Vietnam's M&A market in 2025 is forecasted to "blossom" with impressive numbers, with many industries returning such as finance, education, and healthcare receiving the attention of investors.

Vietnam's M&A market in 2025 is forecasted to "blossom" with impressive numbers, with many industries returning such as finance, education, and healthcare receiving the attention of investors.

This is the forecast of Mr. Nguyen Cong Ai, Deputy General Director of KPMG Vietnam at the 16th Vietnam Mergers and Acquisitions Forum 2024 (M&A Vietnam Forum 2024) organized by Dau Tu Newspaper on the afternoon of November 27, in Ho Chi Minh City.

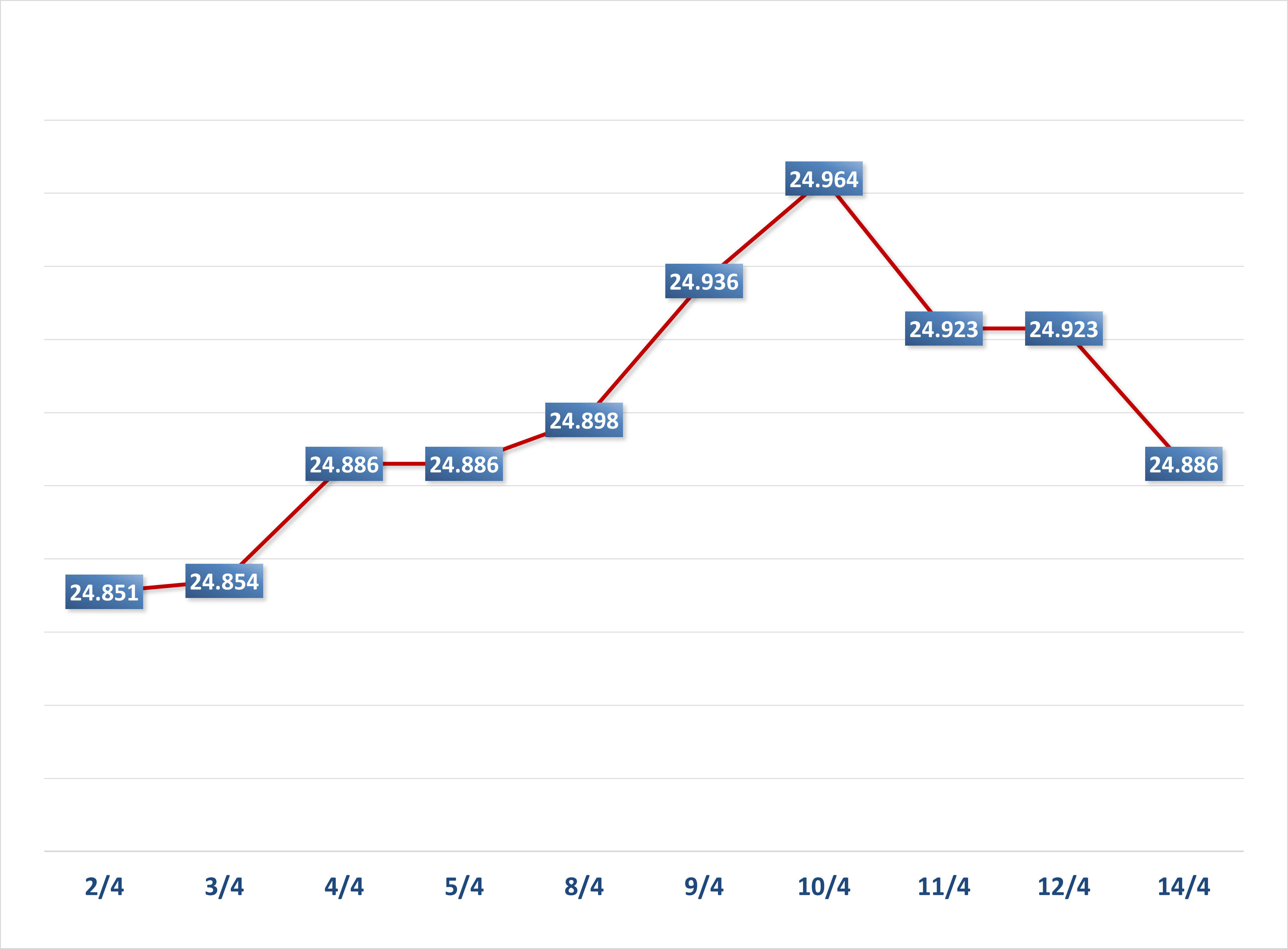

According to data released by KPMG Vietnam, the M&A market in Asia and Southeast Asia remained gloomy in the first 9 months of 2024, as transaction volume and value in the region remained low.

However, in the first 9 months of 2024, Vietnam recorded a significant improvement in M&A transaction value, with a growth of 46% (compared to a decrease of 11.3% in total transaction value of Thailand, Indonesia, Malaysia, Singapore and the Philippines) although transaction volume recorded a decrease of 11.6% compared to the same period last year.

|

| Mr. Nguyen Cong Ai, Deputy General Director of KPMG Vietnam, presented a speech at the M&A Forum 2024. Photo: Le Toan |

In the first nine months of 2024, domestic investors led the activities in the Vietnamese M&A market. The largest deal of the year so far, worth $982 million, was a transaction between a Vietnam-based group of companies acquiring a 55% stake in SDI Investment and Trade Development Company, a subsidiary of Vingroup that indirectly owns a 41.5% stake in Vincom Retail.

The real estate sector contributed the second largest deal when Becamex IDC transferred a $553 million housing project in Binh Duong to Sycamore Limited, a subsidiary of CapitaLand Group from Singapore.

In the consumer sector, a notable deal was US-based Bain Capital investing $255 million in Masan Group through a private placement. In addition, Masan Group also acquired $200 million worth of shares in VinCommerce from SK South-East Asia Investment.

M&A transactions in the first 9 months of 2024 mainly took place in the fields of real estate (53%); consumer staples (14%), and industry (21%), accounting for a total of 88% of transaction value and ranking in the top 5 largest M&A deals.

In the first 9 months of 2024, domestic investors played a major role in Vietnam's M&A market, accounting for 53% of the total announced transaction value, nearly double the total contribution of the 4 largest foreign investors combined.

Mr. Nguyen Cong Ai said that compared to last year in terms of transaction value, the consumer staples and industrial sectors have replaced financial services and healthcare as the largest contributors, while real estate continues to hold the leading position this year.

There are industries that have disappeared from the M&A market, such as the energy and service industries that dominated the M&A market in 2022, but these two industries have not appeared recently. That shows that there has been a shift in the industry in attracting M&A.

According to Mr. Nguyen Cong Ai, the Vietnamese M&A market is expected to "blossom" in 2025, reaching impressive numbers. Key sectors such as real estate, manufacturing, information technology and consumption still show strong growth potential, attracting attention from strategic investors.

"The number of M&A deals is expected to increase in key sectors such as technology and real estate thanks to the Government's support policies. Investment trends are shifting to technology sectors such as AI and technology-based services, which are expected to account for a significant proportion of M&A transactions from 2025," Mr. Nguyen Cong Ai predicted.

Foreign investors, mainly from Japan, South Korea, Singapore and the US, which have led M&A activities in Vietnam, are expected to return from 2025 and the following years.

Explaining his opinion, KPMG Deputy General Director said that Vietnam's macroeconomic stability is the foundation for the development of the M&A market. With stable GDP growth, controlled inflation and increasing income, Vietnam is a bright spot in the M&A market, attracting the attention of regional and global investors.

Regarding the challenges affecting the M&A market in 2025, there will be geopolitical tensions, the imposition of taxes on many countries by the administration of US President-elect Donald Trump, the US Federal Reserve (Fed) reducing interest rates, and making it more difficult for investment funds to transfer capital abroad.

With many challenges in M&A in 2025, Mr. Nguyen Cong Ai recommends that when conducting M&A, businesses need to approach multi-dimensional and comprehensive appraisal to determine risks as well as assess the company's growth potential.

Financial, commercial, legal and ESG (environmental-social-governance) factors need to be considered to ensure the deal meets the multi-dimensional requirements of the buyer and creates long-term value for all parties.

Source: https://baodautu.vn/du-bao-thi-truong-ma-viet-nam-se-no-hoa-trong-nam-2025-d231079.html

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

![[Photo] Touching images recreated at the program "Resources for Victory"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/99863147ad274f01a9b208519ebc0dd2)

![[Photo] Children's smiles - hope after the earthquake disaster in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9fc59328310d43839c4d369d08421cf3)

Comment (0)