USD exchange rate today (March 24): Early morning of March 24, the State Bank announced the central exchange rate of Vietnamese Dong to USD is currently at: 24,813 VND.

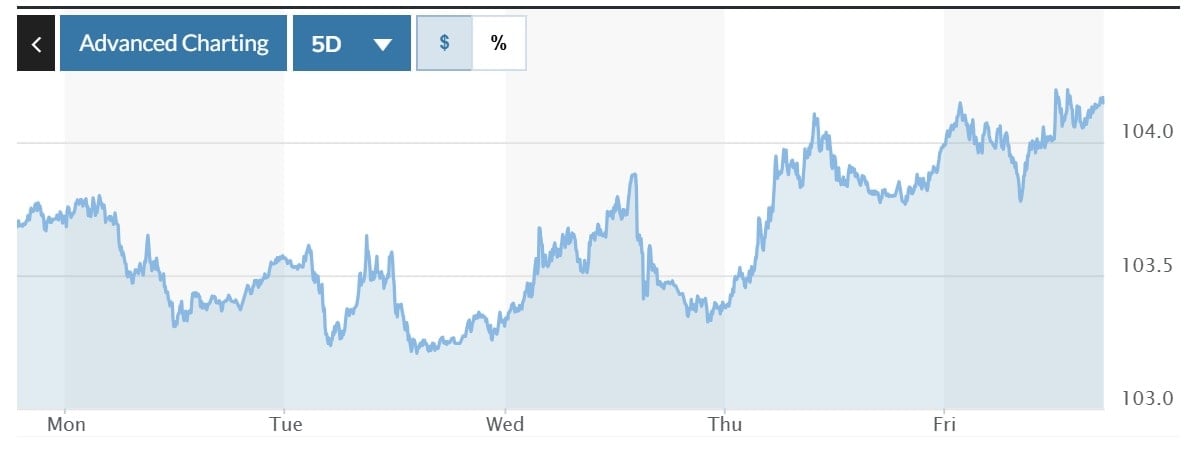

The USD Index (DXY), which measures the greenback's performance against a basket of six major currencies, stood at 104.15.

Forecast of USD trend this week

The outcome of the US Federal Reserve (Fed) meeting did not push the greenback to rise strongly. Basically, it was not a noteworthy event because the Fed kept interest rates unchanged at 4.25-4.5% as predicted.

|

| Chart of DXY Index fluctuations over the past week. Photo: Marketwatch |

The dollar has been under pressure since the start of the year on concerns about the impact of President Donald Trump’s tariff policies on US economic growth. The greenback rebounded this week after the Fed said it would not rush to cut interest rates. Fed policymakers signaled two 25 basis point rate cuts by the end of the year, the same median forecast as three months ago.

Despite the upward revision in inflation forecasts, the move failed to trigger a sharp rise in Treasury yields and the greenback. Personal consumption expenditures (PCE), the Fed's inflation gauge, is expected to rise 2.7% this year. In December, the central bank had projected PCE at 2.5%.

The DXY index remained stable and closed the week slightly higher than the previous week. The index is finding support around 103.20. It is likely to correct to the 105-105.50 zone in the coming time.

However, after this increase, the DXY index may turn down again and continue the downtrend. That decline could drag the DXY index down to the 102-101 zone and even 100 in the medium term.

The yield on the 10-year US Treasury note has been stuck in the 4.1-4.35% range for the past three weeks. That makes the short-term outlook unclear. However, the overall trend remains bearish. Strong resistance is at 4.45-4.5%.

If yields remain anchored below 4.5%, the short-term trend would be to fall to 4% and even 3.8% in the coming weeks.

While the USD rose, the EUR/USD pair turned lower, failing to break above 1.0950. The support level for this pair is currently at 1.08. If the EUR breaks below this level, we could see the EUR drop to the 1.0730-1.0700 range. The market expects the EUR to reverse higher from 1.08 or around 1.07. Such a recovery would keep the overall bullish view intact. If the EUR/USD pair breaks above this level, it would head straight to 1.10, followed by an extended rally to the 1.11-1.12 range.

Currency markets have been volatile in recent months as traders reassess their initial expectations that President Trump’s economic policies would support the dollar and weaken other currencies. This has sent the dollar down 6% against the euro since mid-January. Since taking office in January, President Trump’s announcement of imposing and then suspending tariffs on many trading partners has unsettled markets.

|

| USD exchange rate today March 24: What direction for the USD? Photo: Reuters |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on March 24, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD at 24,813 VND.

* The reference exchange rate at the State Bank's transaction office increased slightly, currently at: 23,623 VND - 26,003 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,370 VND | 25,760 VND |

Vietinbank | 25,275 VND | 25,855 VND |

BIDV | 25,400 VND | 25,760 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center decreased slightly, currently at: 25,576 VND - 28,268 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 27,001 VND | 28,481 VND |

Vietinbank | 26,843 VND | 28,343 VND |

BIDV | 27,260 VND | 28,472 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office for buying and selling has slightly decreased, currently at: 158 VND - 175 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 165.13 VND | 175.63 VND |

Vietinbank | 167.55 VND | 177.25 VND |

BIDV | 167.74 VND | 175.58 VND |

MINH ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-24-3-huong-di-nao-cho-dong-usd-246925.html

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)