Downtrend narrows, positive signal expected

The results of the Purchasing Managers’ Index (PMI) just announced by S&P Global show that the Vietnamese manufacturing industry in November fell to its lowest level in the past 5 months, from 49.6 points in October, down to 47.3 points. This shows that the number of new orders of Vietnamese manufacturers has decreased again, leading to a more significant decrease in production output. Not only that, the report also shows that Vietnamese companies continue to cut jobs and purchasing activities, and are hesitant to accumulate inventories.

Working overtime to produce goods in time for export to Malaysia (photo taken at a factory in late November 2023)

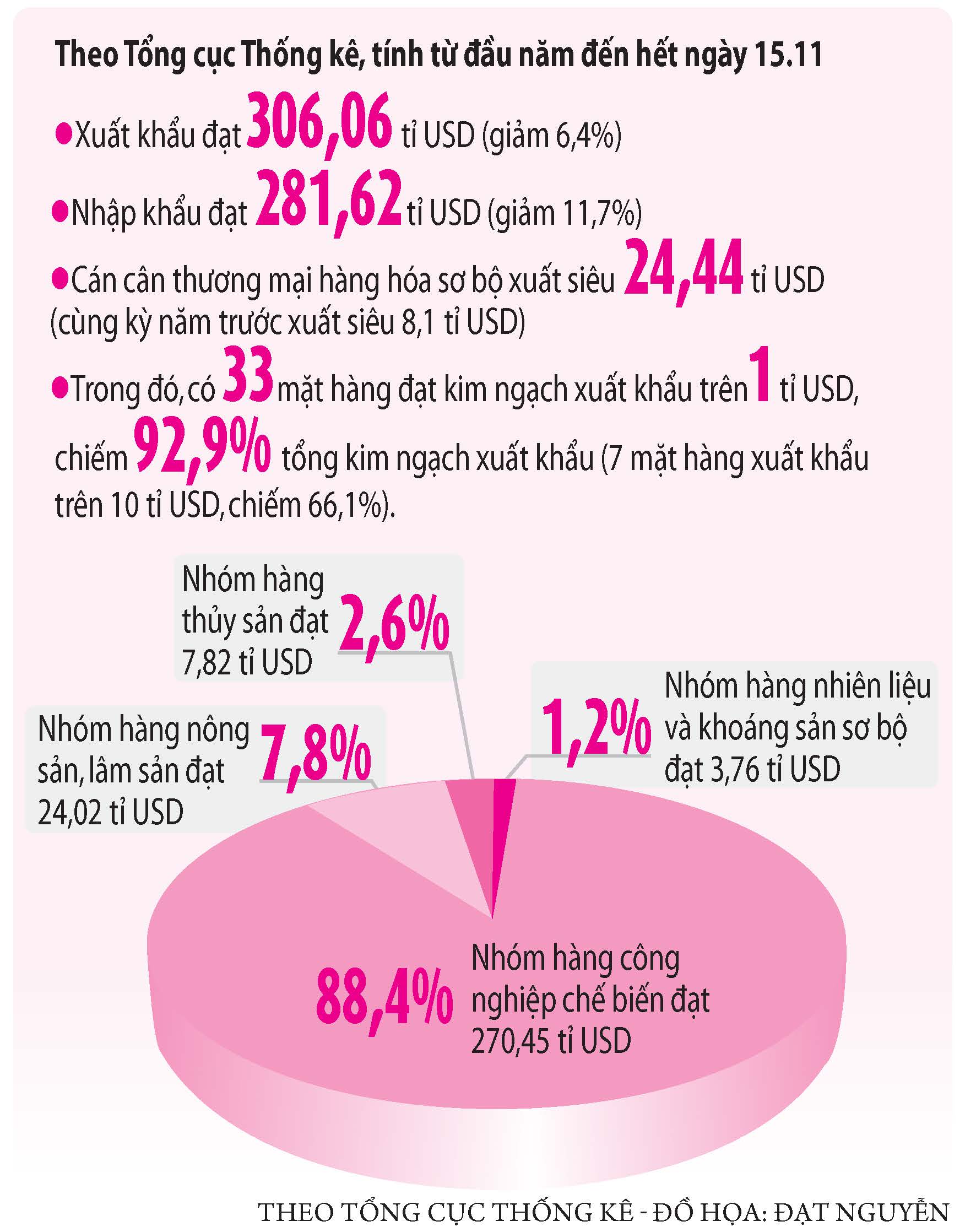

In addition, the General Statistics Office's report by mid-November also showed that the export turnover of some commodity groups with a value of over 10 billion USD decreased by double digits. For example, the export value of telephones and components decreased by 12.4%; footwear exports decreased by 17.7%; textiles and garments decreased by 12.7%; wood and wood products decreased by 18.4%, seafood decreased by 19%... In addition, the export of machinery, equipment and other tools also decreased by 7%. On the contrary, imported goods with a value of over 10 billion USD such as machinery, equipment, spare parts and fabrics... also decreased by about 10 - 14%.

However, some businesses still believe that there are some positive signs in the last month of the year and the first quarter of next year. On the afternoon of December 1, speaking with Thanh Nien , Mr. Nguyen Chanh Phuong - Vice President and General Secretary of the Handicraft and Wood Processing Association of Ho Chi Minh City (HAWA), said that the decrease in turnover according to statistics of 11 months is accurate, but since November, the number of export orders of wood industry enterprises has improved significantly. Specifically, in November, the export turnover is estimated at 1.3 billion USD, November orders are increasing higher than in November 2022 and much higher than October. October decreased by nearly 20%, now decreased by 18.4%, this rate shows that although the growth is negative, the decline has narrowed.

However, Mr. Phuong admitted: The growth rate of these items is not large due to high inflation pressure, weak consumer demand and the trend of tightening spending still maintained in many markets. The rate of new orders is only scattered in some companies. Currently, inflation in the world has signs of decreasing but is still high, the economy is still difficult, so it still has a very negative impact on Vietnamese enterprises. According to calculations, by the end of this year, growth will still decrease compared to last year. In addition, due to changes in customers, the export of wood chips this year has decreased sharply, only wooden furniture has increased, so the turnover of the whole industry "compensates for each other", causing a significant decrease.

Mr. Le Duy Toan, Director of Duy Anh Foods, also expressed his "impatient" feelings when the number of orders in expected markets was lost or decreased. Even orders that were "doing well" in the Middle East market were also suspended due to the outbreak of conflicts in this region. In addition, the market for dried vermicelli and dried pho noodles, which were consumed well in countries with Asian and Vietnamese communities such as France, the US, Japan, etc., also decreased significantly and only improved in November but did not reach expectations. "Last year, we attended many large trade fairs around the world, with the aim of finding new orders, some have begun the stage of evaluating samples to proceed to placing orders. So if we talk about optimistic signals, we have to wait until the first quarter of the year," said Mr. Duy Toan.

Choose a niche to go

S&P Global also pointed out that the reason for the decline in orders in the last few months of the year was partly due to rising selling prices. Many customers did not want to pay higher prices to buy products, so they stopped buying. S&P Global experts commented: "In the context of increasing input costs for companies, manufacturers may have difficulty competing on price in the coming months. Therefore, the manufacturing industry is ready to enter 2024 in a rather gloomy situation, hoping that demand will soon increase again."

Ms. Dao My Linh - Sales Director of Dony International Joint Stock Company, said that the company chose the lowest possible profit margin to sell more products and especially compete on quality and design. Therefore, fortunately, there are still new orders. The company tries to find customers with geographical advantages to reduce costs. For example, the factory is located in the southern region, the geographical advantage has also significantly increased wholesale orders from Cambodia.

"We have gone all the way to Cambodia to offer products to major exporters. They are also a processing country, but now every week the company has shipments exported to Cambodia by road. The main road is difficult to travel, so we choose alleys and lanes to penetrate the markets," Ms. Linh revealed and boasted that she is speeding up to complete 2 export orders to the US by the end of this month and one export order to Malaysia. Before meeting us at the factory at the end of November, Ms. My Linh said that she had just managed to export a 40-foot container of uniforms to the Middle East market.

In the mechanical industry, some enterprises choose to export on the spot when the foreign market is difficult. This morning, December 2, Duy Khanh Mechanical Company inaugurated the Duy Khanh precision mechanical factory in the Ho Chi Minh City High-Tech Industrial Park. Mr. Do Phuoc Tong - Chairman of the Board of Directors of Duy Khanh Company, proudly affirmed that for the first time, a Vietnamese enterprise dared to invest in a technological line to produce supporting industrial products, with a scale to penetrate the global supply chain.

"The mechanical industry has seen a decrease in orders over the past year, but we have increased investment because of our capacity and scale to fully meet the global production chain, especially on-site export for FDI enterprises in Vietnam. The factory has powder stamping and sintering technology (Sintering technology) which has the special feature of large-scale mass production at low cost, environmentally friendly with a very high rate of raw material usage (95%) compared to traditional metal cutting methods (45%)", Mr. Tong said and added: "We invest to support many industries such as components of control systems, transmission systems of hand tools, electrical equipment, components in motorbikes, cars, etc. Currently, FDI enterprises and domestic enterprises are mainly buying these components from China, Korea, Taiwan, and Japan. Why can we export but not supply to local enterprises?".

Many businesses are still looking for market niches to overcome difficulties, maintain production, and retain employees to wait for opportunities in the coming time.

Source link

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

Comment (0)