The central exchange rate remained unchanged, the VN-Index increased by 18.63 points compared to the previous weekend, the Vietnamese stock market is expected to break out in the second half of 2025... are some notable economic news in the week from January 13-17.

| Economic news review January 15 Economic news review January 16 |

|

| Economic news review |

Overview

Vietnam's stock market is expected to be sluggish in 2024, but is expected to break out in the second half of 2025.

In 2024, according to the State Securities Commission (SSC), the Vietnamese stock market will maintain its growth momentum from previous years. As of December 31, 2024, the VN-Index reached 1,266.78 points, up 12.11% year-on-year; the market capitalization of the three stock exchanges HOSE, HNX and UPCoM increased by 19.6% compared to the end of 2023, equivalent to 69.4% of the estimated GDP in 2023. The average trading value reached VND 20,849 billion/session, up 18.6% compared to the average of the previous year.

The market has 720 stocks listed on the 2 Stock Exchanges and 888 stocks registered for trading on UPCoM. The number of accounts has reached more than 9.1 million accounts, an increase of about 26% compared to the end of 2023, equivalent to 9% of the population, exceeding the target set by the Stock Market Development Strategy to 2030.

However, the main growth trend of the Vietnamese stock market in 2024 will mainly focus on the first quarter. The rest of the year will see the market move sideways, with the HNX-Index fluctuating around 100 points, with the resistance level at 1,300 points and the support level at 1,200 points.

The average liquidity of the Vietnamese stock market in 2024 will reach over VND20,000 billion. However, this figure is mainly due to the bustling trading in the first half of the year, with many sessions recording billion-dollar trading values. In the second half of 2024, the trading scale will gradually narrow, especially when individual investors show signs of caution. The month of the deepest decline will be in mid- and late November when the market tends to bottom out. In December 2024 alone, the HoSE floor will have many sessions with matching liquidity of only around VND10,000 billion. Meanwhile, foreign investors continue to net sell with a value of more than VND91,000 billion for the whole year, the highest level in the history of the market.

Assessing the sluggish market performance in the second half of the year, experts said that the negative stock market performance contrasted with the macroeconomic growth rate when GDP in 2024 increased by 7.09%, and did not go hand in hand with the effective growth of enterprises, when the profits of enterprises in the whole market in the third quarter increased by 18.8% over the same period, and the cumulative increase in 9 months was 14% over the same period.

Experts explain that the main reason comes from outside, the global investment flow withdrawing from emerging and frontier markets to the US market has become a wave throughout 2024, at the same time geopolitical instability in the world also negatively affects the stock market.

In 2024, the Government issued a number of new documents that are expected to actively support the development of the stock market. Notably, Circular 68/2024/TT-BTC, effective from November 2, 2024, regulates the pre-deposit of foreign institutional investors when trading and requires information disclosure on the stock market. This is an important step in removing obstacles, helping the Vietnamese stock market meet the criteria for upgrading according to FTSE Russell standards, thereby attracting more attention from international investors.

Next, the Securities Law (amended) was passed at the 8th session of the 15th National Assembly in a shortened form, effective from January 1, 2025. The new Securities Law has updated important regulations such as the central clearing mechanism (CCP), securities issuance procedures and measures to enhance investor protection. These adjustments are expected to not only improve the efficiency of market operations but also strengthen investor confidence in the coming time.

In 2025, experts expect the stock market to remain volatile in the first half of the year, but to be positive in the second half. In the short term, with the uncertainty of Donald Trump entering the White House and the possibility of making unpredictable policy decisions in the first and second quarters, exchange rates in most markets still tense, the USD still rising and bond yields still high, especially the Fed being more cautious with its interest rate cuts, many negative factors affecting the market will still exist.

In the second half of the year, combined with the opportunity factor of upgrading, the third and fourth quarters will be the period when cash flow increases more strongly, international investors return to net buying and the market will be more positive.

Domestic market summary week from January 13 - 17

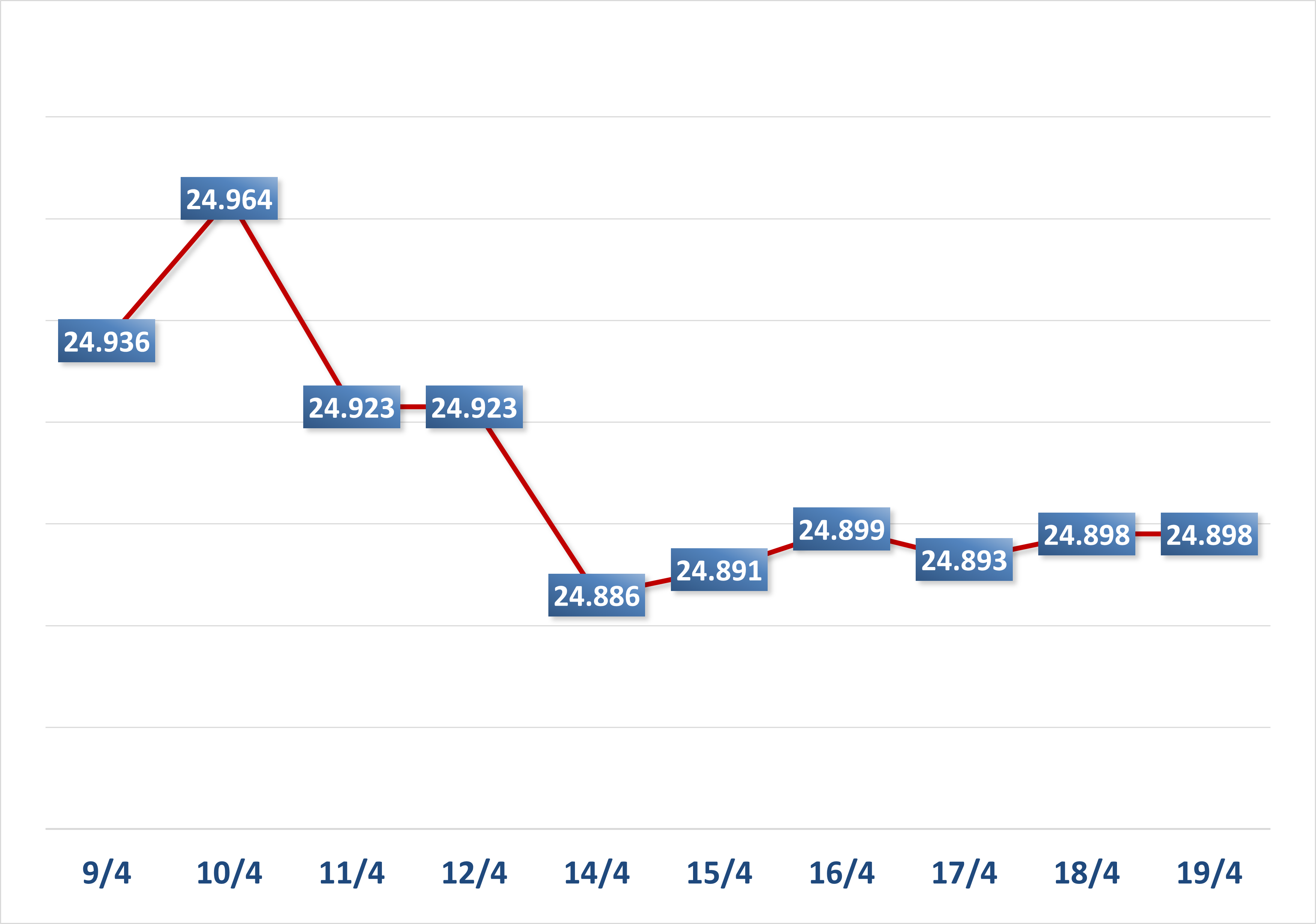

In the foreign exchange market, during the week of January 13-17, the central exchange rate continued to be adjusted up and down by the State Bank. At the end of January 17, the central exchange rate was listed at 24,341 VND/USD, unchanged from the previous weekend session.

The State Bank of Vietnam continues to list the spot buying rate at 23,400 VND/USD and the spot selling rate at 25,450 VND/USD.

The interbank USD-VND exchange rate in the week from January 13 to January 17 fluctuated in a downward trend. At the end of the session on January 17, the interbank exchange rate closed at 25,328, down 22 VND compared to the session at the end of the previous week.

The dollar-dong exchange rate on the free market continued to decrease sharply last week. At the close of the session on January 17, the free exchange rate decreased by 125 VND in both buying and selling directions compared to the previous weekend session, trading at 25,530 VND/USD and 25,630 VND/USD.

Interbank money market, week from January 13 to 17, interbank VND interest rates after increasing in the first session of the week have decreased again. Closing on January 17, interbank VND interest rates were traded at: overnight 4.00% (-0.76 percentage points); 1 week 4.32% (-0.59 percentage points); 2 weeks 4.90% (-0.07 percentage points); 1 month 5.06% (-0.08 percentage points).

Interbank USD interest rates decreased across all terms last week. On January 17, interbank USD interest rates were: overnight 4.36% (-0.04 percentage points); 1 week 4.41% (-0.07 percentage points); 2 weeks 4.51% (-0.04 percentage points) and 1 month 4.56% (-0.04 percentage points).

In the open market last week, in the mortgage channel, the State Bank of Vietnam bid for a 7-day term with a volume of VND43,000 billion, with an interest rate of 4.0%. The entire volume was won and VND54,999.88 billion matured last week in the mortgage channel.

SBV bids for 7-day interest-bearing treasury bills. VND32,750 billion was won, with an interest rate of 4.0%. VND51,680 billion of treasury bills matured last week.

Thus, the State Bank of Vietnam net injected VND6,930.12 billion from the market last week through the open market channel. There were VND43,000 billion circulating on the mortgage channel, and VND68,600 billion of State Bank of Vietnam bills circulating on the market.

Bond market, on January 15, the State Treasury successfully bid VND5,014 billion/VND7,000 billion of government bonds called for bid (winning rate reached 72%). Of which, the 5-year term mobilized VND100 billion/VND1,000 billion of bid, the 10-year term mobilized VND4,040 billion/VND4,500 billion of bid, the 15-year term mobilized VND700 billion/VND1,000 billion of bid and the 30-year term mobilized VND174 billion/VND500 billion of bid. The winning interest rate for the 5-year term is 2.10% (+0.04 percentage points compared to the previous auction), the 10-year term is 2.79% (+0.02 percentage points), the 15-year term is 2.98% (+0.03 percentage points), and the 30-year term is 3.25% (+0.03 percentage points).

This week, on January 22, the State Treasury plans to bid VND11,000 billion in government bonds, of which VND500 billion will be offered for the 5-year term, VND7,500 billion for the 10-year term, VND2,000 billion for the 15-year term, and VND500 billion for the 20-year and 30-year terms.

The average value of Outright and Repos transactions in the secondary market last week reached VND12,910 billion/session, a sharp increase compared to VND7,785 billion/session of the previous week. Government bond yields last week increased in most maturities, except for the 7-year term. At the close of the session on January 17, government bond yields were trading around 1-year 2.03% (+0.05 percentage points compared to the session at the end of last week); 2-year 2.08% (+0.06 percentage points); 3-year 2.12% (+0.07 percentage points); 5-year 2.40% (+0.04 percentage points); 7-year 2.63% (-0.01 percentage points); 10-year 3.07% (+0.04 percentage points); 15-year 3.25% (+0.07 percentage points); 30 years 3.37% (+0.08 percentage points).

Stock market, week from January 13 to 17, the stock market had a week of recovery. At the end of the session on January 17, VN-Index stood at 1,249.11 points, a strong increase of 18.63 points (+1.51%) compared to the previous weekend; HNX-Index added 2.99 points (+1.36%) to 222.48 points; UPCoM-Index increased 0.96 points (+1.04%) to 93.11 points.

Average market liquidity reached over VND11,530 billion/session, down slightly from VND11,900 billion/session the previous week. Foreign investors continued to net sell very strongly, nearly VND4,800 billion on all three exchanges.

International News

The US received many positive economic indicators last week. First, the US Census Bureau said that the core PPI producer price index in the country was flat (0.0% compared to the previous month) in December 2024, contrary to the forecast of continuing to increase 0.2% as in November 2024. The total PPI last month also increased slightly by 0.2% compared to the previous month, lower than the increase of the previous month and at the same time the forecast of 0.4%. Compared to the same period in 2023, the core PPI and the total PPI in December 2024 both increased by 3.3% compared to the same period in 2023.

Next, the core CPI in this country increased by 0.2% compared to the previous month in December 2024, a slight deceleration compared to the increase in the previous month and also the forecast of experts at 0.3%. The headline CPI in December 2024 increased by 0.4% compared to the previous month, following the increase of 0.3% in November 2024 and matching the forecast. Thus, the core CPI and headline CPI in the US increased by 3.2% and 2.9% respectively compared to the same period, opposite changes compared to 3.3% and 2.7% in November 2024.

In terms of retail sales, core and total retail sales in the US both increased 0.4% month-on-month in December 2024 after increasing 0.2% and 0.8% respectively in the previous month, lower than the forecast of 0.5% and 0.6% increases. Compared to the same period in 2023, total retail sales in the US increased 3.9% year-on-year in December, lower than the 4.1% increase in November 2024.

In terms of construction, the number of permits and housing starts in the US in December 2024 reached 1.48 million and 1.50 million units, respectively, both more positive than the forecast of 1.46 million and 1.33 million units.

Finally, on the US labor market, the number of initial jobless claims in the US for the week ending January 11 was 217 thousand, up from 203 thousand the previous week and at the same time surpassing the forecast of 210 thousand. The 4-week average was 212.75 thousand, down 0.75 thousand from the previous 4-week average.

The UK also recorded some notable economic news. The UK Office for National Statistics (ONS) announced that the country's GDP increased by 0.1% month-on-month in November 2024 after falling by 0.1% in the previous month, lower than the forecast of 0.2%. The UK's industrial output in November 2024 also recorded a decrease of 0.4% month-on-month, following a 0.6% decline in the previous month, contrary to the forecast of a slight increase of 0.1%.

On the other hand, construction output rose 0.4% month-on-month in November 2024 after falling 0.3% in October, matching analysts' forecasts. The UK goods trade balance posted a deficit of £19.3 billion in November 2024, the same as the previous month and larger than the forecast £18.0 billion. In December 2024, UK retail sales showed a 0.3% month-on-month decline after rising 0.1% in November 2024, against expectations of a fairly strong 0.4% increase.

Finally, on inflation, the headline CPI and core CPI in the UK increased by 2.5% and 3.2% year-on-year in December 2024, both decelerating from 2.6% and 3.5% in the previous month, and both lower than the forecast of 2.6% and 3.4%. Of which, the service price index of this country slowed sharply from 5.0% to 4.4% year-on-year last month, much lower than the forecast of 4.9%.

Source: https://thoibaonganhang.vn/diem-lai-thong-tin-kinh-te-tuan-tu-13-171-159982-159982.html

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)