At the end of yesterday's trading day, silver prices extended their decline to the third consecutive session, falling more than 4% to $29.41/ounce.

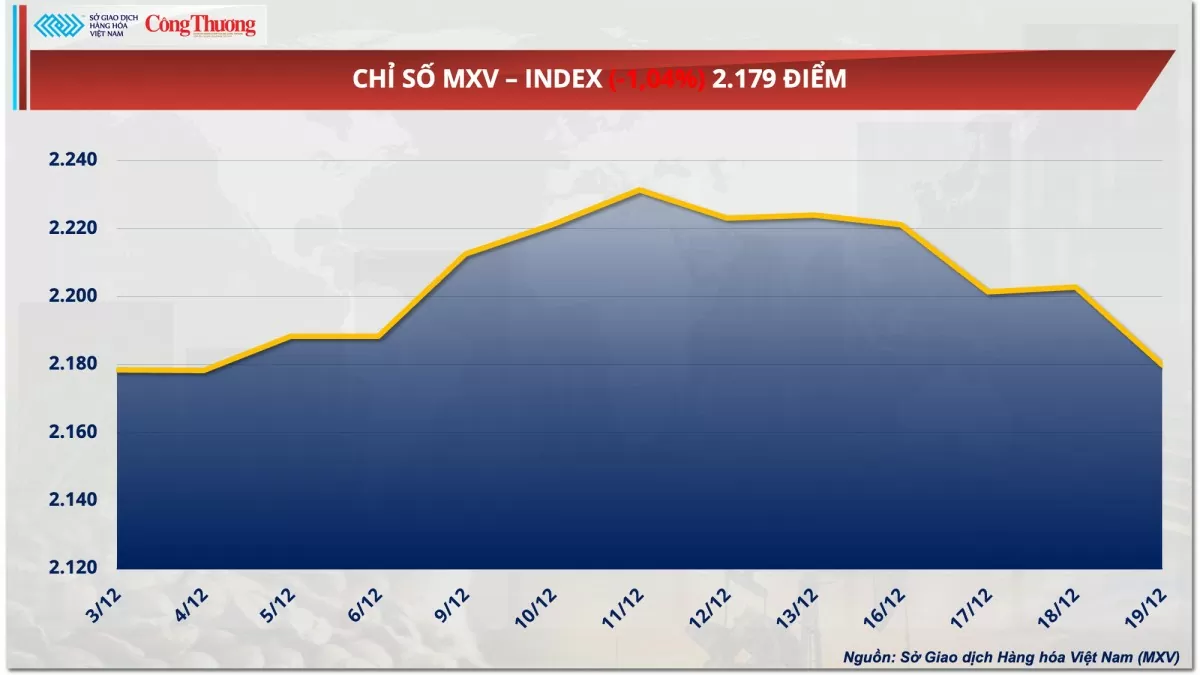

According to the Vietnam Commodity Exchange (MXV), red returned to dominate the world raw material price list in yesterday's trading session (December 19). Notably, the metal group was under strong selling pressure when all 10 commodities weakened, in which silver prices plunged more than 4%, falling below the $30/ounce mark for the first time since mid-September. In sync, the energy group's price index also recorded a decline. Closing, the MXV-Index decreased by 1.04% to 2,179 points.

|

| MXV-Index |

Metal market plunges due to macro pressure

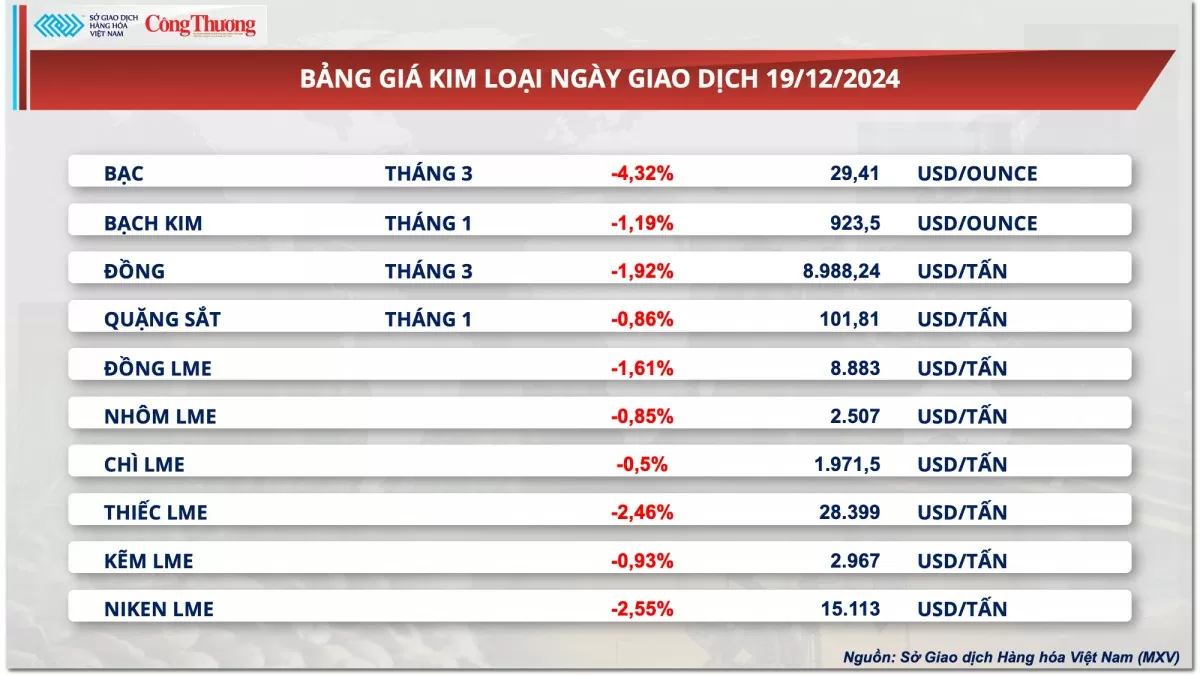

At the end of yesterday's trading session, the metal group continued to face strong selling pressure due to increasing macro pressure. For precious metals, silver prices extended their decline to the third consecutive session, falling more than 4% to $29.41/ounce. This is also the first time silver prices have fallen below the $30/ounce mark since mid-September. Platinum prices also fell more than 1% to $923.5/ounce. Precious metal prices continued to be under pressure from the stronger USD and concerns about slower interest rate cuts.

|

| Metal price list |

The US dollar has surged after the US Federal Reserve (FED) showed a tougher stance on future interest rate cuts. In its interest rate decision announced early yesterday morning, the FED revised down its forecast for interest rate cuts next year by 50 basis points, equivalent to two 25 basis point cuts, bringing the target interest rate to 3.75 - 4%. This cut is less than half the 100 basis points announced at the September meeting. By the end of 2026, the policy interest rate will be reduced by another 50 basis points to 3.4%, higher than the previous forecast of 2.75 - 3%. Moreover, the inflation forecast for 2025 has increased to 2.5%, higher than the previous estimate of 2.1% and much higher than the FED's target of 2%.

This tougher stance from the Fed has boosted the USD. In addition, the strength of the USD was further reinforced after the US revised up its third quarter GDP data yesterday. Specifically, according to official data released by the US Department of Commerce's Bureau of Economic Analysis, the country's third quarter GDP increased by 3.1% compared to the previous quarter, 0.3 percentage points higher than the preliminary data.

Accordingly, the USD continued to increase strongly. After reaching a two-year peak in the previous session, the Dollar Index continued to increase by 0.35% in yesterday's session, reaching 108.41 points. The stronger USD increased investment costs while the risk of interest rates slowing down caused the price of precious metals, which are sensitive to interest rates and currency fluctuations, to continue to decrease sharply.

For base metals, the stronger US dollar also put pressure on the group’s commodities, causing all prices to weaken. Most notably, the price of LME zinc fell nearly 1% to $2,967/ton, its lowest level in a month. In addition to the stronger US dollar, prices of this commodity were also under pressure amid concerns about falling demand from the manufacturing and construction sectors in China, the world’s largest consumer.

Crude oil prices continue to slide slightly

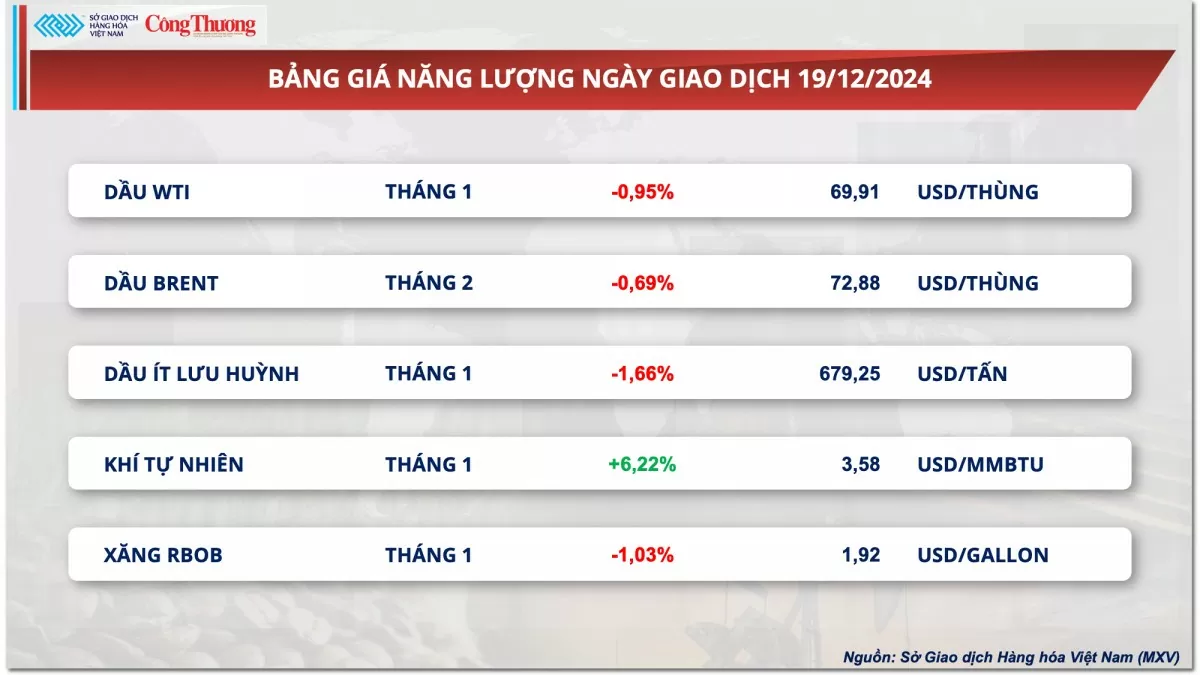

MXV said that selling pressure also dominated the energy market in yesterday's trading session. Except for natural gas, all other commodities closed in the red. Crude oil prices continued to fluctuate during the session and closed down nearly 1%. Pessimism after the Fed's December policy meeting remained the main factor putting pressure on oil prices.

|

| Energy price list |

Closing yesterday's session, WTI crude oil price decreased 0.95% to 69.91 USD/barrel, while Brent crude oil price decreased 0.69% to 72.88 USD/barrel.

The dollar surged to a two-year high after the Fed’s rate decision, making oil more expensive for buyers holding other currencies and pushing prices lower. Concerns about the outlook for global economic growth and oil demand in 2025 continued to dominate the market after the Fed warned it would scale back rate cuts next year due to a possible return of inflation.

On the other hand, better-than-expected US economic data released yesterday had a bullish impact on prices. Third-quarter GDP growth was unexpectedly revised up to 3.1%, stronger than expectations of an unchanged 2.8%. In addition, initial jobless claims last week fell by 22,000 from a week earlier and were below market expectations. In addition, leading indicators for November unexpectedly rose 0.3% month-on-month, compared with expectations of a 0.1% decline and the largest increase in nearly three years. Finally, existing home sales in November rose 4.8% month-on-month to an eight-month high of $4.15 million, compared with expectations of a 3.2% increase to $4.09 million.

China's oil demand still has room to grow, which also supported oil prices yesterday. State-owned oil refiner Sinopec forecasts that China's oil consumption is expected to peak in 2027 at 16 million barrels per day.

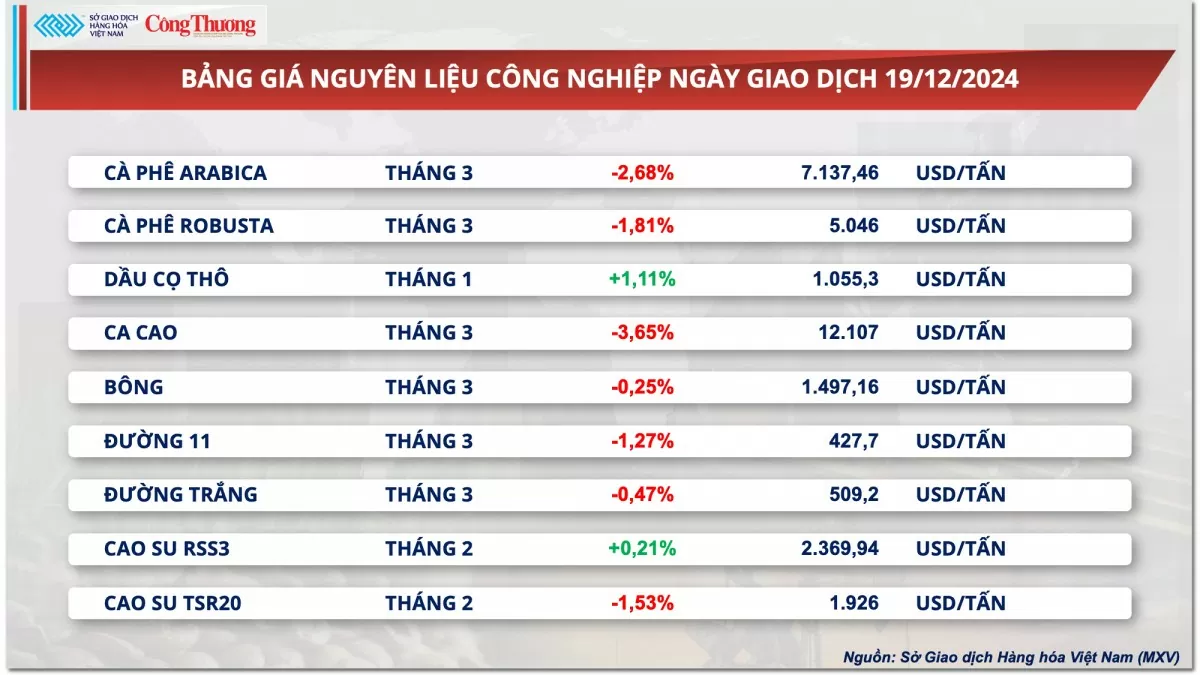

Prices of some other goods

|

| Industrial raw material price list |

|

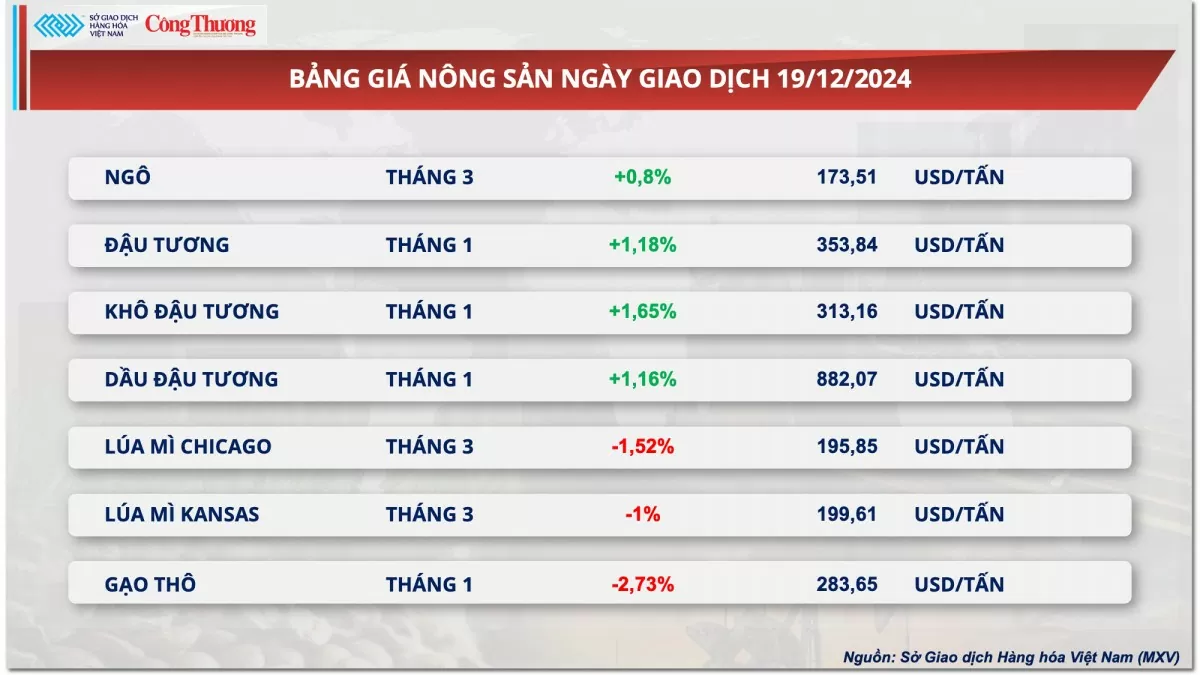

| Agricultural product price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-2012-gia-bac-roi-khoi-moc-30-usdounce-365233.html

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)