- Dak Lak implements many sustainable poverty reduction solutions

- Escaping poverty thanks to preferential credit capital in Dak Lak

- Change your life with preferential credit loans in Dak Lak

- Dak Lak: Policy credit contributes to social security development

- Dak Lak: Bringing policy credit capital to beneficiaries quickly

With this program, the dream of a solid, spacious house has become a reality for the family of Anh Y Thoih Ktla and Ms. H Mieu Kdoh in Drao village, Cu Dlie Mnong commune. They are poor ethnic minority households, lacking land for production, and the family's main source of income is from working for hire and raising livestock, so they dare not think about building a solid house to live in.

With access to loans from the District Social Policy Bank under Decree 28, after more than a month of construction, the house of Mr. Y Thoih Ktla and Ms. H Mieu Kdoh in Drao village is being completed, bringing joy and happiness to the family.

In the excitement, Mr. Y Thoih Ktla shared: “My family is very poor, living in an old, dilapidated wooden house that leaks every time it rains, with no place to sleep. After the family received support from the authorities at all levels and borrowed 40 million VND from the Social Policy Bank to build a new house, the family was able to build a house. Now, I feel much more secure, no matter if it is sunny or rainy, I don’t have to worry about leaks anymore.”

Thanks to the capital from Decree 28/ND-CP, Ms. H Nhim Hwing was also lent 40 million VND by the authorities at all levels and the district Social Policy Bank to build a new house, and her family has a place to "settle down" so that they can feel secure in their production.

Staff of the District Social Policy Bank inspect the use of capital sources under Decree 28

In recent years, implementing the Prime Minister's preferential policies for ethnic minority households and poor households in particularly difficult communes and villages, the Social Policy Bank of Cu M'gar district has actively organized and implemented them, contributing to solving part of the urgent needs for residential land, housing, production land and domestic water for poor ethnic minority households in the area.

The total outstanding loan balance under Decree 28/ND-CP as of June 22, 2023 at the Transaction Office of the Social Policy Bank of Cu Mgar district is 2,535 million VND with 45 ethnic minority households receiving loans. Of which, housing support loans are 200 million VND.

Livestock developers thanks to access to loans from the Social Policy Bank of Cu M'gar district, Dak Lak province

Decree 28 of the Government opens up new opportunities to help ethnic minorities in the district have the opportunity to settle down, start a business, and improve their lives.

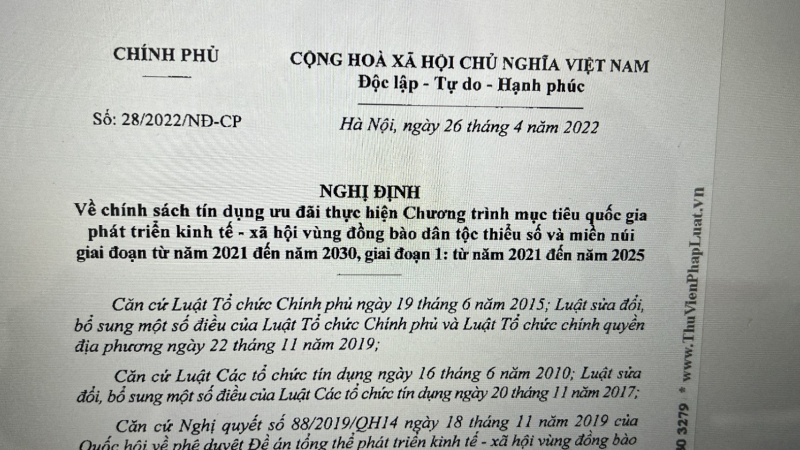

Decree No. 28/2022/ND-CP: On preferential credit policy to implement the National target program on socio-economic development in ethnic minority mountainous areas from 2021 to 2030; Phase 1 from 2021 to 2025.

Source link

Comment (0)