Gold price today February 3, 2025, the world gold market is expected to continue to increase, in the context of the US imposing high taxes on the 3 largest partners, which could cause a trade war. Will domestic gold prices explode after the 1-week Lunar New Year holiday?

Last week, on the world market, spot gold price opened at 2,770 USD/ounce and closed the first session of the week at 2,740 USD/ounce.

In the next session, gold prices increased to $2,760/ounce. The gold market was less volatile waiting for the interest rate policy move from the Federal Reserve (Fed).

After its first policy meeting of 2025, held on January 28-29, the central bank kept interest rates unchanged as expected and signaled that further rate cuts were unlikely due to persistent inflation and strong labor data. This caused spot gold prices to briefly fall to $2,745 an ounce before rebounding to $2,772 an ounce.

Gold prices surged to $2,800 an ounce after weaker-than-expected US GDP data was released.

The trade war tensions between the US and Canada, Mexico and China have increased the demand for safe havens, causing gold prices to skyrocket. Gold prices reached a new all-time high of $2,817.21 per ounce.

Gold prices have rallied sharply in recent weeks due to concerns about US tariff policy, said Adrian Day, chairman of Adrian Day Asset Management.

US President Donald Trump signed an executive order imposing a new 25% tariff on goods imported from Mexico and Canada, and a 10% tariff on goods imported from China, effective February 4. Canada and Mexico almost immediately announced tariffs in response to President Trump.

The uncertainty created by the new U.S. administration is not going away anytime soon. In fact, it will only get worse, according to Darin Newsom, senior analyst at Barchart. The market is seeing safe-haven buying of gold even as prices hit new record highs.

According to brokerage SP Angel, physical gold hoarding in the US is attracting attention. Physical gold deliveries from the Bank of England have been ongoing for several months. The focus has been on building up large reserves on the Comex floor in the US, pushing the spread between London and New York bullion to a record high.

At the end of last week, the spot gold price traded at $2,799/ounce. The gold futures price for April 2025 on the Comex New York floor was at $2,835/ounce.

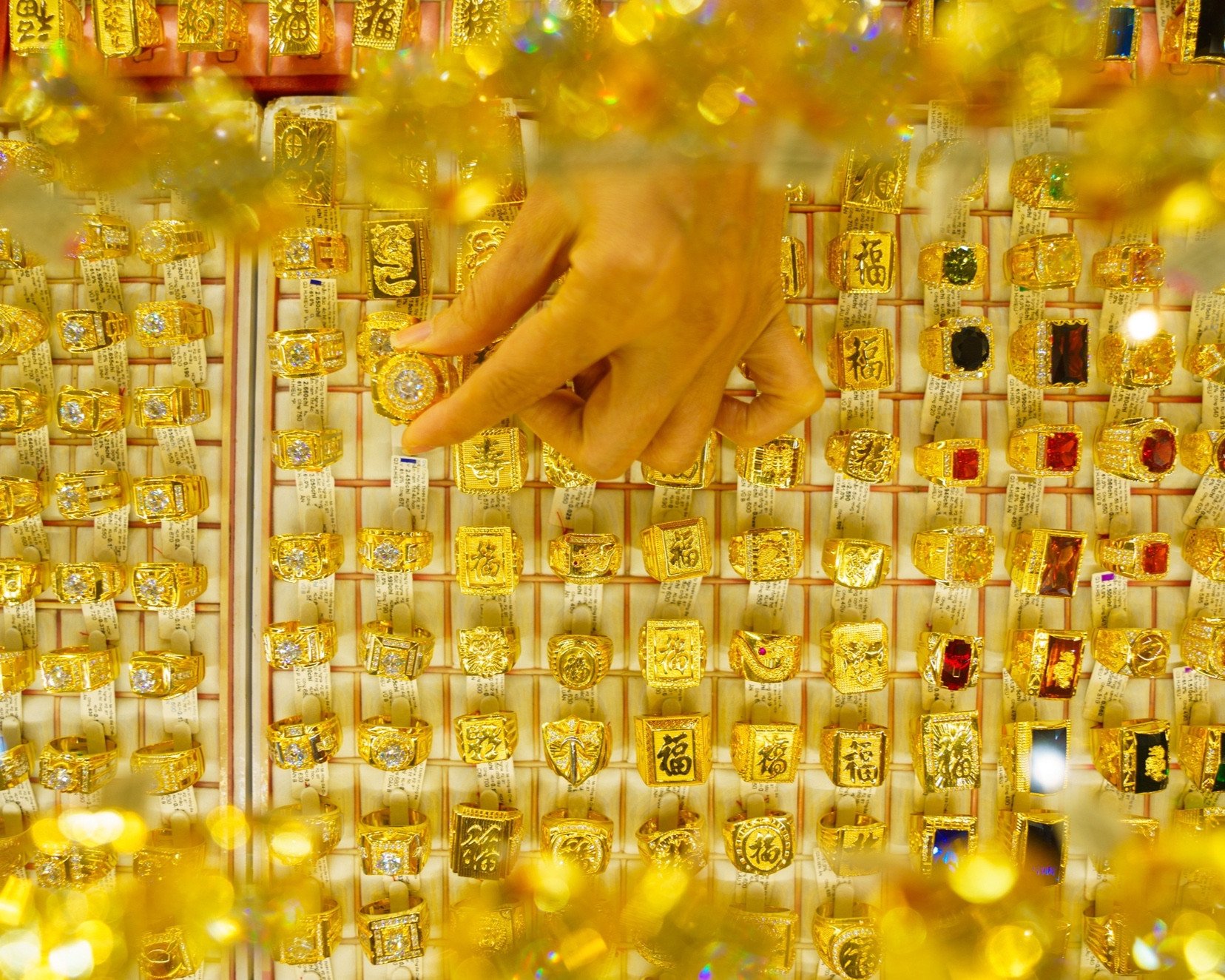

The domestic gold market is closed for the Lunar New Year holiday. On February 1, the price of gold bars at SJC was listed at VND86.8-88.8 million/tael (buy - sell). Doji announced the price of gold bars at VND86.9-88.9 million/tael (buy - sell).

The price of 1-5 chi SJC gold rings is listed at 86.3-88 million VND/tael (buy - sell). The price of 9999 gold rings at Doji closed the session at 86.6-88.1 million VND/tael.

Gold Price Forecast

According to the latest Kitco News weekly gold survey, industry experts and retail traders remain bullish on gold. Experts agree that gold prices will continue to rise in the near future.

Thirteen analysts participated in Kitco News’ gold survey, with the majority predicting higher gold prices in the coming days. Accordingly, 69% expect gold prices to rise; 18% choose gold prices to fall and 13% believe that gold will tend to move sideways in the near future.

Gold could surge above $3,000 an ounce next month, according to Chris Vermeulen, founder and chief investment officer at The Technical Traders. Gold is still in an uptrend. He predicts that gold will break out and rise to $3,050 an ounce.

Continued economic uncertainty is driving people to seek safe-haven assets like gold. Investors tend to turn to physical gold when they are worried about the financial system.

Vermeulen also warned that gold will have a major correction at the right time, possibly this year.

Source: https://vietnamnet.vn/gia-vang-hom-nay-3-2-2025-the-gioi-lap-dinh-vang-sjc-co-bung-no-2367868.html

Comment (0)