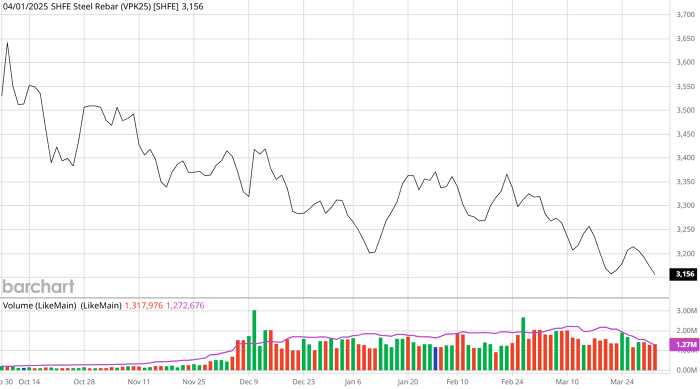

World steel prices

At the end of the trading session on April 1, the price of rebar for May delivery on the Shanghai Futures Exchange (SHFE) fell another 0.5% (17 yuan) to 3,156 yuan/ton. Steel prices were pressured by concerns about China's demand outlook, after steelmakers cut production.

Meanwhile, the May iron ore price on the Dalian Commodity Exchange (DCE) rose 0.7 percent (5.5 yuan) to 783 yuan/ton. The Singapore Commodity Exchange iron ore price rose $1.9 to $102.89/ton.

May rebar futures prices on the SHFE. Source: Barchart

In India, finished steel imports in the first 11 months of the fiscal year (starting April) reached 8.98 million tonnes, up 15% year-on-year, according to Reuters.

India, the world's second-largest crude steel producer, turned a net importer in the 2023/24 financial year, a trend that continued with rising imports from China, South Korea and Japan.

Last month, India proposed a 12% provisional duty on some steel products for 200 days to curb imports. South Korea was the largest exporter of alloys to India in the April-February period, with shipments reaching 2.6 million tonnes, up 7.1% from a year earlier, according to data. Imports of finished steel from China were 2.4 million tonnes, down 5.3% from a year earlier, while imports from Japan were 1.9 million tonnes, up nearly 70% from a year earlier.

Flat steel products accounted for 95 percent of total finished steel imports, the government reported, adding that hot-rolled coil was the most imported product by volume.

India's finished steel exports during April-February were 4.4 million tonnes, down 33.7% year-on-year.

Italy was the largest export destination during the period, but exports fell 56.2%, while exports to Belgium and Spain also fell. Exports to Europe are likely to be further impacted by increasingly stringent import restrictions from the European Union, but the Indian government is confident that strong domestic demand will offset the impact, Reuters reported last week.

India’s domestic consumption of finished steel products stood at 137.8 million tonnes, up 11.3% year-on-year. Crude steel production stood at 138.2 million tonnes during the period, up 5.2%.

India's steel industry, which is heavily dependent on coal, is facing huge financial penalties from the European Union's (EU) Carbon Border Adjustment Mechanism (CBAM) unless it quickly adopts carbon-reducing technologies.

Indian steelmakers, including big names like Tata Steel and JSW Steel, are taking initiatives like integrating renewable energy and carbon capture technology to reduce emissions and meet increasingly stringent global standards.

Despite efforts, the Indian steel industry needs to accelerate decarbonization to remain competitive in the European market and avoid large carbon costs, which could reach $116 per tonne by 2034.

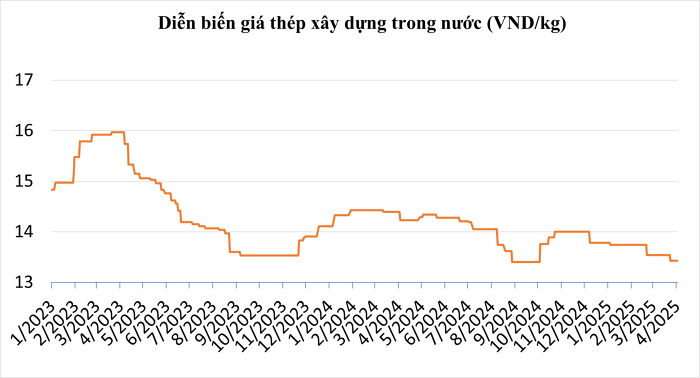

Update domestic construction steel prices

Domestically, construction steel prices at enterprises remained stable. Specifically, the price of Hoa Phat's CB240 steel was recorded at VND13,530/kg, while CB300 steel was stable at VND13,580/kg. Similarly, at Viet Sing Steel, the price of CB240 steel was recorded at VND13,330/kg, while D10 CB300 steel was quoted at VND13,53/kg.

Steel prices recorded as of April 2, 2025. Source: SteelOnline

Steel prices in the North

CB240 steel prices range from 13,400 - 13,580 VND/kg, with VAS being the lowest (13,400 VND/kg) and Viet Y being the highest (13,580 VND/kg). D10 CB300 steel prices range from 13,450 - 13,740 VND/kg, with VAS being the lowest (13,450 VND/kg) and Viet Duc being the highest (13,740 VND/kg). The price difference between brands is not too large, showing that the steel market in the North on March 27, 2025 is quite stable.

Steel prices in the Central region

The price of CB240 steel in the Central region ranges from 13,530 - 13,840 VND/kg, with Hoa Phat having the lowest price (13,530 VND/kg) and Viet Duc having the highest (13,840 VND/kg). The price of D10 CB300 steel ranges from 13,640 - 14,140 VND/kg, with Hoa Phat having the lowest price (13,640 VND/kg) and Viet Duc having the highest price (14,140 VND/kg).

Compared to the North (based on previous data), steel prices in the Central region are slightly higher, especially for the Viet Duc brand (about 400-410 VND/kg higher for both types of steel). Hoa Phat and VAS also have a slight increase of 50-400 VND/kg depending on the type.

Steel prices in the South

CB240 steel prices in the South range from 13,400 - 13,480 VND/kg, with Tung Ho having the lowest (13,400 VND/kg) and Hoa Phat having the highest (13,480 VND/kg). D10 CB300 steel prices range from 13,550 - 13,750 VND/kg, with VAS having the lowest (13,550 VND/kg) and Tung Ho having the highest (13,750 VND/kg). The Southern market shows stability, with prices not fluctuating much compared to other regions.

Source: https://baodaknong.vn/gia-thep-hom-nay-2-4-tiep-da-giam-nguoc-chieu-gia-quang-sat-248008.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)