Steel prices in the North

According to SteelOnline.vn, Hoa Phat steel brand, with CB240 rolled steel line at 13,690 VND/kg; D10 CB300 ribbed steel bar is priced at 13,840 VND/kg.

Viet Y steel brand, CB240 rolled steel line is priced at 13,640 VND/kg; D10 CB300 ribbed steel bar is priced at 13,740 VND/kg.

Viet Duc Steel, with CB240 coil steel line at 13,640 VND/kg, D10 CB300 ribbed steel bar is priced at 13,840 VND/kg.

Viet Sing Steel, with CB240 coil steel priced at 13,600 VND/kg; D10 CB300 ribbed steel bar priced at 13,800 VND/kg.

VAS steel, with CB240 coil steel line at 13,600 VND/kg; D10 CB300 ribbed steel bar is priced at 13,700 VND/kg.

Steel prices in the Central region

Hoa Phat Steel, with CB240 coil steel line at 13,690 VND/kg; D10 CB300 ribbed steel bar is priced at 13,840 VND/kg.

Viet Duc Steel, currently CB240 coil steel is at 13,940 VND/kg; D10 CB300 ribbed steel is priced at 14,340 VND/kg.

VAS Steel currently sells CB240 coil steel at 13,910 VND/kg; D10 CB300 ribbed steel bar is priced at 13,960 VND/kg.

Steel prices in the South

Hoa Phat Steel, CB240 rolled steel is at 13,690 VND/kg; D10 CB300 ribbed steel is priced at 13,840 VND/kg.

VAS steel, CB240 coil steel line is at 13,700 VND/kg; D10 CB300 ribbed steel bar is priced at 13,800 VND/kg.

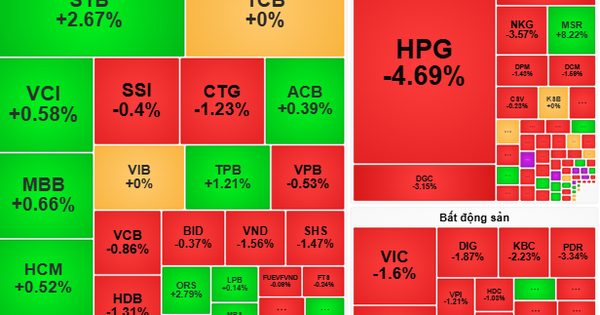

Steel prices on the exchange

Rebar on the Shanghai Futures Exchange (SHFE) for September 2025 delivery rose 12 yuan to 3,412 yuan a tonne.

Iron ore prices rose in early February 2025 after falling in January, with May futures on the Dalian Commodity Exchange at $112.22/t, up 5.6% from the end of 2024.

Meanwhile, the price of March futures on the Singapore Exchange increased by 5.3% to $105.95/ton. Thus, the price has recovered to the highest level since early December last year.

The iron ore market has seen significant volatility in early 2025 due to a number of economic and geopolitical factors. January saw iron ore prices fall as investors were frustrated by China’s lack of incentives and rising domestic raw material inventories.

In particular, iron ore futures hit a seven-week low on the Dalian exchange, reflecting concerns about demand from Chinese steelmakers.

However, the situation began to change in the second half of January. New hopes for additional incentives from the Chinese government, as well as reduced iron ore supplies from Australia and Brazil, contributed to the price increase.

In addition, improved economic performance in China and increased steel exports have supported positive market momentum. As of mid-January, iron ore prices hit a four-week high, reflecting recovering demand and investor optimism.

The iron ore market continued to show volatility in February. On the one hand, concerns about trade relations between the US and China weighed on prices. On the other hand, disruptions to supplies from Australia due to adverse weather conditions and a weak US dollar supported prices, pushing them to a two-month high.

Forecasting further growth in the iron ore market, analysts expect that by 2025, China's imports of this raw material could reach record levels, despite falling steel demand due to the ongoing real estate crisis.

Imports are estimated to increase by 10-40 million tonnes compared to 2024, reaching 1.27 billion tonnes. Meanwhile, iron ore prices are expected to fluctuate between $75-$120 per tonne throughout the year.

The main factors influencing the market will be China's economic policy, the global economic situation and the dynamics of trade relations between leading countries.

Source: https://kinhtedothi.vn/gia-thep-hom-nay-10-2-tiep-tuc-tang-gia.html

Comment (0)