After Decree 144 of the Government was issued on November 1, animal feed businesses were "frozen" when goods were held up for inspection, causing a series of costs to arise.

Animal feed importers hope authorities will soon resolve the problem – Photo: TM

Businesses raised this concern at the Dialogue Conference on Tax and Customs Policy and Administrative Procedures in 2024, jointly organized by the Ministry of Finance and the Vietnam Federation of Commerce and Industry (VCCI) on December 13 in Ho Chi Minh City.

Business cannot wait

Up to 450 businesses from the South, from Quang Ngai and further south, attended this conference, which is held annually. Although the chairman announced that the time was up, asked businesses to send their questions in paper and promised to post the answers on the website, hundreds of hands from businesses still went up.

They have too many concerns that need to be answered directly by the tax and customs leaders at the conference.

Ms. Nguyen Ly Long Khanh, representative of GAD Vietnam Joint Stock Company (Binh Thuan province), was upset when she sent three questions but was not invited to dialogue.

Standing up to speak at the end of the dialogue, Ms. Khanh said that after Decree 144 of the Government (on export tax schedules, preferential import tax schedules, list of goods and absolute tax rates, mixed tax, import tax outside the tariff quota) was issued on November 1, the general situation of animal feed businesses was very chaotic.

She said that the enterprise imports raw materials for animal feed production, HS code is 23040090. After this decree, goods arriving at the customs branches for this item are now being analyzed for trade and all enterprises importing soybean meal must undergo inspection.

Each such declaration incurs internal and external fees of about 7-8 million VND/shipment, and currently the goods have not been cleared through customs.

“So what is the purpose of Official Dispatch 144, which item is it aimed at, why are customs branches confused and applying HS code 2304029 as raw soybean powder while there is no scientific document stating that it is powder? We request the Ministry of Finance and the General Department of Taxation to intervene immediately in this matter, we cannot let businesses suffer like this,” Ms. Khanh suggested.

According to Ms. Khanh, the strange thing is that businesses have never been stuck before, but since the tax exemption regulation was introduced, they have been stuck. This difficulty does not only happen to her business , but to many other businesses . Every time goods arrive at the port, customs will send them for analysis and classification, while no one in the production process grinds them into powder.

According to Tuoi Tre 's research, HS code 23040090 is understood to be soybeans in the form of flakes, obtained from the process of extracting soybean oil, not powder.

After the conference ended, Ms. Khanh continued to question the leaders of the General Department of Customs and requested the Ministry of Finance and the General Department of Customs to have immediate solutions due to the urgent situation - Photo: AH

Suffering from VAT refund verification

Mr. To Vinh Hung, Deputy General Director of Southern Steel Company (VNSteel), said that the company's VAT refund dossier has been stuck since August 2022 until now with an amount of nearly 200 billion VND.

The main reason is that the company's input materials are scrap, which is a risky material and must be inspected before tax refund.

At the time the company started the scrap trading activities, all the company's records and procedures were in accordance with tax refund regulations, the arising activities were explained, and the company checked the input invoices of the suppliers, which were all operating. However, when the tax refund was made, the local tax department inspected and found that the input units had stopped operating and were waiting for bankruptcy and dissolution procedures, leading to doubts about the legality of the invoices. From then on, the tax authority suspended the tax refund.

In addition, VNSteel also has problems related to input invoices because the partner from which the company purchased goods was identified by the Ho Chi Minh City Tax Department as being involved in illegal invoice trading and is transferring the case to the investigation agency. This caused the Ba Ria - Vung Tau Provincial Tax Department to temporarily suspend tax refunds for VNSteel.

“At the time the company started scrap trading, all the documents and procedures were correct and could be explained. The unit that declared the tax incorrectly will be responsible. We recommend that the investigation and verification should only take place during the tax audit. After that, it should be separated.

The principle is that the wrongdoer will be punished. If there is no basis to conclude that the input invoices of the enterprise requesting a refund are illegal, then we suggest considering a tax refund for the enterprise ,” he suggested.

In response, Mr. Mai Son, Deputy Director General of the General Department of Taxation, said that he would accept the comments of businesses and would improve them during the process of drafting the law. However, Mr. Son said that because the company purchased goods, scrap and products from other units, when completing the tax refund dossier, the tax authority determined that these businesses had signs of risk.

In fact, recently many businesses have been set up to buy and sell invoices and appropriate tax refunds.

However, at present, the tax authority only has the authority to verify, but not enough authority to determine whether a business is using illegal invoices or not. Therefore, there are cases where the tax authority can verify to refund taxes to businesses , but there are cases where it is necessary to coordinate with the police to investigate. The fact that the Ba Ria - Vung Tau Provincial Tax Department transfers the file to the police is to ensure the regulations.

Mr. Son also requested that the Tax Department of Ba Ria - Vung Tau province actively coordinate with VNSteel to resolve problems promptly, in accordance with regulations, and ensure the rights of businesses .

Too difficult request of tax authority

Ms. Cao Thi Theu, representative of Namtex Company, raised the issue that the company has been exporting on the spot for more than 20 years. When making the declaration, there was no request to verify whether the foreign trader was present in Vietnam or not. Now that the incident happened a long time ago, it was not until July 2023 that verification of this issue was requested.

“So how will the declarations that businesses made before 2023 be handled? When businesses have cleared all declarations and completed all production processes, they are now required to pay all VAT. So are the declarations from 2023 and earlier correct or incorrect? If they were incorrect, why not stop the business and let it do it, and now they are being prosecuted and said that the business did it wrong,” Ms. Theu said indignantly.

Businesses cannot wait for a written response.

Not only stopping at reflecting at the conference, after the closing speech of the conference by the leader of the Ministry of Finance, Ms. Nguyen Ly Long Khanh continued to meet and directly question the leader of the General Department of Customs present at the dialogue.

In response to Ms. Khanh's reflection, the customs agency said that it was impossible to go into further explanation without having detailed documents and asked the enterprise to provide information so that the customs agency could respond in writing. The representative of the customs agency also suggested sitting down with the enterprise to specifically consider where this problem originated from, which HS code category has been in place for the past ten years, and if there is no change, then the matter would be considered resolved. "The customs agency can only talk about principles because there are no specific documents" - Mr. Dang Son Tung, Deputy Director of the Import-Export Tax Department (General Department of Customs), explained.

However, Ms. Khanh did not agree because the situation was urgent. “The company will have a shipment arriving on December 15 and 16, so we cannot sit here talking about theory or waiting for the authorities to respond in writing.

“The authorities may say that in principle, businesses can request an appraisal and have the right to complain, but in reality, just half an hour of anchoring at the port will incur a lot of fees, all calculated in USD. Businesses that cannot complete the procedures and the goods are released late will be fined by the shipping line. We request that the Ministry of Finance and the General Department of Customs intervene immediately in this matter, we cannot let it drag on any longer. This item cannot be called a powder, but 100% of appraisals show the HS code is 2304029, which is a powder. Businesses declaring HS code 2304009 will be fined for “incorrect” declaration. Is there any way to make immediate adjustments?”, Ms. Khanh urgently asked.

![[Photo] National Assembly Chairman Tran Thanh Man meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/4e8fab54da744230b54598eff0070485)

![[Photo] Reception to welcome General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9afa04a20e6441ca971f6f6b0c904ec2)

![[Photo] General Secretary To Lam holds talks with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/b3d07714dc6b4831833b48e0385d75c1)

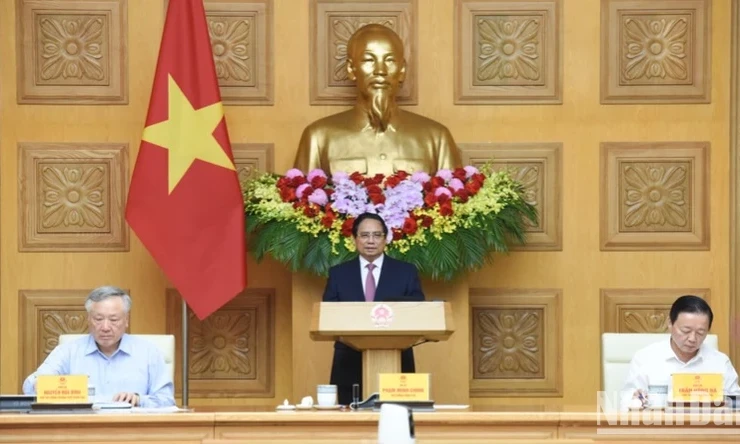

![[Photo] Prime Minister Pham Minh Chinh meets with General Secretary and President of China Xi Jinping](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/893f1141468a49e29fb42607a670b174)

Comment (0)