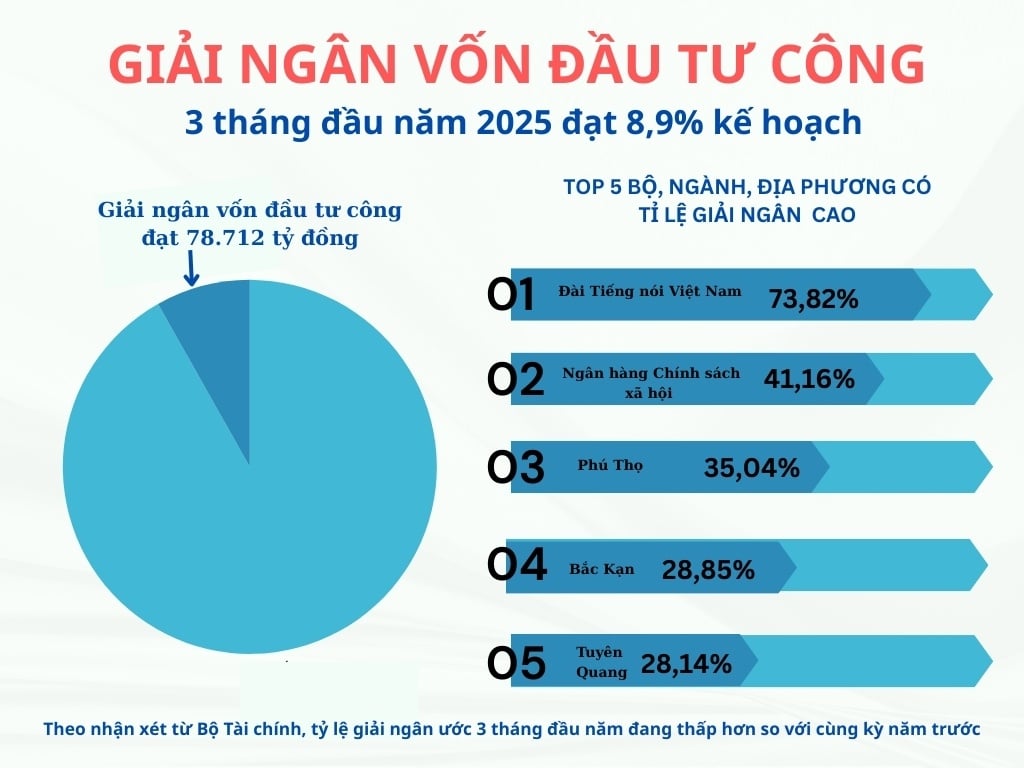

According to the Ministry of Finance's report, the estimated disbursement of public investment capital in 2025 by the end of March was VND 78,712 billion, reaching 8.98% of the plan; reaching 9.53% of the plan assigned by the Prime Minister. Of which, the National Target Program was VND 3,638.8 billion (reaching 16.57% of the plan assigned by the Prime Minister).

According to comments from the Ministry of Finance, the estimated disbursement rate in the first 3 months of the year is lower than the same period last year (in the same period in 2024, it reached 11.64% of the plan and 12.27% of the plan assigned by the Prime Minister).

There are 13 ministries, branches and 36 localities with an estimated disbursement rate compared to the plan assigned by the Prime Minister that is above the national average. Some ministries, central agencies and localities have good disbursement rates (over 20%) such as: Voice of Vietnam (73.82%), Vietnam Bank for Social Policies (41.16%), Ministry of Public Security (23.73%), Women's Union (20.37%); Phu Tho (35.04%), Bac Kan (28.85%), Tuyen Quang (28.14%), Ha Nam (25.58%), Lao Cai (22.89%), Ha Giang (21.75%), Binh Dinh (20.25%).

However, many ministries, branches and localities have not yet disbursed, or have disbursed very little (including 17 ministries and central agencies that have not disbursed; 16 ministries, central agencies and 6 localities disbursed less than 5%).

There have been many difficulties and obstacles affecting the progress of disbursement of public investment capital. The report of the Ministry of Finance pointed out 5 major difficulties and obstacles related to mechanisms and policies; capital allocation; difficulties in implementation; difficulties and local budget revenue sources and difficulties and obstacles related to the National Target Program.

For example, the 2024 Law on Public Investment stipulates that the preparation of estimates for investment preparation tasks must be based on the investment preparation tasks decided by competent authorities. However, the Law and guiding Decrees do not have specific regulations on the content of investment preparation tasks; authority, order of preparation, appraisal, and decision on investment preparation tasks, leading to difficulties and obstacles in the implementation process.

Furthermore, the establishment and determination of project management costs and consulting costs of public investment projects without construction components face many difficulties because many fields do not have specific regulations on project management cost norms and consulting costs such as the fields of health, education and training, natural resources and environment, etc.

The regulation on adjusting the annual state budget investment plan before November 15 of the planning year is not appropriate, does not create flexibility for localities in organizing implementation, and makes it difficult to ensure disbursement of 100% of the plan.

|

| There are 5 reasons leading to slow allocation of public investment capital. |

Regarding the problem of slow capital allocation, the Ministry of Finance's report said that the total amount of capital that has not been allocated in detail is currently over VND 62,015 billion, accounting for 7.51% of the plan assigned by the Prime Minister, of which the majority of the unallocated capital is expected to be allocated to projects that are completing investment procedures. The failure to allocate a relatively large amount of capital has affected the disbursement rate of public investment capital from the state budget in the first months of 2025.

In addition to the above-mentioned problems, in reality, there are still some ministries and branches that have allocated details to projects that do not meet the conditions for allocation and disbursement such as: Not having approved investment preparation estimates, not having investment decisions, arranging exceeding the approved total investment, exceeding the medium-term public investment plan, exceeding the capital allocation time... With this reality, the Ministry of Finance has issued a document to inspect and comment in detail to each ministry, branch, and locality to request adjustments and improvements.

Another difficulty raised by the Ministry of Finance is the difficulty related to land use revenue at the local level. Specifically, due to the lack of assurance compared to the estimates assigned by the competent authority, some localities have large land revenue but have not collected it since the beginning of the year, leading to slow allocation of land use revenue, affecting the implementation and disbursement of projects using this capital source.

In addition, there is still a situation where localities are still afraid of making mistakes, are not resolute in implementing and disbursing capital for national target programs, and are slow to complete investment procedures, affecting the allocation of capital plans; the land fund of some localities to solve the problem of residential land and production land for people is still limited; the support level according to regulations to implement support for residential land and production land is very low compared to the actual cost.

Source: https://thoibaonganhang.vn/kho-khan-can-buoc-giai-ngan-von-dau-tu-cong-161968.html

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] Phuc Tho mulberry season – Sweet fruit from green agriculture](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/1710a51d63c84a5a92de1b9b4caaf3e5)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to discuss tax solutions for Vietnam's import and export goods](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/19b9ed81ca2940b79fb8a0b9ccef539a)

Comment (0)