The journey from poor boy to real estate billionaire has made the chairman of Evergrande Group a symbol of China's economic development.

His promise to turn villages into cities with amenities for the middle class has made him one of China's richest men. But now he is under scrutiny for alleged illegal activity.

A Hong Kong court recently ruled against Evergrande. Judge Linda Chan said the company failed to come up with a reasonable restructuring plan despite a months-long delay in the trial.

The company has about $240 billion in assets but more than $300 billion in debt, making it the world’s most indebted company. The liquidation of Evergrande could shake China’s already fragile capital and property markets.

Who is behind Evergrande?

Mr. Xu Ka-yin is the founder of the giant real estate group China Evergrande. He was born in 1958 to a poor family in Henan province (China). He lost his mother when he was less than 1 year old and lived with his grandmother in poverty in a rural area. He had a miserable childhood when he had to eat moldy buns and bread.

Growing up, he said he planned to become a construction worker so he could earn a steady salary. “I was very eager to help others and was eager to get a job, leave the countryside and have a new life,” he said in a 2018 speech.

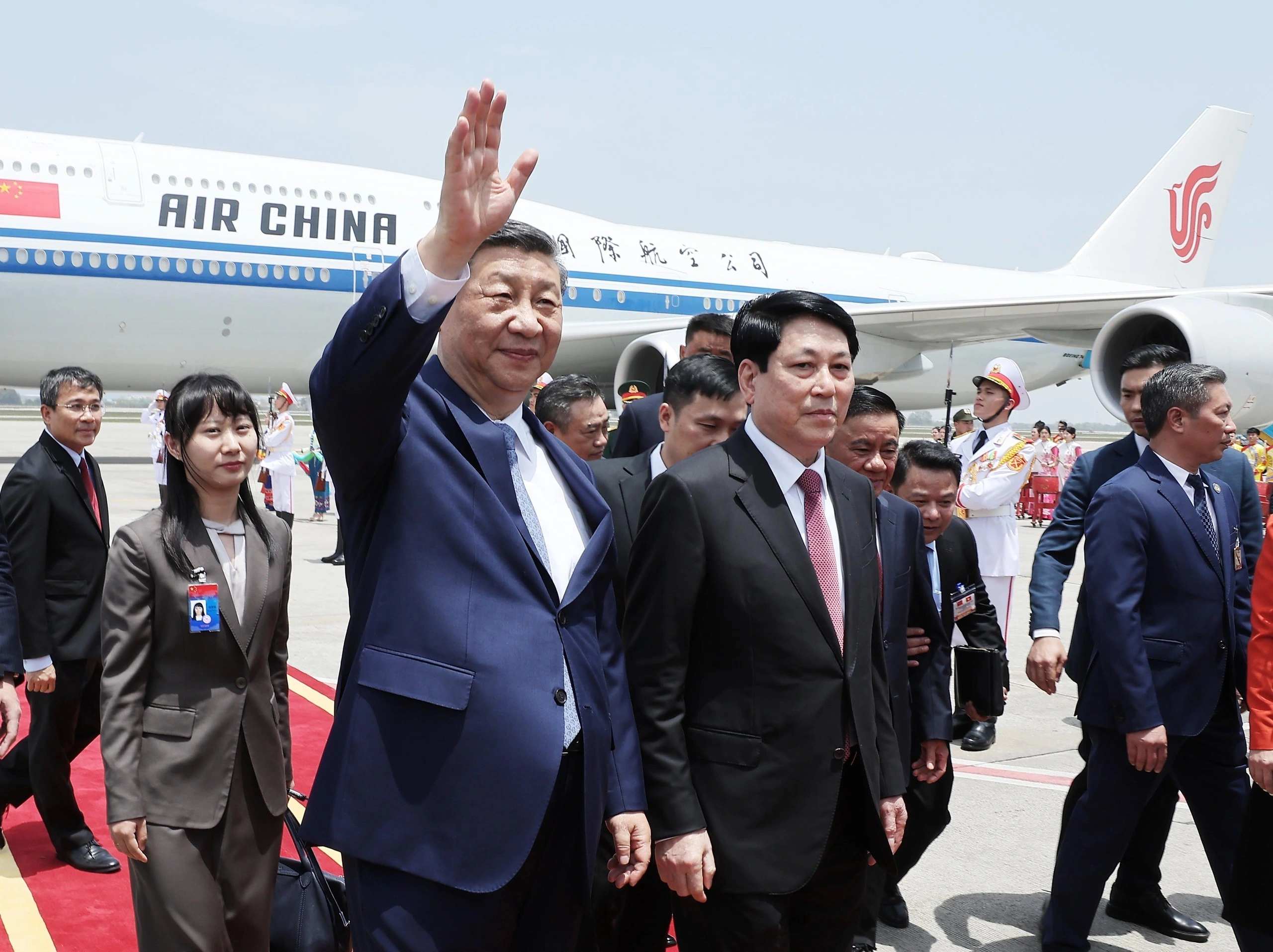

Mr. Xu Ka-yin (Photo: SCMP).

In 1975, after graduating from high school, he dropped out of school and worked at home as a farmer. In 1977, he decided to take the university entrance exam but failed.

In 1978, with great efforts, he passed the entrance exam to Wuhan Iron and Steel Institute. He graduated in 1982, then worked at the steel factory here for a while before coming to Shenzhen in 1992.

During his first time in Shenzhen, he slept in the hallway of a friend's house, then became a manager at a company office, sleeping in the kitchen at night. He also opened a small company in Shenzhen before moving to Guangzhou.

A golden age

In 1996, Hui Ka-yin set a milestone by founding Evergrande Group. Just 10 years later, Evergrande was officially listed on the Hong Kong Stock Exchange.

The group quickly rose to become the leading real estate company, selling the most housing units in the country. Evergrande has developed "miraculously" with 1,300 real estate projects in 280 cities.

In 2020, the group announced that it owned more than 293 million square meters of land. Most of Evergrande's land is located in first-tier cities in China, worth up to 81.34 billion USD.

Buyers have been snapping up Evergrande apartments in hundreds of cities across China. Evergrande often pre-sells units years before a building is completed. During its heyday, the company reported record sales as home prices soared.

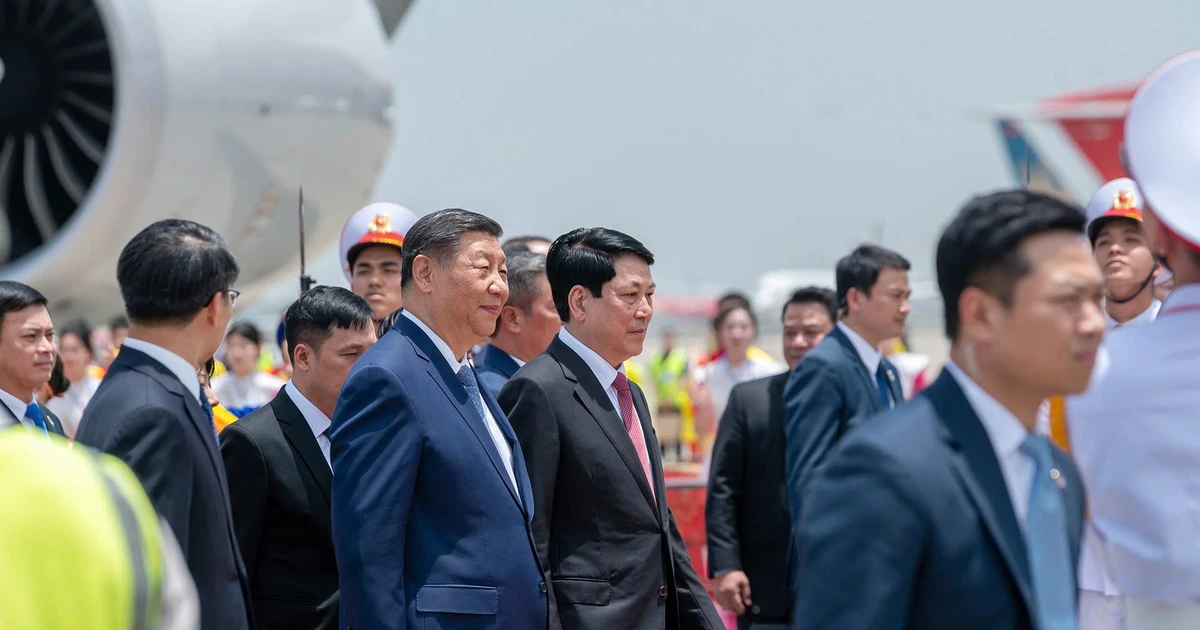

An Evergrande project in Huai'an city, China (Photo: Bloomberg).

After listing Evergrande, Mr. Xu Ka-yin also used profits from real estate in other fields.

Evergrande has bought football clubs and spent billions of dollars on foreign players over the years. Some of his other investments include electric vehicle development, traditional medicine...

In its ambition to expand nationwide, Evergrande has borrowed heavily. The company has borrowed money from banks and even its own employees.

Waves come one after another

However, in contrast to its 34% increase after listing in 2009, Evergrande quickly became a symbol of excessive borrowing.

By borrowing more than $300 billion, Evergrande is determined to expand aggressively to become one of China's largest companies with apartments, office buildings and shopping malls.

However, Evergrande's troubles began to emerge in 2020 when China's real estate market cooled following a series of government regulations.

Beijing has introduced new regulations to control debt at major property developers. Many of the measures have forced Evergrande to sell its products at deep discounts to ensure it has enough cash to stay afloat.

In addition, tightening measures to prevent the Covid-19 epidemic also affect investor sentiment.

Security guards surrounded Evergrande's headquarters, where many people gathered to demand repayment of loans (Photo: Reuters).

In 2021, Evergrande began defaulting on loans to some lenders. Since then, its bad debts have increased.

Homebuyers protested in many streets. The Central Bank of China had to put Evergrande on alert to resolve debts.

Evergrande had previously been among the market's top-performing stocks. However, following the event, the company's shares fell amid concerns about the company's ability to repay debt and complete apartment construction.

Evergrande has reported debts of more than $300 billion. The company has filed for bankruptcy in New York (USA) and is trying to facilitate debt settlement with foreign bondholders.

Evergrande’s problems have intensified after it had to cancel key meetings with creditors and review plans to restructure its overseas debt. The company has also struggled to sell some of its assets to raise capital.

Reuters reported that Evergrande had to sell the 60-meter superyacht for $32 million as part of the asset sale process. Another source confirmed that the sale had taken place.

As he is investigated, analysts and investors wonder who will run the group's operations and what will happen to plans to restructure overseas debt.

Giant monument collapses

Shen Chen, a partner at Shanghai Maoliang Investment Management, said: "Hua Jiayin has repeatedly helped Evergrande escape the risk of default in the past by selling debts, selling shares...

But this time things are different. Evergrande’s debt crisis is escalating. The company cannot access new capital or dispose of assets quickly enough to raise funds.”

As Beijing tightens borrowing rules, Evergrande is unlikely to issue any new bonds in overseas markets this year.

In addition, in a report to the Hong Kong Stock Exchange, Evergrande announced that he was suspected of illegal conduct by the authorities. Chairman Hui Ka-yin was placed under mandatory house arrest in connection with suspected illegal conduct.

According to the Wall Street Journal , Chinese authorities are investigating whether Mr. Xu is trying to move assets abroad, as Evergrande struggles to complete unfinished projects.

Evergrande's debt restructuring process has also become more complicated after its headquarters was investigated.

Evergrande Monument officially collapsed (Photo: SCMP).

Evergrande is the world's most indebted corporation, with a total debt of more than $300 billion. The crisis of this corporation since 2021 has had a severe impact on the Chinese economy and the global market.

The group had been working on a plan to restructure $23 billion in debt to a special bondholder group for nearly two years. However, the initial plan failed in late September last year when Evergrande founder Hui Ka-yin was investigated.

"Evergrande's liquidation is a signal that China is willing to go to the end to end the real estate bubble. This may have a positive impact on the economy in the long term, but will cause difficulties in the short term," Andrew Collier, director of research firm Orient Capital Research, told Reuters .

China’s property market remains mired in crisis. The stock market has also hit a five-year low. The Evergrande news could make matters worse.

Source

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)